OptionHans

@HansCashFlow

Followers

3,265

Following

494

Media

334

Statuses

3,169

Ivy League award-winning asset manager. Managed $1B in option strategies, $750M in options cash flow. Need help? See below. (tweets are NOT advice)

$750M cash flow for investors

Joined January 2023

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#getoutofrafah

• 1856387 Tweets

Dortmund

• 412239 Tweets

Mbappe

• 307290 Tweets

Stormy Daniels

• 302880 Tweets

#Eurovision2024

• 168216 Tweets

#PSGBVB

• 155105 Tweets

Judge Cannon

• 97154 Tweets

Wembley

• 95270 Tweets

Le PSG

• 92625 Tweets

Reus

• 89380 Tweets

Dembele

• 76380 Tweets

iPad Pro

• 75368 Tweets

Hummels

• 72495 Tweets

El PSG

• 61657 Tweets

Grok

• 59703 Tweets

دورتموند

• 42627 Tweets

Vitinha

• 40507 Tweets

Luis Enrique

• 27762 Tweets

Irlanda

• 27471 Tweets

Wemby

• 26815 Tweets

O PSG

• 24970 Tweets

月9主演

• 21700 Tweets

DPOY

• 17052 Tweets

Marquinhos

• 14336 Tweets

flora matos

• 13635 Tweets

backnumber

• 13429 Tweets

Beraldo

• 13057 Tweets

Donnarumma

• 10813 Tweets

San Jose

• 10639 Tweets

Last Seen Profiles

Does anyone remember why a number of people on here keep repeating that you'd better like the companies you sell puts on? Cause you own them now.

#optionselling

18

3

59

#TSLA

has been a nightmare lately for longs. But if you've been selling calls on the way down it has eased the pain. That's what it's all about sometimes, getting paid while you wait for better days.

Would you have been better off selling the stock before the selloff? Well,…

15

1

53

@Ksidiii

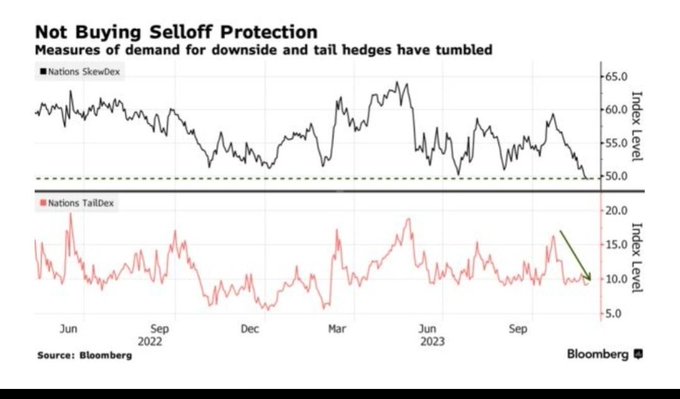

Wow this is awesome Kris. Having traded through many of these events over 25 years I agree completely. Don't be a deer in the headlights. Don't over analyze. Buy vol dips. Don't try the pick the tops and bottoms. Vol is high so know that the scalping ops will stay for some…

1

1

42

Feel the freedom that comes with relinquishing a bad position. It can no longer torment you - you are now free to allocate your emotional capital towards something positive. Don't underestimate the power of moving on...

#Optionselling

6

2

37

Sometimes with options selling you're running to stand still. The market is weak and you're taking in premiums but the overall portfolio is dropping more than you can raise in premiums. That's OK. It's all part of the process.

#Optionselling

4

2

37

Don't want to sell a position at a loss? That's why you're not performing.

Most people take quick profits and let the losers run.

That's why most people don't last in trading.

Don't be most people.

#optionselling

2

0

31

#META

continues to deliver a mastercourse in why selling options into earnings usually doesn't make sense.

Last year it soared through upside expected strikes by a TON. Today it is crashing through the downside expected move by a lot.

Time to decide: do you want…

4

1

27

$TSLY is up less than half of $TSLA's performance this year. In covered calls the path of the underlying stock is VERY important.

#optionselling

4

0

24

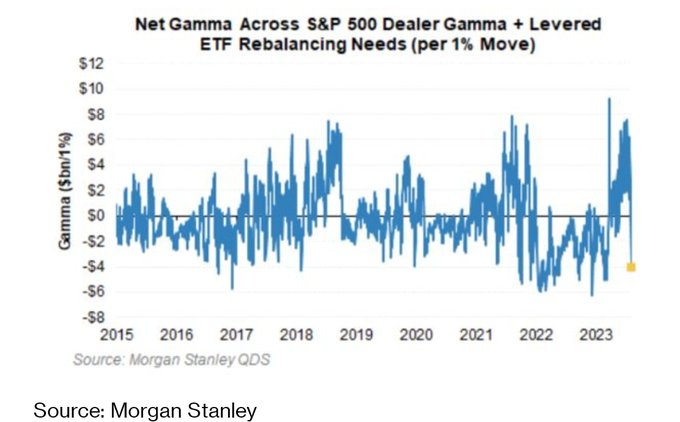

I posted this 9 days ago. Mkts just can't sell off. And I mentioned CTA buying... Sure enough, over the last 10 days CTAs have bought nearly $70 billion in US equities. Largest buying we have seen on record (back to 2016).

@SamanthaLaDuc

Yup Gamma pretty big here. I've been saying we are gonna have a tough time selling off much. Also CTA strats are buying here, and will be more aggressive as mkts move a little higher. Buying begets buying. Fundamentals are deteriorating but doesn't matter for the moment

1

0

5

2

2

20

I don't want to kick the Tesla fanboys while they're down but for those who have been buying it since 200 what exactly about the

#TSLA

chart have you been liking?

23

0

22