Tanay Ved 🌊

@TanayVed

Followers

362

Following

6K

Media

55

Statuses

180

Research analyst @coinmetrics/@talostrading 🎢

🇺🇸/🇮🇳

Joined July 2016

Tooling like @zashi_app and cross-chain rails like NEAR Intents are lowering friction and improving usability across @Zcash, as outlined in the latest report from @coinmetrics by @TanayVed.

📣 New State of the Network: Zcash’s Breakout and the Revival of On-Chain Privacy In @coinmetrics latest State of the Network, @TanayVed breaks down Zcash’s rally, rising shielded usage, and the factors behind its momentum Key takeaways: - Zcash has sharply outperformed the

6

23

169

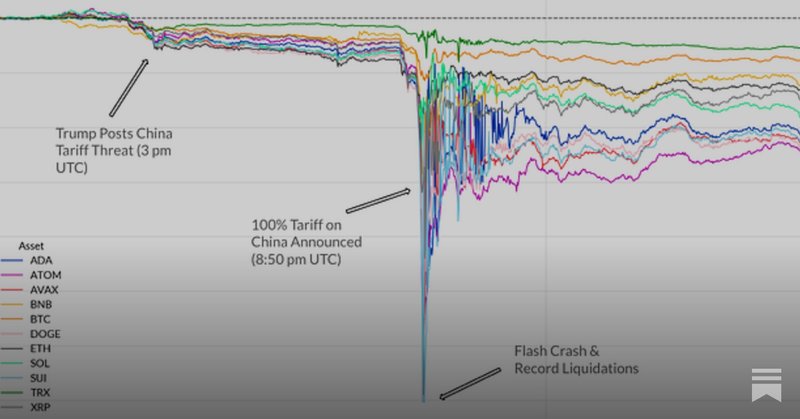

From price dislocations to cascading liquidations, I unpacked Friday’s flash crash in the latest @coinmetrics SOTN. A perfect storm of macro triggers, excess leverage, and vanishing liquidity https://t.co/QhXeu793sJ

api.omarshehata.me

Unpacking the largest day of liquidations in crypto history and what it revealed about leverage, liquidity, and market structure.

2

0

9

📣 New State of the Network - Tether’s Next Chapter: Extending Dominance Across Networks and Rails In @coinmetrics latest State of the Network, @TanayVed examines @Tether_to’s market position as it balances a dominant present with an increasingly competitive future. Key

2

1

5

2/ But most of the value from USDC transaction activity flows to Coinbase (Base) & Ethereum/Solana validators via sequencing + fees. Helps explain the push for USDH (internalize reserve income), native USDC on @HyperliquidX, and Circle’s @arc L1 (capture tx based revenues).

0

0

4

1/ Who captures the value of $USDC? Circle earned ~$640M in Q2 income from reserves backing USDC supply with majority coming from: - Ethereum: 68% - Solana: 15% - Arbitrum: fastest growing (8% in hyperliquid bridge)

2

0

6

📣New Coin Metrics Vertical Analysis: Layer-1s In our latest research, @TanayVed, @HCDuschang, and the @coinmetrics team break down how Layer-1 (L1) blockchains power crypto - from their evolving architectures to usage and token value dynamics. Key Takeaways: - The evolution

5

2

9

the best CEXes are doing more onchain and the best DEXes are doing more offchain

20

7

125

@victoreram1 and I explore what this shift could mean for upcoming crypto exchange IPOs, and how to evaluate them in the latest SOTN 👇 https://t.co/wO04SBRYCY

📣 New State of the Network: Taking Stock of Crypto Exchanges Pursuing an IPO In @coinmetrics' latest State of the Network, @TanayVed and @victoreram1 break down the key metrics for evaluating these exchanges and note some disclaimers about using data reported by exchanges. Key

0

1

5

📣 New State of the Network: The Flows Behind the Crypto Market’s Rise to $4T In @coinmetrics' latest State of the Network, @TanayVed breaks down the structural forces and capital flows fueling crypto’s surge toward a $4T market cap - anchored by institutional demand, regulatory

12

3

8

Oh so you like stablecoins? Name every USD-backed one Coinbase’s relationship with Circle and Circle’s fee-less redemptions are great drivers of adoption to look out for as we watch USDC grow across chains. Report should also help with $CRCL valuation models

How Circle’s $USDC Is Bridging Traditional Finance and DeFi In our latest Analyst Spotlight, Crypto Data Ops Analyst Cooper Duschang @HCDuschang and the @coinmetrics team break down the economic, technical, and regulatory forces driving $USDC’s rise as a leading stablecoin for

1

1

7

JUST IN: Layer 1s Part 1 | OurNetwork #354 🦄 @ethereum | @TanayVed 🔺 @avax | @Haj1379 💧 @SuiNetwork | @biff_buster 🌐 @Aptos | @llcool_hay 🟢 @PlasmaFDN | @seouldatalabs 🏎️ @SeiNetwork | @SSaadmanM Link to read 🔽 https://t.co/XGRweIuBUm

ournetwork.xyz

Coverage on Ethereum, Avalanche, Sui, Aptos, Sei, and Plasma

5

4

20

Stablecoins are going to increasingly be viewed as a matter of strategic importance for the US and its debt situation. Govt is going to keep issuing shorter duration debt and stablecoins will play a growing role in absorbing that supply.

29

31

233

📣 New State of the Network: Q2 2025 Crypto Market Wrap-Up In @coinmetrics' latest State of the Network report, @TanayVed provides a data-driven review of Q2 2025, highlighting the trends, technologies, and macro shifts reshaping digital asset markets. Read the full report

3

2

7

Visualizing the flow of interest income from USDC to Circle and Coinbase: - $1.66B total interest income (2024) - $CRCL retained $768M in net income from USDC - $907M paid to $COIN as revenue share - $114M paid out in USDC rewards → $794M retained

0

0

5

📣 New State of the Network: Circle Goes Public: $CRCL Valuation & the Economics of $USDC In @Coinmetrics' latest State of the Network report, @TanayVed dives into @Circle’s explosive NYSE debut and its long-term prospects as a stablecoin powerhouse. Key takeaways: - Circle’s

4

2

7

In the end, Alcaraz made Sinner his dinner. with these two, tennis fans going to eat for years to come. what an epic #FrenchOpen final.

0

0

4