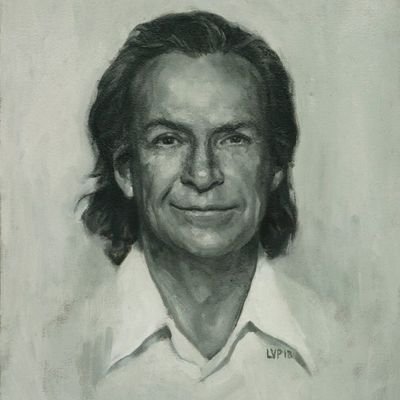

Dominic Kimathi

@SecureWithDomi

Followers

523

Following

205

Media

2

Statuses

113

Financial Advisor @BritamEA || | Investments |Retirement Planning | Savings | Education Planning | Succession || Insurance

Nairobi

Joined July 2019

I’m a financial consultant with Britam. I help you make smart money moves for a secure future. I specialise in: • Investments • Insurance • Retirement Planning • Trust Funds Let’s build your financial future together.

0

0

3

Nairobi Hospital faces a crisis as 8 insurers suspend services over high treatment costs: They include: — Madison — First Assurance — Minet — Old Mutual — Britam — AAR — CIC — Pacis

133

1K

5K

Some people use star signs to guide their future. We use spreadsheets, smart choices and cover that actually works. 😎 Call it intuition. Call it adulting. Just don’t call it later. Don’t wait for a wake-up call. Get ahead today. #BritamAt60

1

2

3

Study, think, create, and grow. Teach yourself and teach others.

71

1K

6K

Every investment decision should answer these questions: – What am I trying to achieve? – What’s my time horizon? – How much risk can I tolerate? – How will I exit if I need to? Whether it’s treasury bonds, real estate, stocks, or a money market fund, the key is alignment.

3

3

28

Compound interest works like a snowball. The more it adds up, the faster and larger it grows. The longer your money stays invested, the more it grows. Even the smallest amounts can grow exponentially. If you invest Ksh 10,000 a month at 10%, for the next 40 years: Year 1:

3

5

24

#ThreadAlert 10 MISCONCEPTIONS ABOUT INSURANCE THAT COULD BE COSTING YOU AND HOW TO FIX THEM Insurance. The word itself can evoke a mix of emotions, from confusion and skepticism to a sense of security. Unfortunately, misconceptions about insurance often overshadow its true

5

13

29

How Much Will Ksh200K in a Britam Bond Fund Earn You? If you invested Ksh200,000 in a money market fund for 20 years at a 12% annual yield, you would have around Ksh2,304,617.55. But here’s where the real power of compounding kicks in: If you invested the same Ksh200,000 and

8

15

78

The life insurance penetration rate in Kenya is at a worrying 1.3% Many people consider life insurance a SCAM, a PRIVILEGE for the RICH or something that only OLD people should consider. Here is why life insurance important in your wealth protection journey👇👇

23

119

519

The wallet may be on E, but the vibes? Still elite. 😎 Payday is just around the corner, and we’re already mentally planning the soft life. Today, we Netflix and chill… and pretend our wallentisn’t judging us. #FriendsForLife

1

2

2

Please push to have: 1) An emergency savings account 2) A good credit score 3) Diversified Investment portfolio 4) A valid will 5) Multiple streams of income 6) Insurance for all your asset Even if we don't have it all now but we aim to have it all.

6

32

111

What are you selling today? #LifeIjipe #YEArightNow

0

0

1

Not all savings accounts are created equal, and neither are your investment options. When planning for short to medium-term goals like a vacation, or upgrading your business equipment, it’s wise to choose a vehicle that balances safety with solid returns. This is where bond

6

4

3

What are you selling today? #YEArightNow #LifeIjipe

0

0

0

#WealthWednesday Besides constant self-improvement, you should normalize the following finance lessons: 1. Start saving/investing in low hanging fruits eg. MMF, bond funds 2. Rent - don't stress, downgrade quickly when you can't afford. 3. Medical insurance - take comprehensive

6

32

137

What are you selling today? #LifeIjipe #YEArightNow

0

0

1

When it comes to Investments, don't ignore the RED FLAGS,,,, no matter how pink they look!!⛳️⛳️ Here are some Red Flags you should think twice about: A thread!🧵 ✅Extremely unrealistic returns - Don't get excited by numbers, question their feasibility and think logically about

2

10

36

No matter how much you may like your job, The day will come when your body and/or mind will say "That's it, I'm done here!" 🙅 Your investments will never experience that exhaustion. Your assets will continue working for you long after you've thrown in the towel on work 🔁

2

39

145

Your 30's are the best financial ages to increase your savings rate. Investing Ksh 3K a month is a great start. But investing Ksh 6K a month is where you will see compounding really get to work at very low risk. 15% on a 100K portfolio is 15K. 10% on a 250K portfolio is 25K.

7

38

258

PLANNING FOR RETIREMENT IN KENYA 🧵🧵 Retirement is coming. Whether you’re ready or not. And no matter how much you will try to postpone it mentally, your ID and HR file will say otherwise. The email will come. "Dear Sir/Madam, as you approach your retirement age..." You’ll

6

21

47