Meyyappan PL

@MeyyappanPl1

Followers

15,277

Following

95

Media

303

Statuses

4,328

Equity Investor , Who loves investing . No Buy & Sell recommendations.

karaikudi

Joined November 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

jeno

• 467546 Tweets

Meet the Grahams

• 285834 Tweets

#بدر_بن_عبدالمحسن

• 262571 Tweets

Óscar Puente

• 78004 Tweets

Saka

• 54350 Tweets

#ライブ・エール

• 52296 Tweets

Bournemouth

• 42845 Tweets

こどもの日

• 36871 Tweets

サヨナラ

• 32875 Tweets

#霊験お初

• 32090 Tweets

الامير الشاعر

• 27895 Tweets

Havertz

• 21883 Tweets

الفردوس الاعلي

• 20971 Tweets

#ARSBOU

• 19463 Tweets

غاب نور البدر

• 14875 Tweets

Christie

• 13653 Tweets

Ipswich

• 13462 Tweets

アジカン

• 11592 Tweets

Last Seen Profiles

L&T bought

#Mindtree

for 61% stake for 10,200cr in 2019

Now in 3 years it's worth 45,750 cr

Sad part

Coffeday's late Siddhartha sold his 20.41% stake for only 2858cr

Now it's worth 15,307cr

(more than enough to cover his debt)

Distress sale due to debt(leverage)

23

79

832

#Balkrishnaindustries

In 2008 Crash

Price

86rs in Jan 08 to

12rs in 2009

(84% correction)

It take 3 years to reach 86rs in 2011.

But now 1772rs (correct 37% from recent peak 2724rs)

Longterm investing is not easy.

Need lot of conviction to hold shares in correction

#BKT

15

49

640

During Jan 2008 equity crash

#Reliance

industries invested 500Cr

In

#Asianpaints

for 4.9% stake.

Still holding them strong

Now the stake is worth 16,000Cr

32 times return in 13 years

This is how bottom fishing 🎣 is done even in treasury investment too.

11

46

617

Adani wilmar🌴

#AWL

Ipo price 230₹

Listing price 227₹ Feb 8th

Today price 728₹

1L invested in Listing date will be 3.2L(75days only)

Retail subscribed just 3.2X only

While applying for other craps

Some are making great money💰

Others are still abusing Adani

31

30

528

#Tubeinvestment

invested

700cr ( in Nov 2020) & 100cr in (Dec 2020)

= 800cr in

#CGpower

Now the stake is worth 13840cr

Whooping 17X returns.

One of the best turnaround stories

Believe best is yet to come

14

39

357

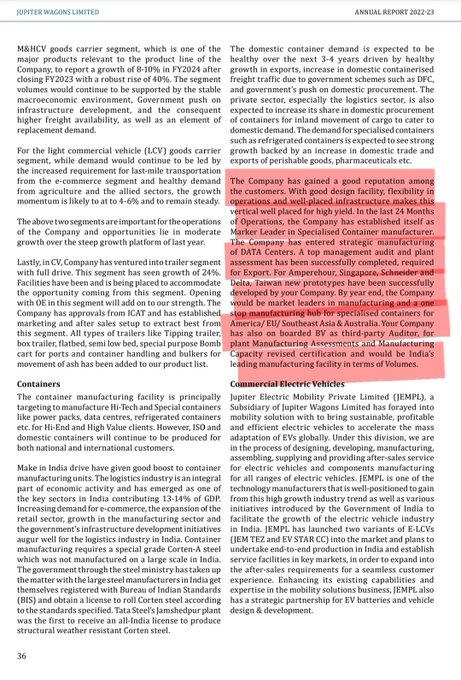

Central Govt mulls 11,000Cr PLI

For shipping container manufacturing

India need 3.5L container/year

90% imported from China

Jupiter wagons supplying to

Adani

GE

Schneider

DPW

Amperehour

By year end company will be market leader in manufacturing specialized container

#JWL

11

70

360

#Polycab

IPO was one of the most successful IPO of 2019

IPO price ₹538

Listing price ₹645(20% premium) 16-4-2019.

