Contango 💃🏾

@Contango_xyz

Followers

21K

Following

2K

Media

2K

Statuses

4K

Loop anything, on chain.

Joined May 2022

First time hearing about looping? Meet @KamelAouane, one of the co-founders of Contango. He will gladly explain what it is, in layman terms.

18

22

99

@pendle_fi @PendleIntern @ethena_labs @OpenEden_X ⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

3

⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read:

docs.contango.xyz

0

0

1

Here's your yearly reminder to: 1. Use MEV protection 2. Rotate your keys 3. Be OpSecxually active (more tips below) 👇

2

0

6

⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

1

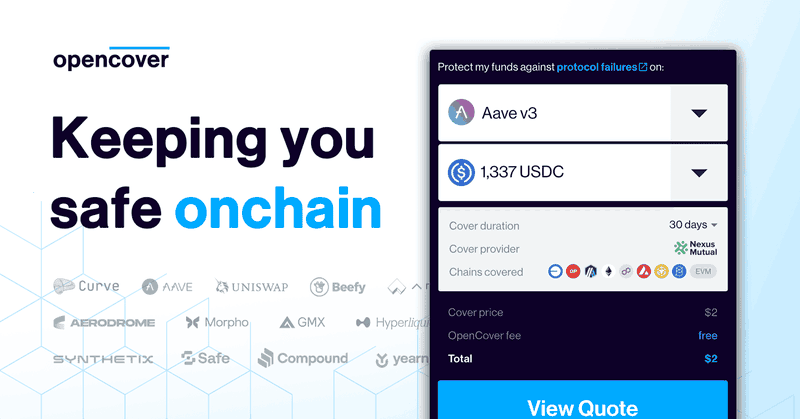

You can access both protocols here: Nexus 👉 https://t.co/5fHfQv78xO OpenCover 👉 https://t.co/hPCPnvY65P DYOR and keep yourself safe onchain ;)

opencover.com

Cover $5,000 from $2 per week on Aerodrome, Aave, Beefy, Pendle, EtherFi and more. As seen on CoinDesk, The Block and Coin Telegraph.

1

0

6

Nexus is the leading insurance protocol in defi. It’s available on mainnet, but it covers all chains where Contango is deployed on. Open Cover works in tandem with Nexus, and was born as its L2 alternative.

1

0

1

Pro tip: if you're a Contango newbie (or even a seasoned pro) you can purchase coverage for your Contango positions through @NexusMutual on L1 or @OpenCover on major L2s. Both options offer bundles with all lending markets that Contango works with.

3

1

8

Time to go long again? Our favorite whale is currently holding back. He closed all his wstETH positions at the beginning of November, crystallizing $500,670 in profits. Now, he's likely sipping a margarita, waiting for a new entry.

Lemme show you how our favorite whale uses Contango for low-leverage longs. Current profits: $1.26M (noyce) 🧵👇

0

0

3

@OpenEden_X ⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

2

The intern is turning into a pro PT looper. He's kindly asking to not dilute his yield. He needs those $8.

1

1

8

⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

1

Look at whales. Learn from their wins. Avoid their mistakes. (Short guide below) 👇

1

0

5

⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

2

FOMC meetings are full of volatility. Just go delta-neutral or farm some yield on correlated pairs. The 𝘈𝘥𝘷𝘢𝘯𝘤𝘦 𝘛𝘳𝘢𝘥𝘦 𝘚𝘦𝘭𝘦𝘤𝘵𝘪𝘰𝘯 is your friend.

1

1

9

⚠️ Trading on leverage carries significant risk. This is not financial advice. Contango builds positions on variable rate markets. If you don’t understand its mechanics, refrain from trading or staking, and read: https://t.co/m2gakJk1kg

0

0

2

@pendle_fi @PendleIntern Before trading PTs, we highly recommend this short guide to avoid rekting yourself like a rookie. https://t.co/ApnjNT8cbp

medium.com

Lil guide to accompany you during your first baby steps into the adulthood of PT-trading.

1

0

4

New maturities for @ethena_labs USDe and sUSDe are out. Deep liquidity on @aave means that you can post $1M margin like nothing. (Plus, if you pick the same base and quote asset you won't face slippage when closing)

3

2

11