TraderMir 🐲

@OptionsMir

Followers

20K

Following

42K

Media

7K

Statuses

49K

OPTIONS DAY & SWING TRADER|Hybrid approach—TA for timing, macro for context — disciplined, multi-angled, no wasted moves|| DISCORD https://t.co/cn8FvQjMER

Joined June 2012

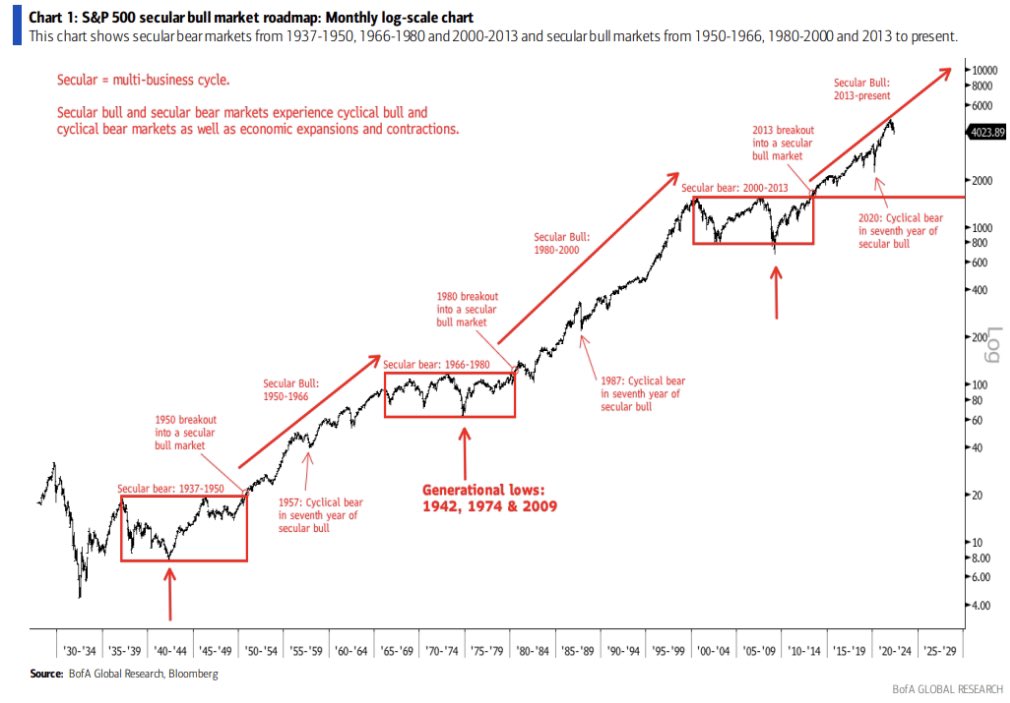

Been a while since I posted this one. $SPX 30K foot view. I don't lose sleep over stonk investments. Ever. Sometimes on oversized trading positions but investments never.

22

31

263

maybe the best setup into next week .$HOOD all good in the hoodie!.

$HOOD . What is good in the hood? . well. it pulled back to its 10ema and found support last week & held the $100 level. The bad? It fell 4.5%. that is to be expected after running from $29 to $113 (a 282% move). HOOD earned the rest stop.

7

0

30

#Ethereum froth? .not seeing it. mostly seeing concern over a pullback after a 1,000 handle run

4

1

18

seeing the same. 114K support.they're buying #ENA.

Looks like the Bitcoin selloff is Galaxy Digital market dumping from a batch of 80K BTC. Could be because they were asked to for a client, something related to Saylor, or moving into Ethereum as Novogratz suggested ETH may move more than BTC in the next few months (today on

4

0

11

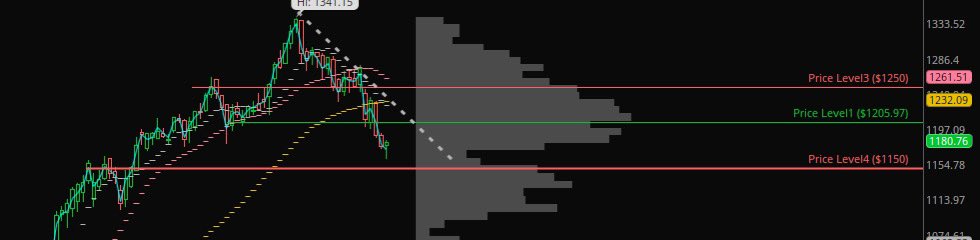

buying #Bitcoin $BTC dips to 117-116K zone has been free money for 2 weeks now . when in doubt zooooom out.

5

2

26