Gichuki Kahome

@kahome_steve

Followers

155K

Following

16K

Media

1K

Statuses

16K

My mission is to spread financial wellness. Email: [email protected] WhatsApp: +254793410596

Worldwide

Joined December 2016

The Nairobi Securities Exchange (NSE) is up +28.4% year-to-date, . Top gainers like Kenya Power (+129%) and KenGen (+95%) are shaking the markets. Many are now asking: Is it too late to invest in the NSE?. Here's a deep-dive 🧵.

5

94

399

RT @VelonCC: Maximum respect between legends 👊. Tadej Pogačar and Wout van Aert praised each other after going head to head on Stage 21 of….

0

4

0

If you enjoy personal finance and investing insights,. You will enjoy our free communities. 1. WhatsApp: 2. Telegram: 3. Youtube:

youtube.com

My mission is to spread financial wellness. I will help you manage your personal finances and build wealth through investing.

1

1

7

RT @kahome_steve: A question that comes up a lot:. “Since MMFs largely invest in T-bills, wouldn’t I be better off investing directly and a….

0

85

0

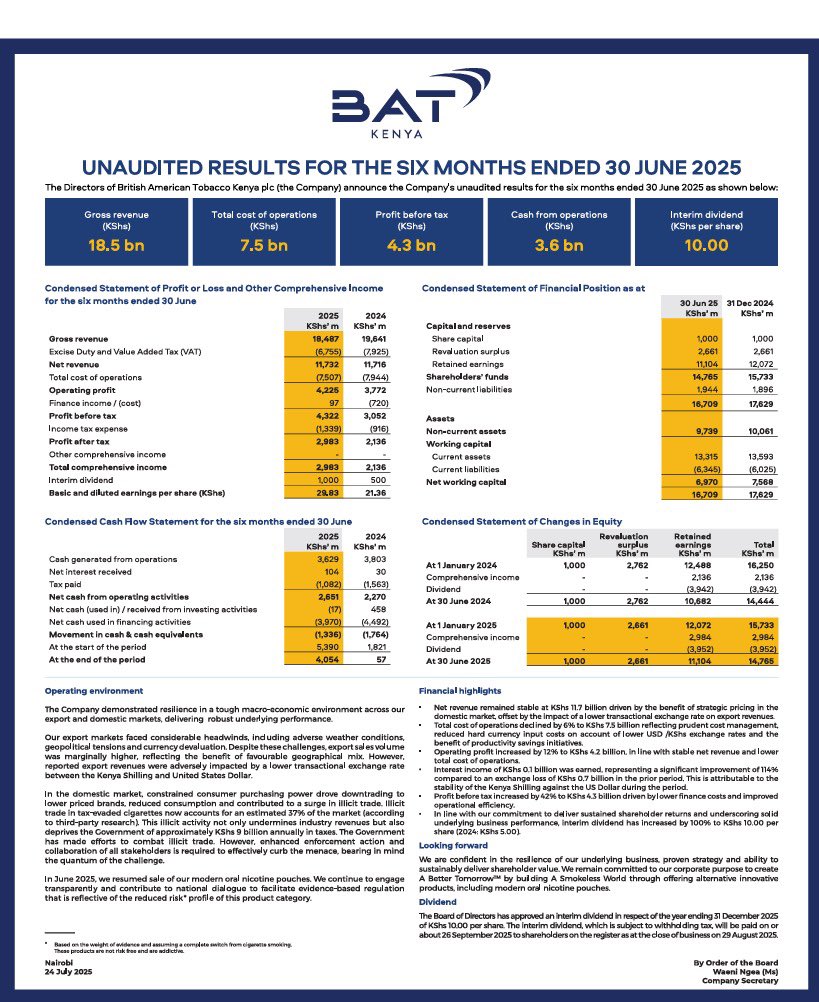

RT @WaruhiuFranklin: BAT presents a buy opportunity at 379.25 - take a position in BAT and hold for dividends. Interim dividend of 10 bob….

0

4

0

RT @kahome_steve: With the reopened Infrastructure bonds currently on offer by CBK. They can be a great addition to a bond ladder. Here is….

0

76

0

You can open a MMF account via one of these links:. 1. Sanlam MMF: 2. CIC MMF:

invest.sanlameastafrica.com

Sanlam Investments East Africa (SIEAL) is a leading fund manager in the region and has a strong record of accomplishment in service delivery and performance.

1

7

21