Journal of International Economics

@JIntlEcon

Followers

9K

Following

244

Media

1K

Statuses

2K

The Journal of International Economics is intended to serve as the primary outlet for theoretical and empirical research in all areas of international economics

Joined September 2019

Here is the agenda for the JIE-GCAP-GSB Conference on Geoeconomics from February 27-28 Organized by @jafrieden, @juhreka13, @CarolinPflueger, @JSchreger and @Ch_Trebesch and hosted by @JIntlEcon, @GCAProject , and @StanfordGSB Get it here: https://t.co/V9Y5NmMrL9

0

15

41

@simon_bolz @FabriceNaumann When firms offshore, a unilateral emissions tax can backfire. In our GE model, >100% leakage can arise via a global technique effect. The cleanest domestic firms start offshoring; offshored production gets dirtier. BCAs stop leakage – but risk raising inequality.

0

0

1

New at JIE: "Unilateral environmental policy and offshoring" by Simon J. Bolz (@simon_bolz), Fabrice Naumann (@FabriceNaumann), Philipp M. Richter https://t.co/L2AKLxmO97

1

4

7

New at JIE: "Inflated concerns: Exposure to past inflationary episodes and preferences for price stability" by Nicolás E. Magud, Samuel Pienknagura https://t.co/k0jm0eQoyy

0

2

6

@LuHanEcon Exporters frequently change their destination markets. Using a new framework that links price–quantity patterns in continuing markets to underlying shocks, this study finds that most market changes are demand-driven (~87%), and about a quarter reflect global or correlated shocks.

0

0

1

New at JIE: "What Drives Exporters’ Market Dynamics? A New Framework for Disentangling Micro Shocks" by Lu Han (@LuHanEcon) https://t.co/DXj0R0M0yV

1

7

20

@IUImpact What if decision-makers don’t see far ahead? The paper's open-economy model with limited foresight captures exchange rate dynamics and excess currency returns, offering a new take on UIP puzzles.

0

0

1

New at JIE: "Expectations and the UIP puzzles when foresight is limited", by Seunghoon Na, Yinxi Xie (@IUImpact) https://t.co/WBCRosGq4b

1

0

1

The agenda for the JIE-GCAP-GSB Conference on Geoeconomics from February 27-28 is now available. View it here: https://t.co/VOK7yUCTrC Organized by @jafrieden, @juhreka13, @CarolinPflueger, @JSchreger, and @Ch_Trebesch and hosted by @JIntlEcon, @GCAProject, and @StanfordGSB

0

13

38

@luchi_casal @rafaguntin Authors study why business-cycle volatility (BCV) is higher in emerging than developed economies. Their model splits BCV into four channels: sectoral composition, firm distribution, intl prices, and aggregate. They find sectoral composition explains up to 77% of excess BCV in EME

0

2

2

New at JIE: "The business cycle volatility puzzle: Emerging vs developed economies" by Lucía Casal (@luchi_casal), Rafael Guntin (@rafaguntin) https://t.co/q9s7Td0LNQ

2

16

45

@robin_kgong The study utilizes the quasi-random assignment of patent examiners to identify the causal effect of a successful first US patent application on the export performance of Chinese firms.Successful first-time patent applicants experience significantly higher export growth.

0

0

0

New at JIE: "Tickets to the Global Market: First US Patent Award and Chinese Firm Exports" by Robin Kaiji Gong (@robin_kgong), Yao Amber Li, Kalina Manova, Stephen Teng Sun https://t.co/gsuPmhSNOM

1

0

1

The authors develop a novel theorem that provides sufficient conditions for uniqueness, attractivity, and stability of solutions in a broad class of economic models that allow multiple heterogeneous agents to interact in heterogeneous ways across several markets.

0

0

2

New at JIE: "Single and Attractive: Uniqueness and Stability of Economic Equilibria under Monotonicity Assumptions" by Patrizio Bifulco, Jochen Glück, Oliver Krebs, Bohdan Kukharskyy https://t.co/gruTwvgpnG

1

0

4

@EmilioEspino15 @kozjuli @martinbcra @vediense In emerging economies, fiscal and monetary rules enhance welfare. Nonetheless, suspending these rules during large, unexpected crises can help stabilize GDP, employment and external trade. Flexible monetary policy proved particularly valuable during the COVID-19 crisis.

0

1

4

New at JIE: "Policy rules and large crises in emerging markets" by Emilio César Espino (@EmilioEspino15), Julian Kozlowski (@kozjuli), Fernando M. Martin (@martinbcra), Juan M. Sánchez (@vediense) https://t.co/R5I0CPEuI8

1

6

23

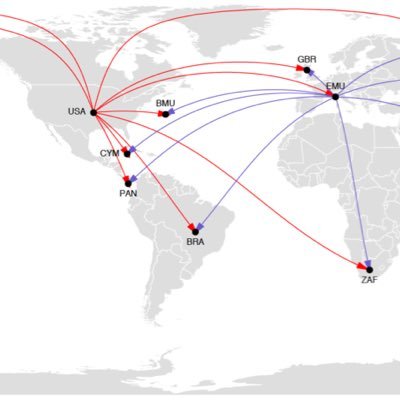

@SilviaMarches12 Authors show that financial crises in developing countries trigger a surge in offshore deposits: three years after a crisis, tax-haven bank deposits rise by almost 30%. The effect is strongest where institutions are weak, revealing how havens drain resources when most needed.

0

1

0

New at JIE: "Knockin’ on H(e)aven’s door. Financial crises and offshore wealth", by Silvia Marchesi (@SilviaMarches12), Giovanna Marcolongo https://t.co/p9DBVO5VON

1

5

12

New at JIE: "Export shocks and banks’ domestic credit: Balancing liquidity provision and risk mitigation" by Stefano Federico, Giuseppe Marinelli, Francesco Palazzo https://t.co/EysVPzqkIv

0

2

14