OurNetwork 🔎

@ournetwork__

Followers

27K

Following

2K

Media

866

Statuses

2K

Distributed research for distributed networks — crypto's go-to platform for onchain analytics.

Joined December 2018

JUST IN: Bridges 🌉 | OurNetwork #358. 🔗 @AcrossProtocol | @IrishLatte_19 .⚛️ @IBCProtocol | @noamwithveto .⏫ @StargateFinance | @elovianoo.🖇️ @lifiprotocol | @0xDamian0x . Read the full issue ⏬.

ournetwork.xyz

Coverage on Across, IBC, Stargate, and LI.FI

1

3

9

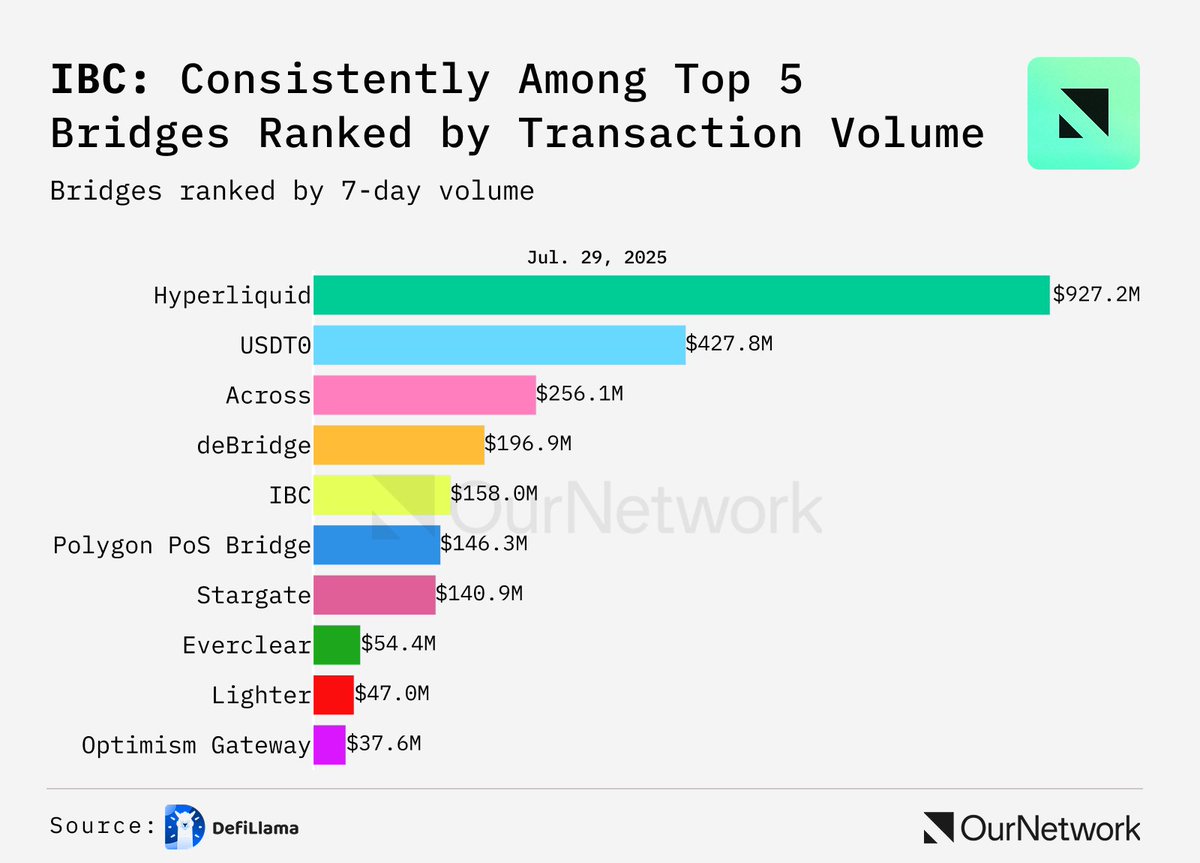

A look at @IBCProtocol:. ➡️ 5th leading bridge in 30-day volume ($821.98M). ➡️ 2nd leading bridge in total transactions (786k). ➡️ Average transfer size is around $1k. Read more from @noamwithveto: Data via @DefiLlama

