Private Eye Capital

@PrivateEyeCap

Followers

4K

Following

2K

Media

1K

Statuses

3K

Rarely in doubt, Frequently wrong. Stock & REIT ideas. #FinTwit DJ. Mainly followed by TwitterX ladybots

Miami, FL

Joined July 2020

Some thoughts on 2Q25 Resi #REITs results & cap rates, per door, expected IRRs:. $AVB $CPT $ESS $EQR $MAA $INVH $AMH $ELS $SUI $NXRT $CSR $BRT $UDR $VNQ $TLT.

privateeyecapital.com

The voting machine turned decidedly sour on the resi REITs following reporting season. Here is my take: What the market didn't like: -As shown below, after starting the year strong, rent rebound/new...

5

0

29

$FVR CEO picking up a few more shares .

Great summary of recent $FVR results from @RealAssetsValue . Tenant issues largely addressed+ addn'l disclosure on tenants+historical renewal info= greater confidence. I value this the same way (7.5 cap fair value) & get to same NAV ($18.50) which is just a shade below IPO price.

2

0

2

In the wake of bid for $PLYM, & recent progress on liquidation of $ELME $AIV $SITC, which #REIT that shouldn't exist will be sold/liquidated next?.

2

0

1

REPE in the #REIT space $PLYM edition: .Step 1. Fleece mgmt & get them to issue warrants representing 25% of company to your fund for nothing. Step 2. REIT tanks as market loses faith in mgmt. Step 3. Buy out company on the cheap.

Commentary from SerenityAlts on this fustercluck of a transaction by $PLYM #mismanagement. Now trades at nearly a 9 cap, $50/ft. Of course they could destroy more value going forward. #ValueDestruction $VNQ $STAG $PLD $FR $EGP $REXR $ILPT $LXP $BX #Industrial #REITs

2

1

13

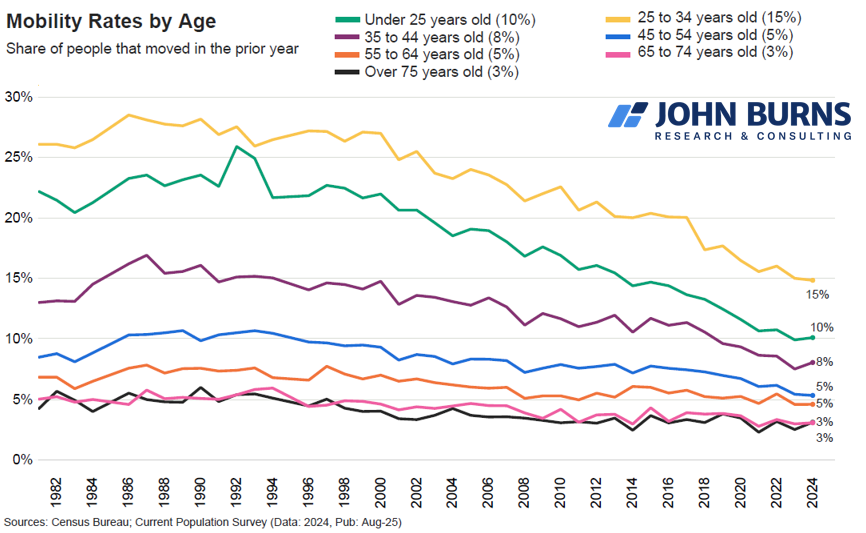

Showing up in very low #multifamily #residential turnover rates (retention ~60% for #REITs despite ~4% renewal rate growth) which is at/near all time lows despite the supply tsunami. $UDR $EQR $AVB $ESS $CPT $MAA $IRT $NXRT $INVH $AMH $BRT.

We've been calling out this trend for years for our clients. The decline is mobility is persistent even across age groups. In 2000, 25% of 25-34 year olds (the most mobile age group) moved during the year. Today? Just 15%.

1

0

1

Great summary of recent $FVR results from @RealAssetsValue . Tenant issues largely addressed+ addn'l disclosure on tenants+historical renewal info= greater confidence. I value this the same way (7.5 cap fair value) & get to same NAV ($18.50) which is just a shade below IPO price.

$FVR Q2 results were solid. Sold assets at 6.75% cap to acquire at 8.2% cap with longer WALT. Occupancy up, bad debt running 25-50 bps. Portfolio "humming". Trades at ~9.5% cap and ~10x AFFO, a ~30% discount to my NAV estimate based on 7.5% cap rate / peer average AFFO multiple.

1

0

4

I've never called a bottom. But $PIPR's #REITs analyst has:.$UDR $MAA $CPT #contra .#multifamily .$EQR $AVB $ESS $INVH

#REIT Headlines 10-31-2023. * Piper Sandler upgrades $AVB to Overweight from Neutral (lower price target by $3 to $194). * Piper Sandler downgrades $MAA to Neutral from Overweight (lower price target by $52 to $130). * Piper Sandler downgrades $CPT ($80) and $UDR ($30) to.

1

0

7

#apartments #multifamily #REITs $AIV $AVB $APO $BX $EQR $ESS $IRT $CBRE $JLL $MAA $CPT $UDR $AMH $INVH $ELS $SUI $BRT $NXRT $CSR $KKR $CG $TPG $ELME $VNQ $TLT

3

1

8