Share price zoom to ₹1200 in feb 20

After Covid crash share fall to ₹600 in may 20

Now ₹2450

Courage is needed to hold the stocks in 50% drawdowns

16

16

352

Dalmia Cement Ltd

In 2002 Rs33

In 2022 Rs 3530

( 2

#dalmiabharat

+ 1

#dalmiasugar

)

It's 107× excluding dividends. (Actually both corrected 35% from recent peak )

long-term investing even in commodity business run by competent management can give multibaggers

Stay long

10

33

319

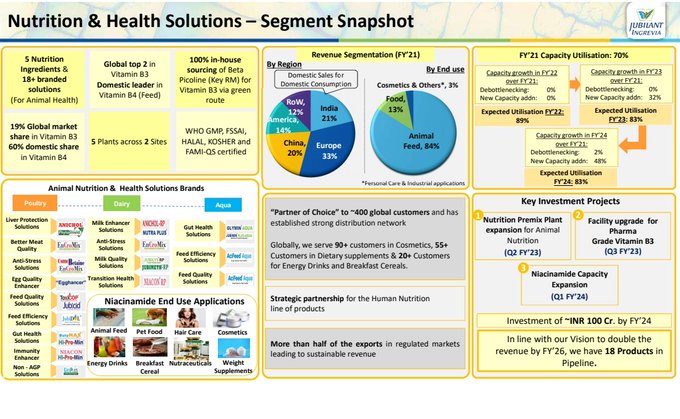

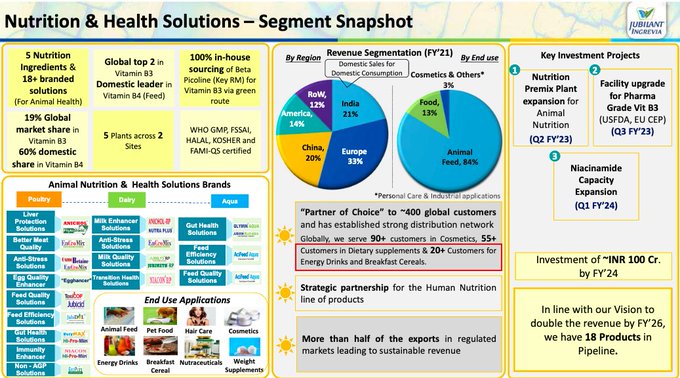

2050Cr Capex plan for 4 years

800Cr committed already

1250Cr planned for fy23 to fy25

Largest Capex by company in 4 decades of operation(funded by internal Accural only)

4500Cr expected Additional sales(70% in high margin Speciality & nutritionsegment)

-

#Jubilantingrevia

18

39

328

Currently Ethanol is being blended only with petrol ⛽

Diesel doesn't easily blend like petrol

#Prajindustries

is developing a Binder to blend Ethanol with Diesel.

The project is in testing phase.

If successful it will be a great innovation & Game changer for fuel blending

6

27

322

#Didyouknow

UB group used own

#bergerpaint

in 80's

UB group's Vijay Mallya Sold berger paints to Dhingara Family for $66million ( around 145Cr) in 1991

Even helped them arrange loans from HSBC

Now Berger paint is worth 76,540 cr

Morale : Don't sell your family Silver

9

26

306

20 nuclear reactors are planned to opened with 2031 (15000MW)

Besides this govt plans 26$ billion pvt investment in nuclear power.

It's a huge opportunity for the beneficiaries

Eg.

#AMIC

forgings supplies Trunnion fir nuclear plants.

#konstelec

electrical EPC for NPCIL

18

68

296

#Didyouknow

Wilmar controls 30% of world edible oil business

Owns 44% in

#Adaniwilmar

&

10 of 18 refineries of

#AWL

are located near sea ports (direct shipment of crude edible oil)

Another partner Adani (owns 44%)

Controls India's largest private port.

Adani ports.