0

0

2

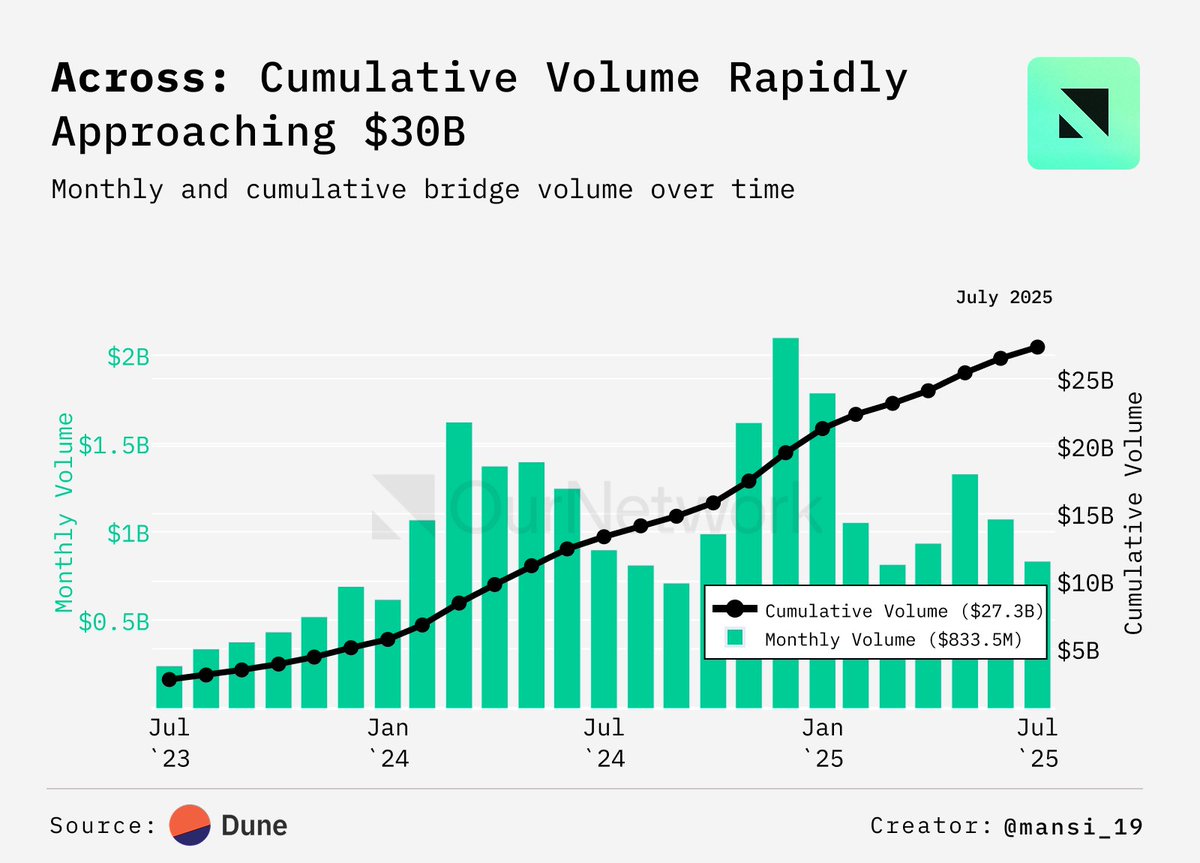

.@AcrossProtocol has surpassed $25B in cumulative volume, with total bridging transactions nearing 20M. Read more in our latest issue ➡️ Data via @Dune & @IrishLatte_19

