Ian Shepherdson

@IanShepherdson

Followers

31K

Following

2K

Media

990

Statuses

10K

Editor-in-Chief, Pantheon Macroeconomics. A 'danger to the world', apparently. Trial: https://t.co/hjv4yzlxDl Speaking: [email protected]

Montpellier/NY/Ldn/Newcastle

Joined July 2011

34 years is enough for me. I could not have found a safer pair of hands than Sam's, plus he and Olly are way better at Excel than me.

Thrilled to formally become Chief US Economist at Pantheon Macro today. @IanShepherdson has been an incredible mentor since I switched focus from the UK in Feb. I look forward to maintaining Pantheon’s reputation for incisive research on the US economy, supported by Oliver Allen.

15

6

68

Some observations about the new BLS head:.- He thinks it is meaningful to annualize price changes over three months and compare to changes over 30 months. - He adds PhD to his handle; the best single indicator of (deserved) intellectual insecurity.- He gets dressed in the dark.

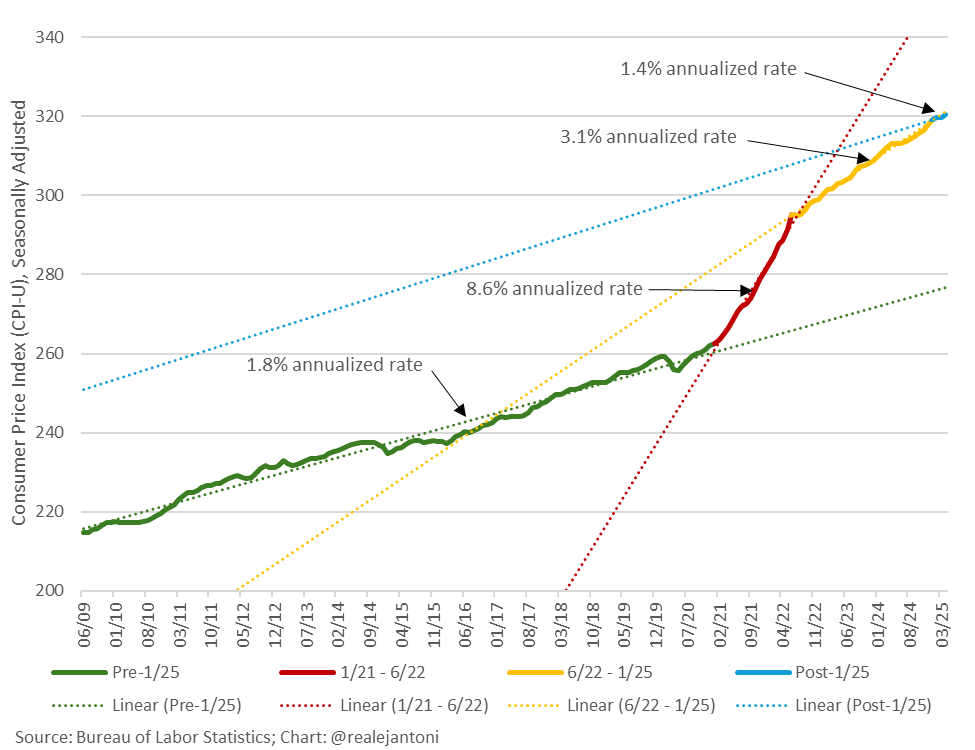

Inflation during Trump's 2nd term is an annualized 1.4%, which is less than the '09-'20 average of 1.8% and less than half the 3.1% annualized rate during Biden's last 30 months - to say nothing of the 8.6% rate during Biden's first 18 months.

5

40

363

RT @RealEJAntoni: Inflation during Trump's 2nd term is an annualized 1.4%, which is less than the '09-'20 average of 1.8% and less than hal….

0

274

0

Pantheon's @Robwoodecon has been ahead of the curve on the UK rates story for months. "Ugly optics": fears mount over stubborn UK inflation via @ft.

ft.com

Central bank warns of ‘genuine uncertainty’ over scope for further rate cuts

0

1

4

Such a creep. And a hack. A creephack, if you like. Trump Administration Live Updates: Hassett Defends Firing of Top Labor Official Over Weak Jobs Numbers

nytimes.com

3

0

14

But the tax cuts are great so. Trump Orders Firing of BLS Chief via @wsj.

wsj.com

President Trump said he directed his team to fire the top Bureau of Labor Statistics official after the bureau issued a weak jobs report on Friday. Trump in a social media post said Erika McEntarfer,...

0

0

3

Er, no. The weakest bit of the economy right now is small businesses, which are overwhelmingly financed by banks, which base overdraft rates on the prime rate, which is based on the. fed funds rate (no capitals please).

If you thinking Powell cutting the Fed Funds Rate is going to solve anything, you don’t understand how bond markets work. Powell wrongly cut by 100 bps this time last year, and all it did was RAISE the 10 Year Yield by 100 bps. Nobody borrows based off the Fed Funds Rate.

1

0

4