Stijn Van Nieuwerburgh

@SVNieuwerburgh

Followers

6K

Following

284

Media

71

Statuses

499

Finance and real estate professor at Columbia Business School

New York, USA

Joined April 2017

Happy to see our Manufacturing Risk-free Government Debt out in JFE. Free access link below. . https://t.co/0rZmuCQuny$

1

0

14

Some friendly advice for a consequential NYC election that revolves around housing affordability issues. https://t.co/hvWk6AnDMy

ft.com

If he is elected mayor, Zohran Mamdani should concentrate on expanding supply

2

1

11

Cuomo is onto something. Reducing the misallocation of rent stabilized apartment units would significantly enhance the value of the RS system. I show this formally in a 2024 paper in RES. https://t.co/5Py1ky8sCO

academic.oup.com

Abstract. Housing affordability is the main policy challenge for most large cities in the world. Zoning changes, rent control, housing vouchers, and tax cr

3

1

11

Please consider supporting an exciting philanthropic venture by my son Paul and a schoolmate Rylan, both students at the Bronx High School of Science that will bring AI education to Africa this summer:

0

4

28

Olga Shurchkov giving a wonderful talk on mentoring in economics at AREUEA National Meeting. AREUEA has a robust mentoring program with Pipeline Scholars, Junior Schokar Program, and WREN. Olga advocated for more mid-career mentoring.

0

1

14

Vikrant Vig and two dozen Columbia finance PhD alumni sharing their wonderful research and making CBS proud.

0

0

37

Looking for an exciting research area with many open questions? Now open for enrollment: Data Economy summer school. Online July 28-Aug 1. For more info and signup, visit https://t.co/ZjEJ3hODFi

#econtwitter #dataeconomy @isaacbaley

1

22

74

New CEPR Discussion Paper - DP20061 An Alpha in Affordable #Housing? Sven Damen @UAntwerpen, Matthijs Korevaar @erasmusuni @ErasmusESE, Stijn Van Nieuwerburgh @SVNieuwerburgh @Columbia_Biz @Columbia

https://t.co/sScFv8sBNq

#CEPR_PE #CEPR_AP #EconTwitter

1

2

9

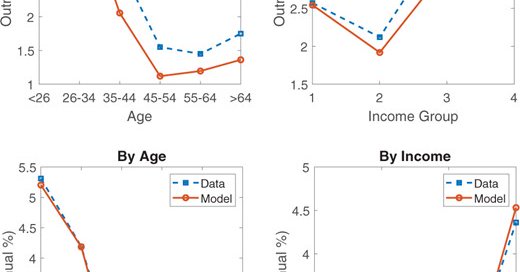

Rental housing returns are highest for low-rent housing, after risk adjustment. Financing, informational, and reputational frictions prevent enough capital inflow in this segment, from @damensven, Matthijs Korevaar, and @SVNieuwerburgh

https://t.co/MXJJpZG5Eg

0

5

20

So excited to host the EFA conference in my home town of Ghent. Mark your calendars, finance friends.

0

3

52

Dear followers, please see my bad-case scenario for where the US economy may be heading in the Financial Times The real threat to American prosperity via @FT

ft.com

Nobel-winning economist Daron Acemoglu on trade wars, tech industry hubris — and how loss of faith in US institutions could spiral

45

288

905

Work From Home continues to make headlines. record office vacancy in Melbourne, Australia, and interesting solution to convert offices to micro apartments in Houston. https://t.co/80Rhk9wEPT

https://t.co/8DtNrWvYQg

bisnow.com

Pew and Gensler laid out a method for office-to-residential conversion that could help solve two of Houston's biggest real estate issues.

0

0

8

@rebeccardiamond @LevyAntoine @EricKlinenberg @Key_Z_E @Boaz_Abramson @Stani_Milcheva @pierremabille @arpitrage This might be a good investment for our new US sovereign wealth fund ;) https://t.co/dKYCQntHP5

bisnow.com

An executive order the president signed Monday directs the secretaries of commerce and the treasury to deliver the plan within 90 days.

2

0

12

Paper is here: https://t.co/175Ct6CyIc Comments welcome @rebeccardiamond @LevyAntoine @EricKlinenberg @Key_Z_E @Boaz_Abramson @Stani_Milcheva @pierremabille @arpitrage

2

0

8

What to do if you are an investor? Consider reallocating more capital to the low-rent segment. What if you are a policymaker? Stimulate the flow of (private or public) capital into this segment.

2

0

7

* and low-income renters cannot afford to buy their property (even if it were for sale) We see strong market segmentation: low-rent properties in NL & BE are owned by unincorporated (P) landlords with 10-50 properties. Corporate investors (B) invest in high-end rentals instead.

1

0

7

We favor a limits to arbitrage explanation: * large landlords don't want to enter this space for reputational reasons and maybe diseconomies of scale * smaller landlords have strong local bias and face binding equity capital constraints that prevent them to scale up

1

0

9

Idiosyncratic risk also cannot explain it. There doesn't seem to be enough idiosyncratic risk at the landlord portfolio level to generate the observed return premium (unless risk aversion were >250). No differential mortgage default risk either.

1

0

5

What about regulatory risk? Isn't there a high risk that future cash flows on low-rent properties could be regulated away? We build a new Renter Protection Index from US State laws with CatGPT. Find no evidence for this story. If anything, goes the wrong way.

2

0

4

One natural explanation for this could be risk. Maybe lower rent properties have cash flows that go down more in recessions? Not true, in fact the opposite happens. Affordable housing is an inferior good for households, a recession hedge for investors.

1

0

9