Leah Wald

@LeahWald

Followers

38K

Following

19K

Media

684

Statuses

8K

bitcoin + decentralized identity | thinking about markets, human agency, and maintaining digital autonomy in the age of AI

Joined November 2014

I'm thrilled to announce I'm joining @Abaxx_Tech as Commercial Advisor. This one's personal. For the past 6 years, I've had the privilege of watching @joshcrumb build something I believe the world desperately needs right now. When he asked me to join the team, I didn't hesitate.

Abaxx Technologies appoints @LeahWald as Commercial Advisor, supporting commercial readiness of Abaxx Digital Title platform ahead of multi-market pilot program. Read Release https://t.co/4XzHanaUR7

13

18

123

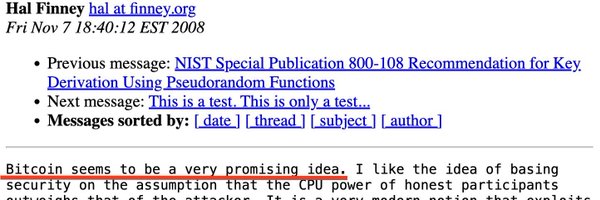

Brink just wrapped up a third-party security audit of Bitcoin Core. To our knowledge, this is the first of its kind public security audit. "The results confirm what long-time contributors and users already know: Bitcoin Core is a mature, conservatively engineered, and

As part of Brink's mission to ensure the safety and robustness of the open-source Bitcoin Core software, we recently sponsored an independent security audit of the Bitcoin Core codebase. This represents the first public, third-party audit of Bitcoin Core. https://t.co/bJQxsDVM48

31

37

258

"That was the remaining problem in public key cryptography. Everybody felt it was such a breakthrough — that we don't need to worry about managing keys. Well, you do. You just have a different problem to solve. It's called the man in the middle attack." Creator of the world’s

0

3

20

🦎 Gavin under scrutiny after new LA wildfire bombshells A new report sheds light on Gavin Newsom and California democrats’ responsibility for the deadly LA wildfires … After Gavin has consistently attempted to blame the fires on climate change

0

20

70

This is what 1.2 million diapers looks like! Had the privilege of visiting the Nashville Diaper Connection’s distribution center on Friday and I’m still thinking about it. Brandi Jack and her team are doing something extraordinary - diapering 7,000 babies every month across

5

1

31

Wild New Yorker piece where programmer/ New Yorker writer James Somers spent his career dismissing AI until he used it to code and had an existential crisis about what thinking actually is. The piece talks about how neuroscientists can now watch individual “thoughts” light up

newyorker.com

ChatGPT does not have an inner life. Yet it seems to know what it’s talking about.

3

11

21

What a great episode. What a privilege it is to work day in and day out with such intellect & passion. With @LeahWald joining Ian & @carriejaqs to co-lead the 🆔++ and FDT commercial rollout, we now have 8 founders as part of the leadership team in the Abaxx Tech group—and

This AM, @DavidVGreely continues with @abaxx_tech's Ian Forester on how cryptographically secured identity & signatures take us from digitization to tokenization — plus Abaxx’s 4 pillars for trusted transactions: identity, intent, assets & data. https://t.co/YOOpsigfEh

3

15

80

Founder & CEO @JoshCrumb outlines Abaxx's work to re-engineer tokenization, focusing on secure digital identity, privacy, and legal finality as the foundations for institutional grade commercial transactions on @Smarter_Markets.

"When the asset lives in the ledger, ledger reconciliation is what matters. When the asset lives in the law, legal reconciliation is what matters. Securities, commodities, the rights and title to commodities — these all live in the law. That's what we've been working to solve."

2

7

58

I'm honored to help commercialize what this incredible team has built. We're not just building better markets. We're building infrastructure that protects human autonomy in an AI-dominated world. Thank you @joshcrumb for letting me be part of this mission. Can’t wait to help

8

5

61

But the technology is only part of why I wanted to work with Abaxx as an Advisor. It's the philosophy behind the company and the people who believe in that philosophy deeply enough to spend years building privacy and identity technology the right way. While everyone else was

1

0

35

What draws me to Abaxx starts with the technology. Their Private Digital Title framework connects verified identity, legal ownership, and privacy within a law-anchored system — giving institutions a compliant, privacy-preserving alternative to public-ledger models. It enables

1

0

26

Here's what keeps me up at night: we're at this inflection point with AI where the speed of advancement should genuinely concern anyone thinking about digital identity, data ownership, and what it means to maintain human autonomy. Without decentralized identity and real

1

5

40

But let me be clear about something: Abaxx isn't a startup. They're a publicly traded company (CBOE: ABXX) that owns and operates Abaxx Technologies and @Abaxx_Exchange, which is a fully regulated, centrally-cleared commodity exchange in Singapore. Abaxx Exchange is doing

5

1

28

Our Bitcoin conversations over the years about centralized finance's failures, custody risks, sovereignty concerns, nation states as bad actors started as "what if" scenarios. Then we watched them become reality. FTX. Bank runs. Debanking. Daisy chains upon daisy chains of bad

1

0

24

Josh is the most visionary CEO I've ever met. And I've met a lot. Former head of metals strategy at Goldman Sachs, co-founder of multiple companies, he's as deep in traditional commodities markets as anyone I know. As an early Bitcoin adopter, he understood both the promise and

1

4

37

A new tech focus for tokenization of RWAs in cap markets “We’re reconciling legal claims rather than reconciling a ledger.” Josh gets it. You don’t need a blockchain for everything, especially for trading of financial instruments like futures, where the onus of risk falls on

I joined Katie Greifeld & Matt Miller on Bloomberg’s The Close to talk modernizing gold, #silver & commodity markets, and how we’ll transform #gold & commodities into HQLA collateral using Abaxx Digital Title tech. ~25% of global central bank reserves are now gold, so why not

3

8

69

If you only learn one thing about the OP_RETURN drama, make it this. From a network perspective, the most important risk to Bitcoin’s longevity is mining centralization, by far. Just when we’re on the cusp of making transaction selection decentralized with Braidpool, P2PoolV2,

Direction transaction submission to miners, out of band, permissionless mining, and mining decentralization

61

87

450

Two underrated Bitcoin risks: 1) Block space utility must eventually pay network security costs, and 2) corporate treasury adoption creates forced-seller cascades during credit events compounded by ETF leverage. The most anti-cypherpunk outcome: institutional “success” that

8

8

27