OpenCover

@OpenCover

Followers

4K

Following

3K

Media

520

Statuses

2K

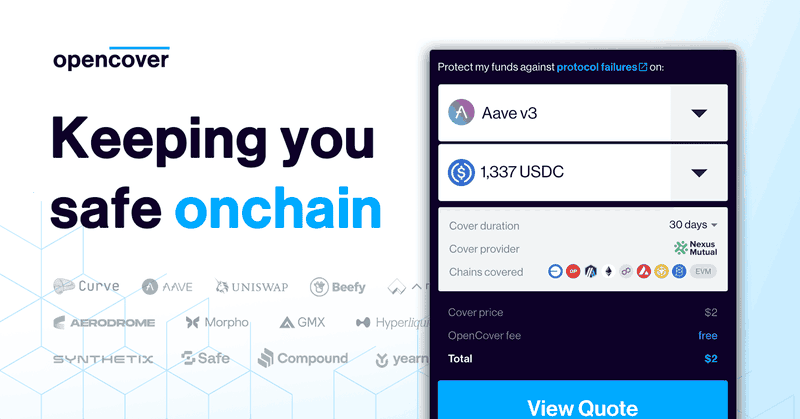

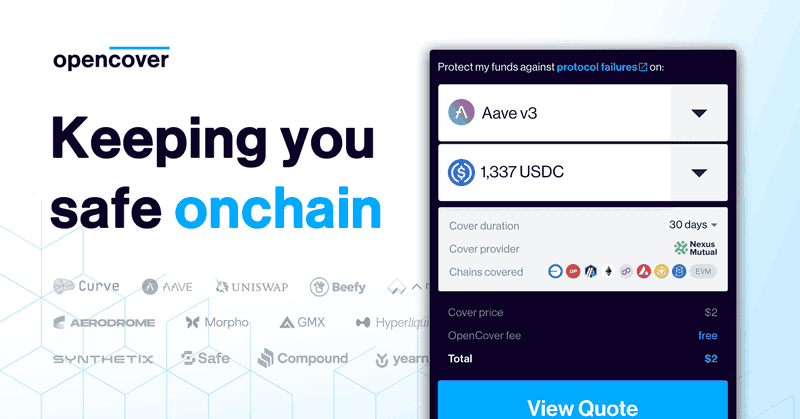

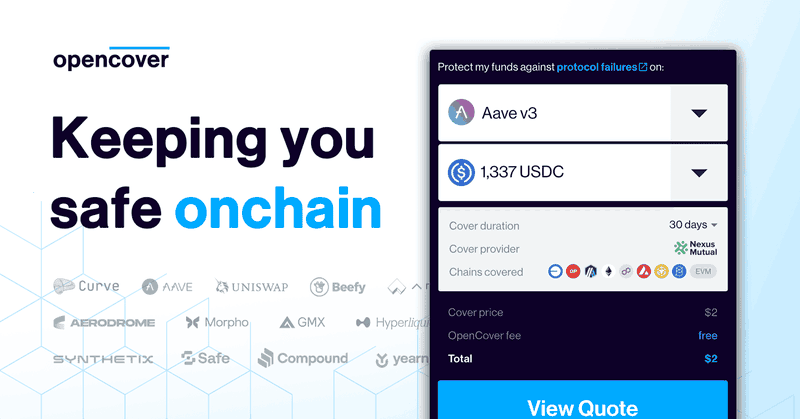

🛡️ Keeping you safe onchain 🛡️ Backed by Alliance, NFX, Coinbase Ventures Base Eco Fund, Orange DAO, Jump.

Derisk your portfolio →

Joined March 2021

⚡️ OpenCover is years ahead. Both in the risks we cover and the user experience we deliver. 🛡️ But none of that matters if we didn’t also achieve stellar outcomes when they are most needed. ➡️ Don't take our word for it, here's what recent claimants had to say 👇

10

8

31

✅ With multi-protocol cover, you're protected. ➡️ Protocol cover protects you from the leading onchain risks: 👾 Smart contract hacks and bugs ❌ Liquidation failures 🔮 Oracle manipulation 👨⚖️ Governance attacks 🔗

opencover.com

Cover $5,000 from $2 per week on Base, Ethereum, Arbitrum and more. As seen on CoinDesk, The Block and Coin Telegraph.

1

0

1

😬 The Stream Finance situation shows how interconnected DeFi - and your positions - are. 👉 The protocol you use can use a protocol, and if that protocol suffers a hack or has an issue, it can impact you. 👻 Scary, right?

2

0

0

⭐️ USER FEEDBACK ⭐️ 🛡️ FM has a position on a @beefyfinance vault that was impacted by the Stream Finance disruption. 🍀 Fortunately, he had previously purchased cover and was protected and we paid him out for his loss. 💬 This was his experience.