12

24

264

During FTIL fiasco

#DalmiaBharat

cement invested first in

#IEX

20% (480 cr in 2015 -16)

Sold 4.47% in May 21 = 487Cr

Holds 15.52% (3650Cr)

×8.7returns

Puneet Dalmia made a brilliant bet & believes in IEX platform business potential ( well before others)

Value investing.

1

23

265

Warburg pincus Sold 19.63 % of

#lauruslabs

in 2020 ( May 441rs & June 508rs) price before 1:5 split.

Even after holding it for 6 years for 1007Cr.

Then next 6 months share shootup to 3500rs

Missed 7× return

Even Mighty PE funds cannot time the share price (Exits)

7

14

263

#ACC

+

#Ambuja

= 70MTPA ( valued at 16.08 $ Billion )

While

#Dalmiabharat

= 35.9MTPA ( valued at 3.43 $ Billion )

12

23

252

#SRF

Results are out of the park.

( Reminds me of Ganguly's Sixers on left arm spinners)

Sales up 51% up 3314Cr

PAT up 38% up 531 Cr

Srf is a juggernaut, largest with highest growth rate.

Best is yet cheapest in the sector.

11

19

251

#intellectdsesign

Arena

Sales up 33% 508.3cr

Ebita up 37%

PAT up 25% 100.9cr

SaaS revenue up 113%

89Cr

Cash at 413Crs.

Profitable SaaS player in global fintech space

6

36

248

#polycab

has 11000+SKUs in wires & cables (ranging from 0.20kV to 220kV)

23 manufacturing units

52 warehouses

4100+ distributors

165000+ retailers.

Optic fiber division too has huge potential

Recently Won 509cr

#Bharatnet

order to deploy 16500km fiber networks of Tanfiet

3

27

231

Railway Capex is the major theme for the next 3years (decade may be)

Eg.

#GPTinfra

A small 330cr Rail infra company has won 3 orders worth 609cr

26 dec 123Cr

16 jan 216Cr

20 Jan 270Cr

in less than a month time

Please

Study the sector you may find some interesting ideas

6

28

226

Barium sulfate is mainly used as filler in the paint industry.

It's a speciality chemical,

currently full demand is imported.

#Vishnuchemicals

Is doing a 90Cr Capex on Barium sulfate with a capacity of 30,000 tonnes

Capex timeline Q4

Production by H1

Import substitution

6

28

228

Very Ambitious plans with an investment of 2685Cr over next 4 years

Including

-Solar cell

-PV module

-Allied power electronics manufacturing

-300 MW Solar plant.

Very honest promoter(gave entire proceed from Numeric UPS sale as Special dividend)

#swelect

energy

10

31

226

#Didyouknow

Palm oil 🌴 is the largest edible oil in the world (30%)

And Wilmar International Singapore.

Is the world's largest producer of palm oil

In India Wilmar operates as JV with Adani

#Adaniwilmar

from 1999.

Wilmar also owns 62.48% in

#Shreerenuka

sugars .

6

24

209

#Tatasteel

share price

April 2020 is ₹ 250

Now EPS of Tata steel for last year is ₹ 332

In 2 Years

EPS 2022 > share price of April 2020

Cyclical at its best

7

8

211

Major Chinese Solar panel are denied entry in US due forced labour allegations.

This marks 2$billion solar export opportunity in US for Indian manufactures.

Pannel & component makers may benefit

#swelect

may benefit with new 700MW coimbatore unit & strong presence in US

5

22

197

Another Microcap I am bullish on is

#Rubfila

-India's only talcum coated &silicon coated rubber thread maker.

-capacity increased from 5000TPA in 2013 to 20000TPA

-5000TPA on going Capex.

-Zero debt

-Promoter bharat patel(renowned investor) family increases by holding 5%

7

36

193

Refrigerat Gases business of

#SRF

is expected to generate a 30.3% CAGR for FYI 22 to 25

By commissioning of R22 by 12,500 tonnes by FYI 23

By commissioning of R32 by 15,000 tonnes by FYI 24

7

19

191

Carlyle group goes for aggressive MD for

#sequent

Mr Rajaram Narayan ( Sanofi india MD)

Is Ex Cheif Marketing officer of AirTel & HUL Alumni

Where as conservative former Strides guy Manish Gupta is replaced.

