JustJousting

@OnlyJousting

Followers

540

Following

2K

Media

21

Statuses

582

Wow, it's been 3 years and some change since I made https://t.co/ncjwvFNTeC. I originally made it for myself to determine what I wanted to compound my bribes into (cvxCRV or CVX). I still see @ConvexFinance community members reference it and each time it puts a smirk on my face

5

5

25

Curve on… @unichain Why? Because it’s the best AMM for LSTs!

Considering that there are immediate positions on @unichain @MorphoLabs markets at risk of liquidation, and considering that there is very limited liquidity on @Uniswap for wstETH > ETH, there is now a @CurveFinance pool that liquidators can use: https://t.co/8RhRPxUY5q It's

14

26

193

Llamas discuss their favourite yield platforms very important conversation.. 😅

2

4

21

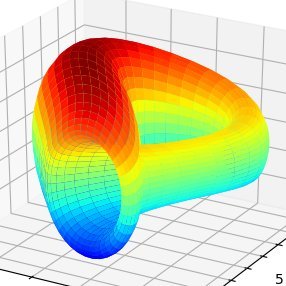

If anyone has ever wondered how Curve's Cryptoswap pools work Here's the WETH-CVX pool rebalancing its Center of Liquidity automatically around the MA price (internal price oracle) for 2 days The pool automatically moves its center of liquidity if it costs less than 50% of the

25

49

374

the power of donations is live! imagine a concentrated liquidity amm that did not require an external agent to do manual rebalancing but instead it did the rebalancing on its own. this is the basis of cryptoswap, which is markedly different from other approaches. cryptoswap has

The new version of twocrypto is very efficient! I'm proud of our work at @CurveFinance. The crvUSD-wBTC pool on @yieldbasis, with $2M TVL, offers better rates than the og tricrypto ($27M TVL). These pools will be the primary place to swap bitcoin once deposit caps are raised.

2

10

39

🔥UPDATE: Savings $crvUSD APY has increased from 7.4% to 9% as weekly distributions to scrvUSD hit a new record high this week: Demand for crvUSD is expected to increase dramatically due to the strong performance of $CRV which is pushing yields up across all @CurveFinance

scrvUSD is currently offering some of the highest organic stablecoin yield in all of DeFi @ 7.4% That's much higher than the 4% $sUSDe offers, or the 3.5% average supply rate of $USDC, $USDT on AAVE, or even Hyperliquid's HLP vault, which is currently offering 6% APR on USDC

4

14

57

I don't understand but I vibe steak 🤷♂️

i dont think you understand you vibe stake a llama you get 1 share of treasury yield/month you vibe stake another llama you get 2 shares of yield/month you vibe stake another llama you get 3 shares of yield/month you vibe stake another llama i dont think you understand

0

2

6

Yes. A few miscellaneous thoughts. (1) First, the new bottleneck on AI is prompting and verifying. Since AI does tasks middle-to-middle, not end-to-end. So business spend migrates towards the edges of prompting and verifying, even as AI speeds up the middle. (2) Second, AI

The view that imagines AI wiping out jobs or causing some overnight shock to the system doesn’t contemplate that companies are a made up of a series of bottlenecks. When AI accelerates work in one area, you run into a bottleneck somewhere else. As any individual workflow gets

143

586

3K

Savings rates are increasing. No votes needed - just market doing its thing https://t.co/4jJUC7I0ZC

22

21

161

We will very likely switch to https://t.co/qumQTcqJhU domain permanently

curve.finance

Curve-frontend is a user interface application designed to connect to Curve's deployment of smart contracts.

44

32

250

Seems like https://t.co/vOeMYOTq0l DNS might be hijacked. Don't interact!

curve.finance

Curve-frontend is a user interface application designed to connect to Curve's deployment of smart contracts.

92

206

539

We are officially back. Special thanks to everyone who helped to return the account back so fast: @_SEAL_Org, @0xChar, @9gagceo, @pcaversaccio, @ChainPatrol, even @haydenzadams, and of course X support team

32

62

439

Twitter of @CurveFinance seens to be hacked - be careful!

17

107

294

Oooh, finally we get to see this go live 🥳

Resupply is now Officially Live! — It's time to make your stablecoins work harder for you! You can now borrow $reUSD, a decentralized stablecoin backed by yield-bearing lending vault tokens. Visit our dAPP which is now live at: https://t.co/oQPvcLNJm8 and start earning now! 1/5

1

0

4

🤯

tfw when you are seeing 20% gains in venom _across the board_ ... nice work, @harkal and the @vyperlang team!

1

1

3

What difference do dynamic fees make? If liquidity is lopsided, quite a lot. Easy double-digit increase in revenue on constantly imbalanced pools.

2

10

24

Always use protection

Spent yesterday in Liq Protection (soft-liquidation) with my 5x leveraged $ETH long on @CurveFinance I'm back above now, my total loss was 0.06% of my collateral, which is great considering my losses are 5x usual due to 5x leverage Quite happy tbh, Always use protection ☺️

0

1

8

Crazy how many people don’t know about Soft Liquidations. Read here: https://t.co/Hf41lJIvb6 Simulate here: https://t.co/v7IvGbpsX3 $CRV

6

23

118