0

0

3

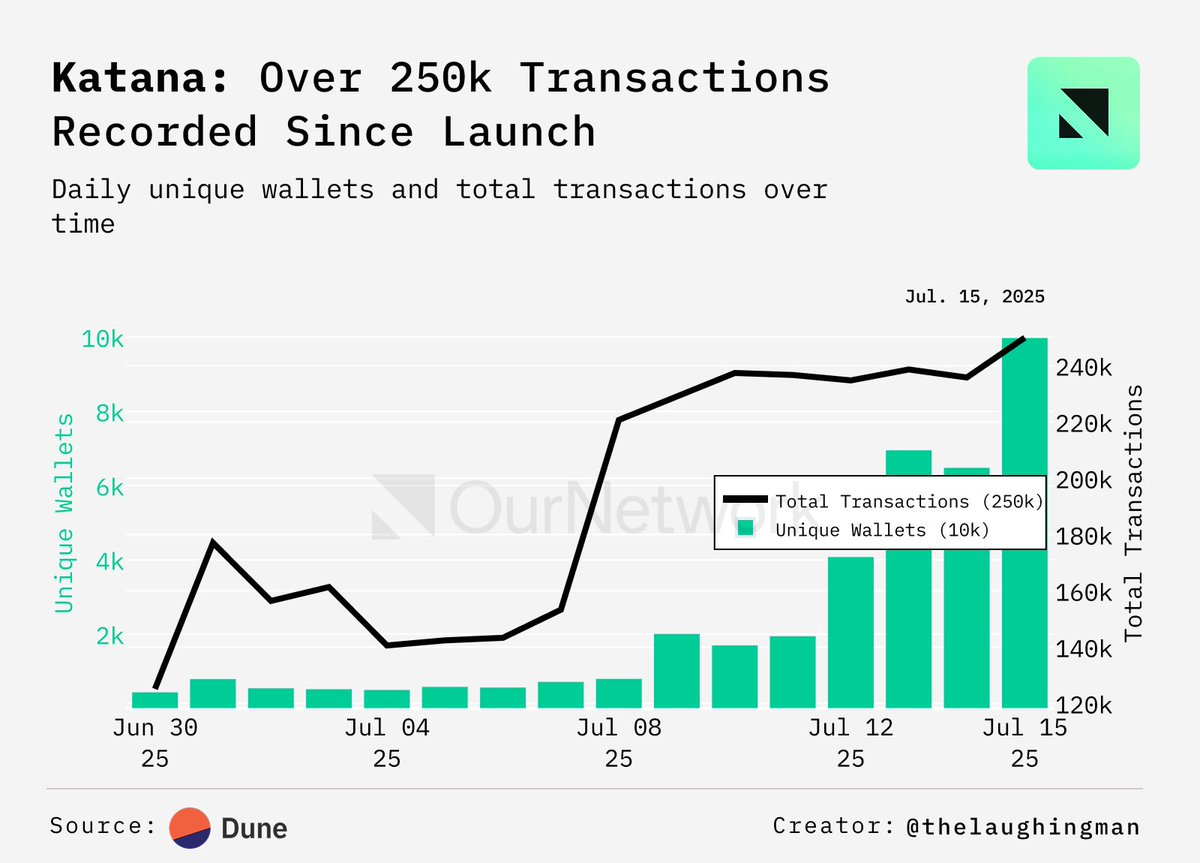

.@Katana has been pushing >100k transactions since mainnet launch, however, the daily unique wallets appear to be relatively low in proportion. See what’s causing the mismatch in our latest issue from @LeLaughingMan: Data via @Dune