New promoters are going for aggressive sales growth

10

7

186

#lauruslabs

signs agreement to manufacture Molnupiravir ( anti viral covid medication)

Note: they are doubling their formulation from 5 billion to 10 billion capsules by March 2022.

Means huge capacity ready in place

6

11

185

India imports 45% of its diketene needs.

Laxmi organics is only producer of diketene in India with 55% market share.

#jubilantingrevia

commissioned 7000T Diketene facility at Q4 last year.

#Laxmiorganics

too commissioned 200cr capex Q1 this year

Import substitution play.

7

28

187

At this Mcap

#Hikal

is available at the value of its Agro chemical division alone.

Pharma division is available as a bonus.

0

17

186

Prepaid about 548Cr long term debt in fy22

Outstanding gross debt is 286Cr In jun22

Net debt to ebita improves to

0.2 vs 0.4

Ongoing 2050Cr Capex fully funded by internal accruals

Debt will remain less than 0.3

Net cash accruals 550Cr/year

Cash~ 57cr

#jubilantingrevia

4

10

183

#Tubeinvestment

Plans to invest 1000cr in 4 EV platforms ( 250 Cr each)

- Three wheeler 🛺

- Tractor 🚜

- heavy commercials vehicle 🚚

- 4th is on works

Yesterday launhed

Montera "Super Auto"

for 3L will be available at 100+ dealers Across country

6

26

183

Bajaj finance is

#Bajajfinance

.

Aum growth of 31% in such a huge base.

Like Rajeev Jain said real growth of Bajaj finance is yet to bone in next e years .

Note:- it's real fintech, no NBFC or bank can match it in technology

3

11

183

Besides Railway Business

#jupiterwagons

is one of the leading manufacter of Load bodies of commercial vehicle

And Also

One of the few Manufacter of indigenous Container Manufacter

With govt push to replace Container import from China. Company Aims huge growth.

10

20

182

#Jubilantingrevia

Speciality chemicals division

Sales up 34% 468Cr

Ebita up 15% 87Cr

Now spec Chem Accounts for 52% of Ebita from 33% (yoy)

Also increased ongoing Capex plan 2275cr fom 2050cr(fy22 to fy25)

Commodity to Speciality transmission is on.

6

16

183

#SRF

planning to do 15,000 Cr Capex in the next 5 years ( 80% in chemicals)

-Ashish Barat Ram.

Behemoth in making .

7

16

177

For 5G in India

Optic fibre cable OFC deployment should be need to increase 2-3 fold from current 16-18 million kfm/year.

#polycab

Company launched Solar products

Solar Cables

Panels

Module ( mono & poly crystalline)

Range of inverters

DC MCBs

India need Cables for growth

14

17

178

Famous brokerages like Motilal Oswal come with a buy call on PC jewellers in 2017

Thesis is simple

Mcap of

#PCjewellers

is 20,000cr

Where as

Mcap of

#Titan

is 60,000cr

What happened

Almost 23,000cr investors wealth got lost

All glitter are not Titan ✨️

17

10

177

Besides smart meters.

#Salzer

electronics bets big on EV chargers.

They have products starting from 30KW to 240KW.

Can do 120cr with existing infra.

Scale upto 600Cr sales with 70-100Cr Capex.

They feel its Technologically superior product in EV charging infra

3

28

179

As a part of Vibrat Gujarat in the pre summit event today

#SRF

committed 7,500cr to be invested in next 3 years

On going Capex itself is 2,500cr.

Srf is a Capex mammoth 🦣, best is yet to come .

Srf run on simple theme

Capex-> Sales-> profit ->more Capex

4

21

174

I am so happy to be followed by the first person I followed on Twitter.

@unseenvalue

sir.

