jordaniza.eth

@JordanImran2

Followers

235

Following

3K

Media

54

Statuses

1K

Solutions Lead @aragonproject curl -s https://t.co/WqTsQT2W9V | jq '.slip.advice' | Prev @ambosfinance @auxodao @piedao_defi

Gangstas Paradise

Joined January 2022

Aragon has spent the last few years pushing the intersection of value-driven tokenomics and how we can remediate the known problems with vanilla token-based governance. We will be hosting office hours in Buenos Aires. I'll be there for any technical deep dives needed. DMs open.

After a packed Value Accrual Lab in Cannes, we’re bringing a new format to Buenos Aires: The Value Accrual Lab: Office Hours!

0

0

3

High level banter you wouldn't understand

0

0

0

Anons spend years repeating to themself they will make that project/learn that language/play the instrument once they have enough money. "I can't, I need to make it" Sometimes they win the perp lottery only to find out their spineless self have no interest. The grind was the

no you wouldn't. if you had generational wealth and ability to do whatever tf you want, learning AI and running local LLMs wouldn't be in the top 1000 things you'd choose to do unless you are genuinely curious and talented. it's 10x harder to grind when you don't NEED to.

0

1

3

active exploit going down on balancer pools and and forks like Beets and others, seems ETH pool specific

3

3

25

I'm generally bullish on teams who have spent time in the trenches doing the hard part of iterating on a product people actually use. So with this in mind I'm very excited to see what @solidity_lang team come up with after a decade of working on smart contract DSLs

soliditylang.org

Posted by Solidity Team on October 21, 2025

0

0

2

I'll say it before and I'll say it till I die. Y'all on CT manage to make absolutely everything somehow doomer vibes. Go outside and touch grass it'll be good for your mental health. You're almost certainly in a financial position at least 90% of the world would kill for.

0

0

0

Year of the linux desktop is when hiding the google meet sharing modal doesn't require shell scripting.

0

0

0

OGs unite

gearing up for mainnet launch in Q1, we're excited to partner with @AragonProject to deploy our pre-deposit vaults! SNT and LINEA vaults go live first, followed by ETH and [redacted 👀] in december early depositors get the highest KARMA 火 rewards + bonus in LINEA, SNT, and

0

1

6

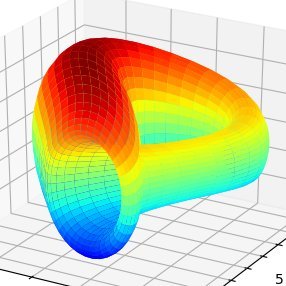

One of the most interesting bits of research I've done so far. A lot of work went into this and the results are very timely and relevant. Watching closely to see how @yieldbasis scales!

We investigated how much volume YieldBasis generates for Curve. We found: - Every $1 traded on YieldBasis generates at least $1.089 volume on Curve - >88% of this volume was due to crvUSD swaps - YieldBasis has a disproportionate impact in increasing Curve’s market share

2

3

32

Very interesting article from our friends at @in_pangea . @yieldbasis generating ~8% incremental volume for @CurveFinance . Some thoughts: One key point is that YB has focused on providing extremely deep liqudity in a specific pair (crvUSD and BTC through 3 wrappers). This

We investigated how much volume YieldBasis generates for Curve. We found: - Every $1 traded on YieldBasis generates at least $1.089 volume on Curve - >88% of this volume was due to crvUSD swaps - YieldBasis has a disproportionate impact in increasing Curve’s market share

1

1

7

Sharing a tool for improving the auditability of contracts that one of our devs cooked up at @AragonProject Smart contract audits are performed against a specific Git commit hash, and contract source code is typically verified on block explorers like Etherscan. But a critical

github.com

CLI tool to compare EVM smart contracts verified on Etherscan against local codebases - brickpop/evm-mirror

0

0

6

Security hard Spearbit Gud

A new high-touch smart contract audit: @AragonProject x Spearbit We reviewed Aragon’s lock-to-vote OSx governance feature - enabling any token without governance compatibility, such as pool tokens in DeFi, to vote or veto decisions without requiring a balance snapshot. Report

0

0

1