3

1

10

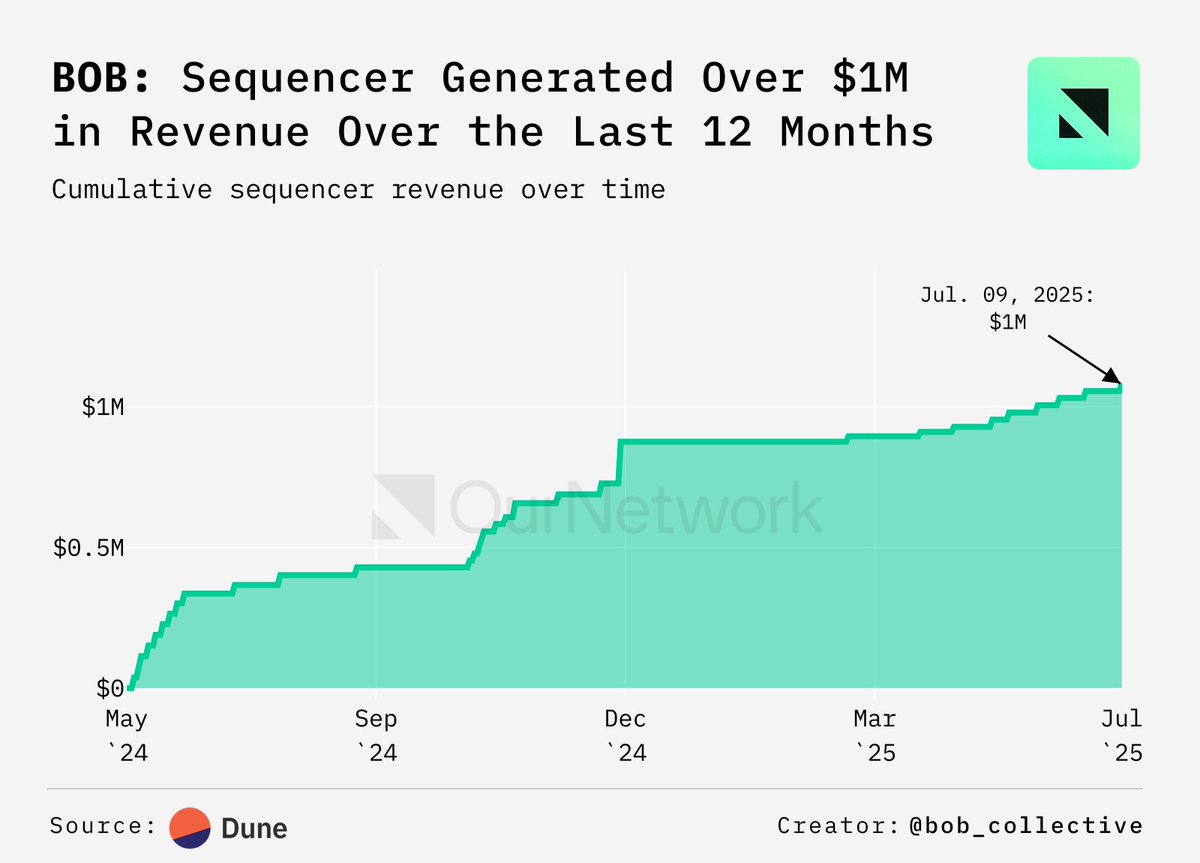

With more than a million $USD of revenue generated over the last 12 months, @build_on_bob has quickly become one of the most profitable L2s. Read more about the network from @TheTruePhilippB ➡️ Data via @Dune

16

7

43

A look at @0xPolygon:. ➡️ Leading @Ethereum-based payments chain. ➡️ Had 2.6M active $USDC senders in June (29% of the market). ➡️ Processed $107M across 3.39M micropayments (52% of the market). Dive in with @p_petertherock: Data via @Dune

0

0

8

Starknet’s TVL peaked at $1.53B in March 2024 but since then has been bleeding, falling to levels of $410M. Read more about @Starknet from @arabianhorses0: Data via @Dune

0

0

4

JUST IN: Layer 2s Pt. 2 🚅 | OurNetwork #357. 🌀 @Starknet | @arabianhorses0 .🟣 @0xPolygon | @p_petertherock.👷 @build_on_bob | @TheTruePhilippB .⚔️ @katana | @LeLaughingMan . Read more ⏬⏬.

ournetwork.xyz

Coverage on Starknet, Polygon, BOB, and Katana

4

4

18

Both transactions & TVL on @inkonchain have seen steady growth since the airdrop announcement. Read more about the network from @0xsandeshk: Data via @Dune

0

1

8

Over 2.7M of Abstract’s Global Wallets have initiated over 53M transactions (55% of network activity), with half using session keys for signless actions. Get a deep dive from @surfquery 👉 Data via @Dune

0

1

7

$6.86B in organic stablecoin volume was transferred on Arbitrum this month. This makes up 39% of all organic stablecoin activity across EVM chains (excl. @Ethereum), up from 36% previously. Read more on @arbitrum from @on_datawarlock ➡️ Data via @Dune

1

2

7

There are currently 102 Layer 2s live, up 65% from last year. Get a full overview on L2s from @growthepie_eth here:

1

0

5

RT @spencernoon: Applications on @Solana are constantly earning over 2.5x the REV of the Solana blockchain. June closed at $116M in reven….

0

8

0

JUST IN: Layer 2s 🚅 | OurNetwork #356. 🌐 Sector Update | @growthepie_eth.🔵 @arbitrum | @on_datawarlock.🟢 @AbstractChain | @surfquery.🟣 @inkonchain | @0xsandeshk. Link to read 🔽

ournetwork.xyz

Coverage on Sector Update, Arbitrum, Abstract, & Ink

1

5

19

RT @0xCheeezzyyyy: The top 3 DePIN protocols just crossed $50M in annualised revenue according to @ournetwork__ research. While this may s….

0

5

0

A look at @SonicLabs:. ➡️Apps earn 90% of gas fees. ➡️ Greater than 1.5M daily transactions. ➡️ 3,700 real TPS. Read more about the network from @real_obbwd: Data via @Dune

0

1

6

.@Ronin_Network is seeing a major comeback — active players surged 193% month-over-month, hitting the second-highest level ever this year. See what’s driving the growth from contributor @p_petertherock 👉 Data via @Dune

0

1

11

In Q2 2025, @SkaleNetwork processed over 320M transactions, a 24.5% increase from Q1 – this growth reflects rising adoption across gaming and AI-powered applications. Read more on SKALE from @JeffreyHacker_: Data via @Dune

0

15

52

The TON ecosystem is mature enough to support diverse workloads across DeFi, GameFi, payments & merchant services. Get an onchain look on @ton_blockchain from @shuva10v: Data via @Dune

1

0

2