Kevin Fromer

@KevinFromer

Followers

940

Following

81

Media

25

Statuses

272

@FSForum President & CEO. Former U.S. Treasury official. @UVA alumnus. Boys and Girls Clubs of Wash Board Member

Washington, DC

Joined January 2010

Great to attend today's policy conversation with @SecScottBessent hosted by @BreitbartNews. The Forum is proud to join other organizations in sponsoring an insightful discussion on the President's economic agenda.

0

1

0

In the most recent Forum File, I spoke with @BNY's Global Treasurer Tiffany Eng on leverage ratio reform and what the proposal could mean for the strength and functioning of the Treasury market. Read more: https://t.co/UTHnzU8mcN

0

0

2

Forum CEO @KevinFromer on federal regulators' proposal to update leverage capital rules: "The Forum appreciates regulators taking the first step to ensure the leverage ratio works for the American economy, not against it." Read more:

fsforum.com

Contact: Laura Peavey (202) 457-8770 [email protected] Forum Applauds Efforts to Improve Functioning of Vital Treasury Markets “Forum appreciates regulators taking the […]

0

1

1

Outdated banking rules are impacting our vital Treasury market, raising borrowing costs and causing unnecessary issues for taxpayers and the economy. Solutions are at hand. Read more from @Reuters, @peteschroeder, @saeedhas, @DBarbuscia:

reuters.com

The banking industry is optimistic that U.S. regulators will soon move to change how much capital they set aside against typically safe investments, particularly after the turmoil in Treasury markets...

0

0

0

In my latest @AmerBanker @BankThink piece, I discuss the urgent need for sensible reforms to bank leverage capital requirements to better serve taxpayers and the economy. Read more: https://t.co/i2TXvBRTj2

0

2

2

“Current leverage-based requirements are outdated, counterproductive, and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses, and the economy,” said Forum CEO @KevinFromer in @AmerBanker @BankThink: https://t.co/FJs1Vulh18

0

1

1

Current leverage-based capital requirements are outdated, counterproductive and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses and the economy, writes @KevinFromer, of @FSForum, in @AmerBanker @BankThink. https://t.co/RZsz4werWc

americanbanker.com

Current leverage-based capital requirements are outdated, counterproductive and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses and the economy.

0

2

5

Current leverage-based capital requirements are outdated, counterproductive, and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses, and the economy, writes @KevinFromer, of @FSForum, in @AmerBanker @BankThink. https://t.co/7guBmxxPdT

americanbanker.com

Current leverage-based capital requirements are outdated, counterproductive and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses and the economy.

0

3

3

We appreciate @SecScottBessent for urging a review of bank leverage capital requirements, which harm U.S. Treasury markets and the broader economy. We look forward to quick action. Learn more:

0

0

0

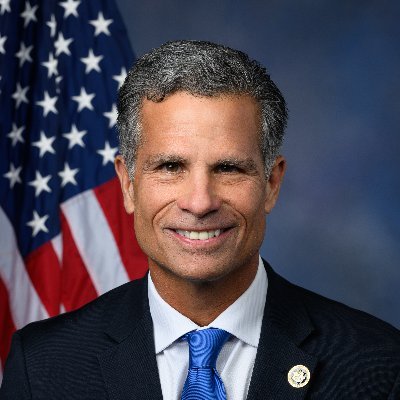

Thank you, @RepMeuser, for the engaging discussion yesterday. I appreciate your commitment to ensuring the competitiveness of our banking system and economy and look forward to our continued collaboration.

I had a great meeting today in my DC office with Kevin Fromer, President and CEO of the @FSForum. We discussed ways the @realDonaldTrump Administration can prioritize access to capital, regulatory flexibility, and ensuring our financial system is the most competitive in the

0

0

2

At today’s hearing, Fed Chair Powell reaffirmed that the largest U.S. banks have the right amount of capital. Over 15 years, their capital has more than tripled to nearly $1T, strengthening the financial system and keeping credit flowing to businesses and households.

0

1

1

Fascinating story from @WSJ showing the importance of derivatives in helping companies manage cost increases; in this case, it’s about the price of chocolate. https://t.co/yk4icfCGO3

wsj.com

The American chocolatier records a $460 million pretax gain on commodity derivatives as cocoa futures hit record highs last year.

0

0

0

Pleased to have joined the “Macrocast” podcast with @ForbesTate and @MarketsPolicy to discuss the upcoming Fed Chair Powell hearings and the role of leading U.S. banks in driving economic growth. Listen to the interview here: https://t.co/TFkaKvllKg

0

0

2

Congratulations to Scott Bessent on his confirmation as the 79th Secretary of the Treasury. @FSForum commends President Trump for this nomination and looks forward to working together to enhance economic growth and financial stability.

fsforum.com

CONTACT: Laura Peavey (202) 457-8770 [email protected] Financial Services Forum Congratulates Scott Bessent on his Confirmation as Treasury Secretary Washington, D.C. – Financial […]

0

1

0

Happy to announce that @Citi CEO Jane Fraser has been elected Financial Services Forum chair, and @BNYglobal CEO Robin Vince as vice chair. I thank @StateStreet Chairman and CEO Ron O’Hanley for his leadership over the past two years.

fsforum.com

CONTACT: Brigid Richelieu (202) 660-2569 [email protected] State Street and Citigroup CEOs Elected Washington, D.C. – The Financial Services Forum today announced […]

0

4

4

@RepFrenchHill @FinancialCmte @FSForum We in the financial services industry are fortunate to have leaders such as @RepFrenchHill, @RepAndyBarr, @RepHuizenga, and @RepFrankLucas advocating for policies that enable the U.S. economy and our capital markets to thrive.

0

0

1

Congratulations to @RepFrenchHill on being selected to lead the @FinancialCmte. @FSForum looks forward to working with you to support policies that promote economic growth and opportunities across the country.

1

0

3

I'm pleased to welcome Laura Peavey as our Director of Media and Outreach. As a previous Communications Director for the House Financial Services Committee, Laura will play a key role working with media and external stakeholders at the Forum.

fsforum.com

CONTACT: Barbara Hagenbaugh (202) 457-8783 [email protected] Forum Welcomes Laura Peavey to Communications Team Former House Financial Services Committee communications director […]

0

0

0

An insightful conversation with @JPMorgan’s Abigail Suarez on the firm’s policy strategies and collaboration with local organizations to expand homeownership. Read about the firm’s $6M commitment to increase affordable housing in Baltimore. https://t.co/vJJzcSQwXP

0

1

1

Thank you, @ryanjtracy and Rob Schmidt @CapitolAccount, for the opportunity to discuss the Forum's work on critical issues, including the Basel III Endgame, which could have broad ramifications across the economy. Read the full interview:

capitolaccountdc.com

Also, SEC approves rule to boost security for electronic filings; new jobs at SEC and ABA

ICYMI: Our Friday interview featured @KevinFromer for a fascinating talk about what it's like to run point in DC for the biggest banks. Get his latest insights into Basel endgame and how banks' efforts to improve their image in Washington are going ...

0

0

0