4

4

9

🔔 Weekly Covered Yield Update New listings: 🛡️ @Coinstancy Savings is now 100% covered by OpenCover. 🛡️ Protocol Cover is available for @upshift_fi. Industry news: ⭐ @NexusMutual surpassed $1B in cover sold in 2025. Covered protocols: 🔹 @Uniswap v4 is live in @revertfinance

0

1

5

➡️ Cover your @upshift_fi positions for just 0.24% p/m and earn up to 16.68% risk-adjusted APY on USDC. ✅ Protect your onchain wealth, cover your yield, and relax over the holidays: https://t.co/vB5lfJnNUU 💪

opencover.com

Cover $5,000 from $2 per week on Aerodrome, Aave, Beefy, Pendle, EtherFi and more. As seen on CoinDesk, The Block and Coin Telegraph.

0

0

0

🛡️ Protocol Cover for @upshift_fi protects you against: 👾 Protocol hacks 📉 Oracle manipulation ❌ Liquidation failures ⚔️ Governance attacks

1

0

0

🛡️ NEW COVER LIVE 🛡️ ⚔️ Protocol Cover is now available for @upshift_fi. 🔒 With $500M+ deposited, Upshift offers yield opportunities on USDC, ETH, and HYPE. Cover your positions for maximum peace of mind.

3

1

6

➡️ Protocol cover protects you from the leading onchain risks: 👾 Smart contract hacks and bugs ❌ Liquidation failures 🔮 Oracle manipulation 👨⚖️ Governance attacks 🔗 Protect your onchain wealth, and destress your DeFi: https://t.co/xOtxmPLjxo ✅

opencover.com

Cover $5,000 from $2 per week on Base, Ethereum, Arbitrum and more. As seen on CoinDesk, The Block and Coin Telegraph.

0

0

1

👉 The benefit of Multi-Protocol Cover is that it protects you if an underlying protocol impacts your position. 👀 In this case, Armand used a @beefyfinance vault that used XUSD as collateral, so he was impacted despite never directly interacting with Stream or XUSD.

1

0

3

⭐️ USER FEEDBACK ⭐️ 🛡️ Armand had funds in a @beefyfinance vault that was affected by the Stream Finance disruption. ✅ Thanks to his cover with us, he was able to receive a payout for his position. 💬 Here's what he had to say about his experience and the process.

2

7

14

Insurance in DeFi 1/ Insurance allows you to hedge against: 🏦 Protocol failures (smart contract exploits/hacks, oracle failure, etc.) 💵Depegging of: 💰Stablecoins 🪙Wrapped or synthetic tokens (like stETH, WBTC) Check out the annual depeg insurance fees by

2

2

3

🤝 Coinstancy Savings is now 100% covered by OpenCover. 🛡️ Protecting users by making covered yield the default is becoming the industry standard.

🔐 Security update on Coinstancy Savings All deposits in Coinstancy Savings are now 100% covered through our partner @OpenCover. In addition, every transaction executed from the dedicated multisignature wallet used to manage savings funds is protected by an automatic co-signer.

2

7

15

🛡️ You can cover your @Contango_xyz positions with just a few clicks to earn covered yield. 🤝 Protect your onchain wealth, touch grass, earn yield.

Pro tip: if you're a Contango newbie (or even a seasoned pro) you can purchase coverage for your Contango positions through @NexusMutual on L1 or @OpenCover on major L2s. Both options offer bundles with all lending markets that Contango works with.

1

0

4

@OpenCover @beefyfinance @ArcadiaFi User experience and results, both matter. Looks like they’re nailing it on both fronts.

0

1

2

🔔 Weekly Covered Yield Update New listings: 🛡️ @LidoFinance Protocol Cover Covered protocols: 🔹 USDC is now connected between HyperCore and HyperEVM, enabling secure, natively minted cross-chain transfers and direct USDC deposits into @HypercoreProto. 🔹 @ArcadiaFi introduced

0

1

6

📣 Want to get a discount on your cover? 1️⃣ RT this post 2️⃣ Follow @OpenCover 3️⃣ DM the OpenCover account 4️⃣ Get a link for 300 credits Covered yield > unprotected yield.

1

0

0

➡️ Cover your @LidoFinance positions for just 0.05% p/m and stake your ETH in peace. ✅ Protect your onchain wealth and take the worry out of DeFi: https://t.co/H390y7Xkzh 👈

opencover.com

Cover $5,000 from $2 per week on Aerodrome, Aave, Beefy, Pendle, EtherFi and more. As seen on CoinDesk, The Block and Coin Telegraph.

0

0

0

🛡️ Protocol Cover for @LidoFinance protects you against: 👾 Protocol hacks 📉 Oracle manipulation ❌ Liquidation failures ⚔️ Governance attacks

1

0

0

🛡️ NEW COVER LIVE 🛡️ 👉 Protocol Cover is now available for @LidoFinance. 🔒 Cover your Lido positions to earn covered yield on your staked ETH.

3

2

4