Stephen Koukoulas

@TheKouk

Followers

62K

Following

10K

Media

2K

Statuses

82K

Treasury, Head of Global Strategy TD, Advisor to PM, punter. Speaker at Ode Management - https://t.co/dXJoiRJt1z MD Market Economics; Also https://t.co/kxt2ibOgfj

Joined May 2009

My 2025 calls:.GDP H1 1.5%; solid recovery H2 2.75%.Unemployment rate up; towards 4.75%.Inflation hovers 2.25 to 2.75%.Wages growth drops to 3% with downside risk.RBA cuts 150bps.10 yr bonds to 3.75%.AUD regains 70 as USD falls.House prices keep falling -6%.ASX200 weaker 7,500.

71

64

247

RT @independentaus: While politicians argue over costly reforms, the RBA’s quiet rate cuts could be doing the heavy lifting for Australia’s….

independentaustralia.net

While politicians argue over costly reforms, the RBA’s quiet rate cuts could be doing the heavy lifting for Australia’s economy — and its Budget.

0

5

0

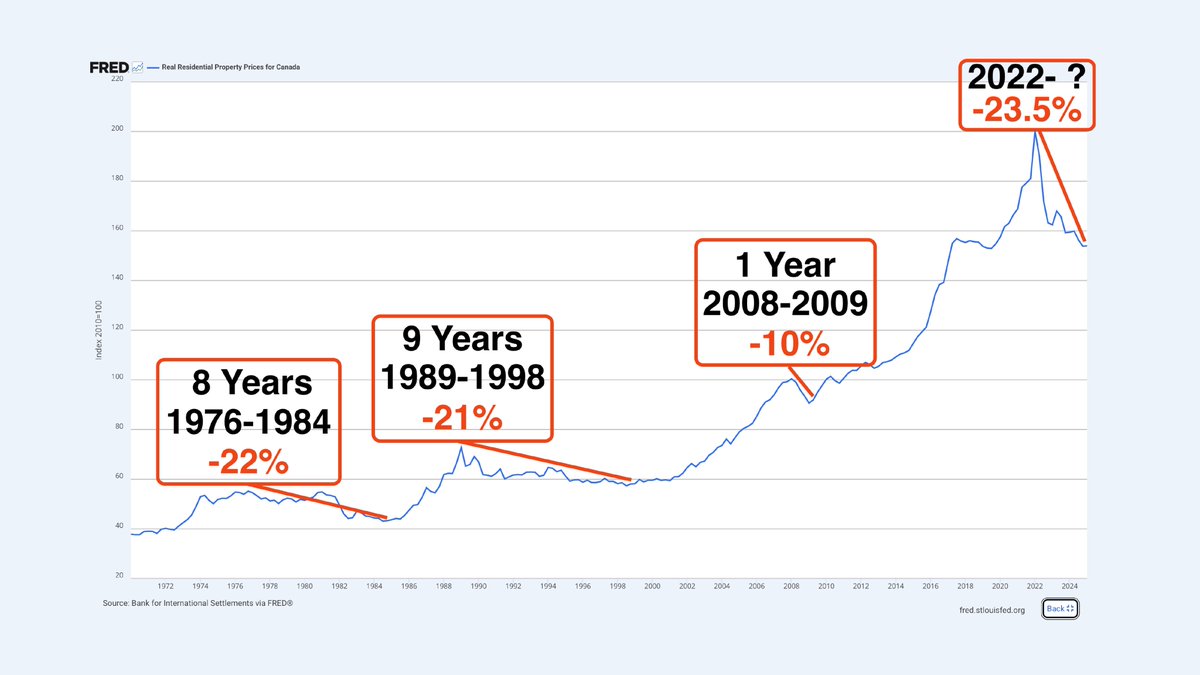

Another example showing how interest rates have little relevance to house prices:.This time Canada where aggressive BoC rate cuts have been associated with record house price falls.

31

10

41

RT @IFM_Economist: When considering whether or not to invest in the US economy, particularly in real assets, it is interesting to note just….

0

11

0

ICYMI.Today's data flow. fair to middling.

Retail spending muddles while the RBA fiddles – building approvals bounce. A gaggle of economic data just released. On any objective analysis, it remains listless. All up, not market moving – growth is so-so; eyes are on inflation & labour force & the RBA.

1

6

19

The ABS described the latest retail trade data as a "surge". Hhhmmm. Chart from @AntipodeanMacro

7

4

22

RT @HistoryInPics: in July 2010, Iran's 🇮🇷 Ministry of Culture and Islamic Guidance officially banned the mullet haircut. .

0

32

0

RT @LouisRoederer_: “Milnon”, Dizy, Pinot noir for #HommageaCamille #CoteauxChampenois “Véraison” is the moment when the berries turn from….

0

7

0

ICYMI.Annual trimmed mean inflation now 2.1%; .Headline inflation 1.9%. Cash rate at 3.85% is massively too high. Real interest rates hugely restrictive.

The RBA policy errors crush inflation. Monthly data. Annual headline inflation 1.9%.Annual trimmed mean 2.1%. Quarterly data. Annual headline inflation 2.1%. Annual trimmed mean: 2.7%. Remember: RBA inflation target is 2 to 3%, aiming for the mid-point.

9

17

48