Gyld Finance

@GyldFinance

Followers

738

Following

4

Media

7

Statuses

12

Pioneering Institutional Staking Markets. Led by @abbasali (former JPM Product Head) & @ruchirgupta90 (former GSR Trading MD, fixed income trader)

Global

Joined June 2025

We’re excited to introduce Active Staking Vaults - a new class of actively managed staking strategies we’ve been exploring with @ConcreteXYZ, the team behind some of the most trusted institutional-grade vaults in DeFi. Our piece lays out three core ideas for where the market is

7

1

16

Volatility doesn’t just move markets — it moves staking rewards. Our latest piece looks at how the October 10 liquidations translated into one of the biggest single-day jumps in Ethereum staking rewards, and what it says about staking as a tradeable asset class.

2

2

4

Today @USTreasury and the @IRSnews issued new guidance giving crypto exchange-traded products (ETPs) a clear path to stake digital assets and share staking rewards with their retail investors. This move increases investor benefits, boosts innovation, and keeps America the

709

3K

14K

Glad to announce that @ChuanBai has joined Gyld Finance as Chief Technology Officer. Chuan brings over a decade of experience spanning traditional and digital finance — from building fixed-income pricing systems at Société Générale, to developing quantitative trading

6

1

12

Our co-founder @ruchirgupta90 was quoted in Decrypt on the rapid rise of Bitcoin ETPs. As access grows, the next phase will be about yield and performance — the kind of infrastructure we’re building at Gyld. https://t.co/u2xY3XuLGW

decrypt.co

Bitcoin ETFs will be a "clear leader" over traditional funds as IBIT nears the $100B milestone, analysts told Decrypt.

2

1

14

We're heading to Token2049 Singapore next week—our founders @abbasali and @ruchirgupta90 will be on the ground meeting investors, clients, and partners. If you’re an asset manager, market maker, or trader interested in institutional staking markets, let's connect!

7

2

13

WOW. The SEC has approved Generic Listing Standards for "Commodity Based Trust Shares" aka includes crypto ETPs. This is the crypto ETP framework we've been waiting for. Get ready for a wave of spot crypto ETP launches in coming weeks and months.

79

313

2K

🚨 SEC approves generic listing standards for ETFs — a landmark step for digital assets. 1/ What changed ETFs tracking commodities (incl. crypto) can now list without bespoke SEC approvals if they meet defined tests (ISG market, 6+ months futures, or an ETF with ≥40% NAV in

3

1

20

🚨 ETH exit queues are blowing out — and it shows exactly why we need institutional staking markets. Kiln is exiting all of its Ethereum validators as a precautionary measure following the recent SwissBorg/Kiln incident. And because Ethereum throttles how many validators can

30

19

79

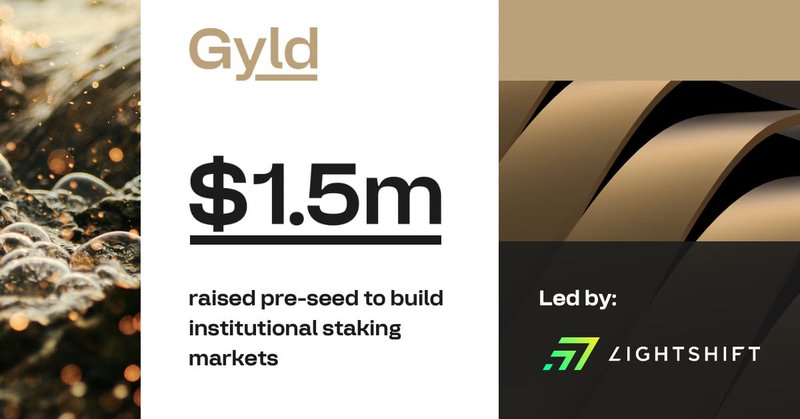

@Lightshift_xyz 📄 Full announcement:

chainwire.org

London, United Kingdom, 9th September 2025, Chainwire

4

2

40

🚀 We’re excited to share that Gyld Finance has raised $1.5m pre-seed, led by @Lightshift_xyz Staking has gone mainstream. ETFs and ETPs now hold staked assets, Digital Asset Treasuries and funds have allocated billions, and regulation is becoming clearer. Institutions are

28

9

79