QuikOptions

@QuikOptions

Followers

223

Following

297

Media

39

Statuses

274

Find all the latest stock, ETF, and select index option information - just AskQUIK (about Options - and even more later).

Joined September 2024

We have launched our new equity options platform and are inviting people to sign up for the Alpha release. Follow the link below to read about what we have to offer (and visit the FAQs page to learn even more). Just click the Sign Up for Alpha button. https://t.co/D63PbAPxIV

0

3

11

Good Morning 🌞Here is today's Morning Briefing for December 22, 2025 Macroeconomic Backdrop and Global Sentiment U.S. equity futures are displaying a constructive bias this morning as markets transition into a holiday-shortened trading week. Global risk sentiment has been

1

2

6

0DTE SPX $SPX VIPER 🐍 Option volume, Delta, Gamma, and Premium Only with Quik Options @QuikOptions $SPY #ES_F

0

3

4

I am logging off until 2026, but before I go... Most New Years, I tell people, “This is going to be your year of expansion. Keep going. Just lose cheap and elegantly, not large and obnoxiously, until you’ve got momentum on your side.” After reflecting on this one, I realized

5

11

46

THOR ⚒️ https://t.co/YMKl6zayha Broadcom $AVGO 16-leg long/short calls on LEAPS Largest spread size for the same expiration is 2k size 44/125 Call Spread 7.4k size straddles at $339 on 09-Jan-26 (similar non-flex terms) Only with Quik Options @QuikOptions $SPX $NDX $RUT $DOW

0

3

3

High Vol on the day as well (considering later in the day the vol had to be higher due to a loss in DTE of 1 day on a 3-day option).

0

0

2

Could it be anymore obvious that someone was a Wednesday frontrunner on the Thursday announcement for DJT and Nuclear Fusion? 1000 lot on the offer fairly close to the opening bell. 🤔🤑🧐 (edited to make 100 1000)

1

3

5

NEW EPISODE - THE HOT OPTIONS REPORT: 12-18-25 Tesla Bulls Charge Toward Parity as Micron Ignites an AI Chip Recovery $MU steals the show with an earnings surge and explosive call action, while the $TSLA chase for higher strikes is heating up! Listen to the full breakdown on

2

2

3

THOR ⚒️ https://t.co/YMKl6zayha MicroStrategy $MSTR $200 ITM Put, Floor traded, expires tomorrow FLEX options for $165 straddles for 20-Feb-2026 Non-FLEX option history on Volatility vs. Volume mode (Large call bubles) for 20-Feb-2026 Only with Quik Options @QuikOptions $SPX

0

4

5

Market FLEX 💪 trades Trade Desk $TTD 24k size Straddle (12k * 2 calls and puts) for $37.5 on 16-Jan-26 FLEX trade has the same terms as non-FLEX options non-FLEX OI has $37.5 strike at 16k puts and 2.2k calls Only with Quik Options @QuikOptions $SPX $NDX

0

2

2

NEW EPISODE: Tesla takes the crown once again! We go deep into the high-volume flow for: ✅ Amazon & Alphabet ✅ Nvidia & Broadcom ✅ Oracle & Palantir ✅ AMD & Netflix Check out the clip below and then listen to the full episode. It's available on major podcast platforms

0

2

2

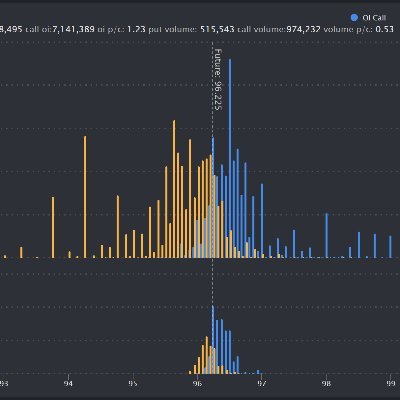

NEW view under our Tradar Focus tool... View option volume by strike over a 5-day period versus the trade's volatility level (Vol2Vol).

0

2

2

Market Tradar 🧑🔧 - Sweep trades Filter for >30DTE Riot Blockchain $RIOT Sweep for $9 puts at size 4378 for LEAPS 2026 Covering tail deltas outside Expected Range Use pricing sheet to see multiple Expected Range on strikes Only with Quik Options @QuikOptions $SPX $NDX

0

2

2

NEW EPISODE: $TSLA dethrones $NVDA for the top options spot! We break down the massive action, plus big trades in $PFE, $MSTR, $PLTR, and the rest of the top 10 on today's episode of The Hot Options Report. Listen now: 🎧YouTube: https://t.co/3jtaRd8BiM 🎧Apple:

1

2

2

We added QuikTake daily overviews from the futures markets to the QuikOptions application. Links open QuikStrike charts and tables. Have a look!

0

3

4

Update: 5-day history on Tradar Focus strike level Option prices, Volatility, Volume, Vol2Vol (Volatility vs. Size) This is used in conjunction with a specific trade being tracked You can buy/sell more options from price volatility Only with Quik Options @QuikOptions $SPX

0

3

5

🚨New Episode Alert - The Hot Options Report! $TSLA dominated the options tape today. Hear the full breakdown, plus flow in $NVDA, $AAPL, $MSTR and the other top equity options. Listen to the full episode. It's available on major podcast platforms incl: 🎧YouTube:

1

2

3

Look at that ~5x +Delta change in $SPY at 690C strikes and above. [Courtesy of @VolumeLeaders and @Barchart; and a new one @QuikOptions] IMHO Friday's drop was a hedging regime that hasn't changed the overall scope/structure of the larger trend. We are in a mean reverting

0

2

5

🚨New Episode Alert - The Hot Options Report! Is $RIVN about to make options traders rich?! That 12% jump was just ONE story in today's Top 10 Most Active Equity Options. We break down the HUGE volume in the $20 calls and what the rest of the market ( $TSLA, $NVDA, $AVGO ) did

1

2

3