Sir your such an inspiration in sharing knowledge 🙏🙏🙏

8

3

174

Greatest

#Atmanirbhar

bharat is RDSO's Kavach Automatic Train protection

Safety integrity level 4 technology

Cost 30-50L/kms vs western nations

>2Cr/kms

By 2028 Indian railway plan to finish kavach for 68,446Kms

Plan to export this tech other countries

#hblpower

#kernex

10

24

173

#SRF

incorporated wholly owned subsidiary

Srf Altech Ltd. ( 21000TPA)

For manufacturer of Aluminum foil.

India imports 50%of Aluminum foil( 1LTPA of total demand of 2LTPA)

Besides chemicals SRF has very Ambitious plans for packaging films division too.

7

22

169

What separate Men from boys.

It's performance when going is tough.

Highest ever sales

Highest ever EBITA

Highest ever PAT

Q4

sales up 35% 3505Cr

PAT up 65% 637Cr

Magin expansion.

Chemical division is on 🔥

Two new Capex

#SRF

Is a different breed all together

10

13

166

Next 2 years Railway wagons manufacturer are sitting at cumulative order of 30,000cr . huge boost is coming for them

#Jupiterwagons

#Texmaco

#titagarhwagons

6

26

166

Mondelez india eyes bigger bite in indian biscuit market

Brands

Oreo

Cadbury chokobakes

Bournvita biscuits

Bournvita fills

#Mrsbectors

is the contract manufacturer of Mondelez india

#DidYouKnow

you know

Mrs Bectors is also Supplying cookies for IKEA india

7

16

170

Expect minimum 20,000 wagon order from railway this year

Expect 2000 to 3000 Cr wagon order from private sector

Capacity increased to 600 wagon/month from 200 wagon/month last year

Planning to increase 700 wagon/month by Q4

#jupiterwagon

Highest margin in the sector too

3

23

164

HFO refrigerants have much lower global warming effect than HFC

SRF is the only firm in india manufacturing 1234YF (an HF0)

Currently Dupont & Honeywell has monopoly (patent expiry by Cy2025)

US Plans by 2030 to phase out HFC.

It's a $17B opportunity by Cy 2030

#SRF

8

23

165

Besides Renewable, govt major push is into LNG sector.

Check out for major beneficiaries in Gas infrastructure space

Eg

Recently listed SME

#PrathamEPC

won a 497Cr pipeline order for 36 months

Compared with 50cr fy23 sales

That's the size of opportunities in Gas ⛽️

9

26

167

Told you so

Today BJP announced pipeline gas available to all households by 2029

Gas infrastructure is one of the main themes for next 5 years

Besides Renewable, govt major push is into LNG sector.

Check out for major beneficiaries in Gas infrastructure space

Eg

Recently listed SME

#PrathamEPC

won a 497Cr pipeline order for 36 months

Compared with 50cr fy23 sales

That's the size of opportunities in Gas ⛽️

9

26

167

17

21

163

Worlds leading Plastic Recycling machine manufacturer Starlinger

Announced that it had commissioned

2 starlinger lines in Warangal of 40,000 Tones

~ 14,000 filament yarn production

~ 26,000 food grade rPET resigns.

18% of India's PET Recycling ♻️ by

#Ganeshaecosphere

2

22

163

#Tubeinvestment

Owns 76% stake in Noida based Moshine electronics ltd

Which will commence manufacturing of Mobile camera modules

Revenue contribution nominal in Fy23 & gradual increase in FYI 24

6

9

161

#DidYouKnow

#GodrejAgrovet

has

India's largest Palm 🌴 oil plantation 75000 hectares & also India's largest crude Palm oil producer.

4

15

156

@unseenvalue

@BrianFeroldi

🧬 👨🔬👩⚕️💉💊🧪 - thermofisher

🐩 ' zoetis

🧬 -Biocon

⭕️ - laurus

🌋- neuland

🧂 - praj

🎨 -asian paint/ sudharsan

🐕 - sequent

🌱 🐴 💊- Hikal

🧬- syngene

🐈 - elanco

💉💊- JB chem

💊 👩⚕️- Apollo hospital

9

26

158

#jubilantingrevia

is world leader in vitamin B3 & domestic leader in vitamin B4

18 products in pipeline in nutrition & health supplements

#Nutraceuticals

(nutritional supplements) - large, growing addressable markets with powerful tailwinds

2

19

127

4

18

157

#Polycab

is now among Top 5 wires & cables companies in the world 🌎

Project leap is firing

I love management which walk the talk.

