Paul Nary

@ProfPaulNary

Followers

3K

Following

3K

Media

273

Statuses

2K

Strategy professor @Wharton | Evidence-based M&A, corporate strategy, private equity, and shareholder activism. Occasionally grumpy, always constructive.

Philadelphia, PA

Joined May 2012

I have been organizing a list of common corporate strategy myths and misconceptions from discussions in my MBA class. Curious to hear others' thoughts on what is missing, unclear, or interesting. Part 1: M&A Deal and Process Myths & Misconceptions. 1) Most M&A fails.2) Mergers of.

10

3

29

RT @petergklein: Re-upping this thread on state-owned enterprises now that the US President is getting into the game.

0

2

0

Timeless wisdom is right, as this is Business 101 presented from a variety of angles, with pragmatism and common sense. All 15 practices more or less fall into the following three buckets:. 1) Understand, develop, nurture, and protect your sources of sustainable competitive.

The most important thing you’ll read today. Timeless wisdom from the Godfather of Private Equity. Carlisms by Carl Thoma

1

0

11

Great behind-the-scenes insights into how this wild Intel+US Gov deal (which I still think is a complete mess) came to be. I do like that Tan + $INTC board reacted immediately to try and solve it right away. I still think the deal only complicates Intel's already poor position.

Inside Intel’s Tricky Dance With Trump . Lots of great reporting in this one w/ @RWhelanWSJ, @AmrithRamkumar and @jdawsey1 .

0

0

6

RT @PEoperator: You thought 401(k)'s were big, just wait until private equity figures out how to sell companies to the US govt.

0

15

0

I wrote a couple of papers on this. In the one cited below, I show that while divesting to PE may lead to lower seller performance, selling to PE-owned firms (e.g. platforms) is generally same as selling to non-PE strategic buyers.

sms.onlinelibrary.wiley.com

Research Summary From the perspective of the divesting firm, do divestitures to private equity (PE) acquirers perform differently from divestitures to corporate acquirers? If so, why? This question...

0

1

0

PE isn't the boogeyman, nor is it a buyer of last resort. Many founders/shareholders happily sell to PE, and that's really the best-case scenario for them. But I wouldn't say PE is the best buyer every time, unless all other factors are equal. E.g. in terms of ability to pay.

Everyone loves to say founders regret selling to PE. That’s incomplete thinking. You just have to understand. I’ve worked in government, 3 public companies, @McKinsey, & private equity. If I were a founder I would pick PE every time. The reasons are obvious once you’ve lived it.

3

3

30

I previously discussed Home Depot M&A strategy here: .

Home Depot's M&A activity over the last decade:. Only a few big deals: .-SRS in 2024 ($18B) - roofing.-HD Supply repurchase in 2020 ($8.7B) - electrical, plumbing, etc. -Interline Brands in 2015 ($1.7B) - maintenance/repair for CRE. Smaller deals: .-IDG/Construction Resources in.

0

0

0

The battle for the "Pro" customer intensifies as Lowe's makes a $8.8B FBM acquisition in an attempt to keep up with Home Depot. It's always interesting to observe major competitors engage in an imitation race and employ largely similar strategies. Doesn't always end well, and.

Lowe's Cos $LOW said it has agreed to buy interior building products distributor Foundation Building Materials $FBM for nearly $8.8 billion, stepping up its expansion into the business that serves contractors and builders. $HD. Lowe's and rival Home Depot are turning to deals to.

1

0

2

Does PE bankrupt PortCos more often? Is leverage evil, at least when it comes to PE? . The answer is likely NO, or at least the truth is more complicated, and we have peer-reviewed research to guide us. First, a few general observations:. 1) On average, PE is more likely to.

In 2024, PE-owned firms accounted for 56% of the largest U.S. bankruptcies (>$500M liabilities) and 11% of all bankruptcies, despite representing just ~6.5% of the economy. The root driver? Leverage. LBOs often load companies with 50‑90% debt. Research shows default probability.

1

0

22

RT @GordonBrianR: There is one sure bet in all of finance: “this time is different” is not going to be different.

0

2

0

RT @RobertMSterling: CEOs, stop with the thread slop already. “In 2020, this man was the king of the business world. But then it all came….

0

18

0

Curious how comfortable OpenAI investors are with this "aggressive expansion" plan, given the highly competitive landscape, and the fact that aggressive diversification into very different markets and products is often a sure way to get into major trouble.

had dinner with sam altman last night and he uh, said some stuff

0

2

4

When analyzing a deal/investment and doing DD, there is often no replacement for seeing it for yourself, as illustrated in the thread below. Some of the most critical factors are often hidden and/or idiosyncratic and all but impossible to uncover without "popping the hood" and.

@ProfPaulNary This is a really interesting exchange on a different investment forum. I was trying to write in a deliberately humorous way that explains all the different sub neighborhoods in NYC and why NYRT was not a table pounding investment

1

2

8

One of my all-time favorite classic strategy papers that doesn't quite look like a strategy paper at first:.

journals.uchicago.edu

We analyze the centralization of political parties and elite networks that underlay the birth of the Renaissance state in Florence. Class revolt and fisical crisis were the ultimate causes of elite...

0

0

1

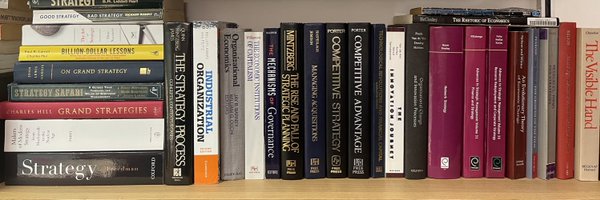

Obviously, books like Freedman's Strategy and On Grand Strategy by Gaddis are classic sources for broad strategic thinking across disciplines. Yet even in management, we do encounter interesting crossover work drawing on nonstandard settings and cases:.

sms.onlinelibrary.wiley.com

Organizational resilience is a subject of great interest to management and strategy scholars. Drawing on over 1,000 years of historical data on the Republic of Rome, and focusing primarily on the...

1

0

1

Can business strategy benefit and learn from other strategy fields, i.e. political, military, etc?. I think so, and take a broad view in my classes. But, it is tough to publish interdisciplinary research due to the nature of peer review. Yet, some try and succeed in synthesis.

@ProfPaulNary There needs to be a lot more economics papers about the macro-macro of military strategy / grand strategy. Trying to get as many things in like-terms as possible.

3

0

5