Its Proxy to India 🇮🇳 consumption

1

9

159

All the Automobile companies in India 🇮🇳

#BajajAuto

is the most profitable company in India.(higher than Maruti,Tata,m&m,hero etc)

Highest ROCE.

Highest dividend yield too.

Most underrated Auto company 🛺.

6

11

153

#Genuspower

Wins 2,247Cr order for 24.18 smart meter.

RDSS scheme is a decadal opportunity

They also comes with 15year maintenance

Now order book above 11,000Cr

Singapore govt GIC is betting big on it

3

25

158

Diketene are used in

-Dyes & pigment

-Agrochemicals

-pharmaceutical

Around 50% of which is imported.

#jubilantingrevia

guided to achieve 8000 Tonnes(full capacity by Q4) four molecules.

Also developing niche molecule for Antimicrobial value added Diketene

~ High margin

5

18

152

#jubilantingrevia

today commisioned 25,000 tones per annum

Food grade Acetic acid manufactured from Green ethanol.

Offering first of it's kind product.

2

12

151

Jubilant ingrevia is a giant in making 😇

Next decade belongs to it

8

20

151

Electrical Two wheeler & Car market "Too crowded"

#Tubeinvestments

Has 3rd largest electric three wheeler capacity 75000 🛺

E-HV 🚚 by Q4.

Leveraging group companies

Consumer EV financing by cholamandalam finance

Gears box & motors for EVs by Shanti Gears & Cg power.

5

13

151

Carlyle group invested 960Cr in Dec 2013 in

#medanta

Owns 25.66%

Sold 5.66% in pre IPO

Going to sell remaining 20% at IPO

Made 2,182Cr

Gets a 1.27× return in 9years.

Another successful exit after SBIcards(10.7× returns)

How much will they make in

Piramal ?

sequent ?

7

9

150

Indian railway brake market is

3000cr/year market

Dominated by Knorr-bremese & Faiveley transport

Jupiter wagon enters the market

2 Jvs with

Kovis for disc brake

Dako CZ for disc system

Both jvs begins operation.

Also acquires Stone India from NCLT.

#jupiterwagon

#jwl

6

16

148

#Salzer

enters smart meter production with a fully integrated manufacturing unit.

With initial capacity 4M units

Plan to scale upto 10M units in 2nd phase.

Production begins in q1 fy25.

Very good track record in manufacturing

RDSS scheme

Smart meter

8

15

148

#siemens

bagged 26,000cr locomotive 🚂 order for Indian Railway for 1200 units over 11 year period on Jan 23

Siemens along with

#BEML

bids for Vande bharat train sets 200 Vande bharat train 🚆sets(16 ongoing)

#Jupiterwagon

is on board as lithium ion🔋 vendor for simens

#JWL

2

17

146

Expecting 18,000cr order wins for smart meters in next 3 to 4 ( billing with in the period itself)

6000cr order on hand.

#Genuspower

Last year sales 808 Cr .

Opportunity Size is huge .

2

13

143

#Genuspower

Wins order worth 2207 cr smart meter order.

They already have 4000 cr+ order book.

RDSS scheme is a boon to the company.

It's extraordinary theme for next 5 years.

Catch them young.

7

15

144

Plan to in invest 1000cr Capex in 2 year

To raise 500 to 600cr for funding Capex

To set up wheel manufacturing with foreign tei up

Expect 1000cr revenue from brake & brake system

Margins are expected to much

higher current levels

#Jupiterwagons

Note

#jwl

has highest margins

4

19

144

Morgan stanely upgrade

#SRF

to overweight

Target to ₹3571 (earlier ₹2757)

Remains thier top pick in speciality chemical

One year sideways consolidation.

4

19

144