Gergely Orosz

@GergelyOrosz

Followers

285K

Following

55K

Media

5K

Statuses

41K

Writing @Pragmatic_Eng, the #1 technology newsletter on Substack. Author of @EngGuidebook. Formerly Uber & Skype.

Amsterdam, The Netherlands

Joined April 2009

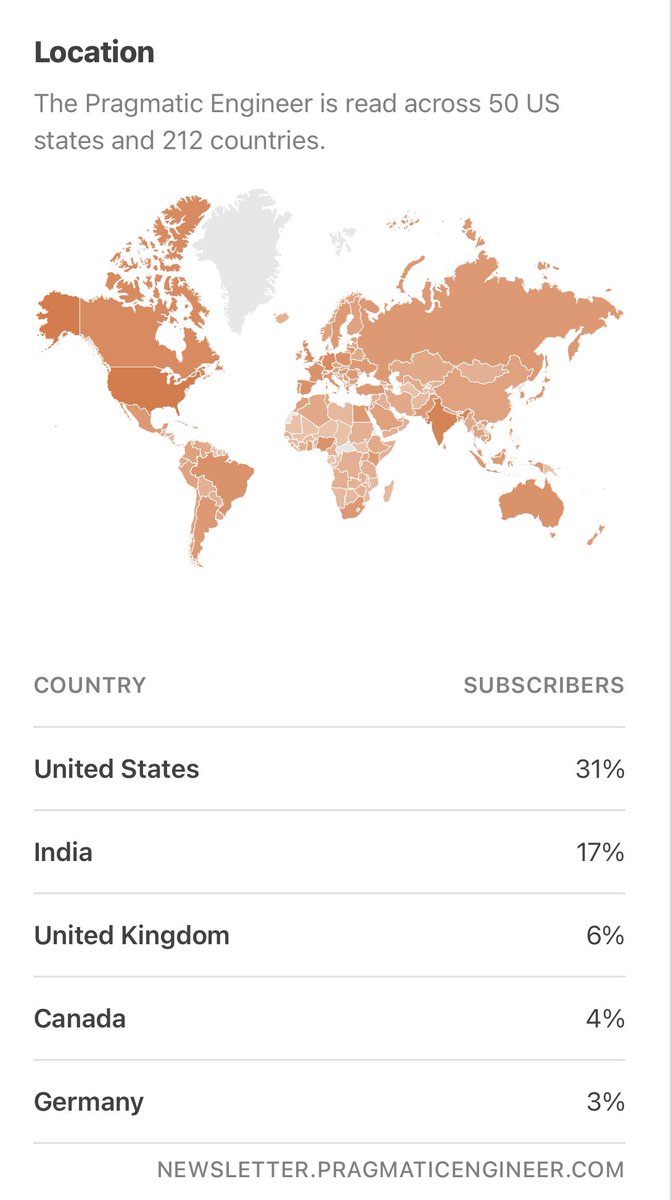

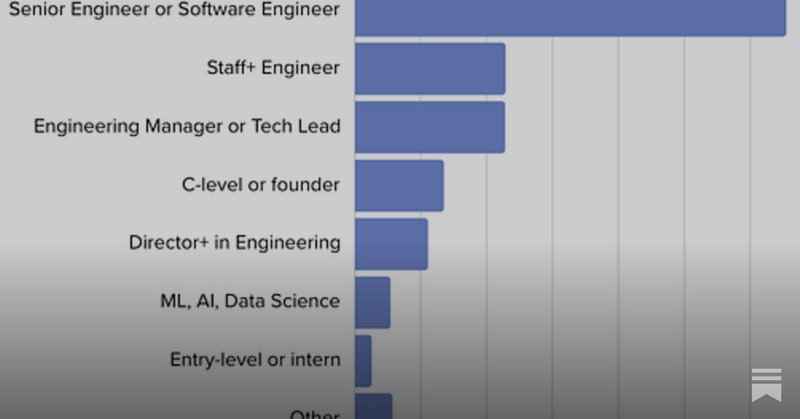

Substack launched analytics insights and: wow. Thank you to everyone reading @Pragmatic_Eng!

51

19

1K

GitHub Copilot is the most frequently mentioned AI tool by software devs as per The Pragmatic Engineer 2025 survey: . My deepdive with Thomas about the past, present and future of GitHub in this recent The Pragmatic Engineer Podcast episode:.

newsletter.pragmaticengineer.com

Which tools do software engineers use for backend development, frontend, infrastructure, AI tooling, and more, today? Reader survey, with feedback and analysis, based on 3,000+ responses

0

1

10

This number (20 million+ users using GH Copilot) is wild because… most estimates put the # of all professional software developers in the world somewhere between 20-30 million. GitHub Copilot either is getting ~100% adoption (unlikely) or it’s expanding the dev pool (likely!).

GitHub Copilot has crossed 20 million users – up more than 5 million from last quarter. We’re also seeing explosive AI growth on GitHub, with AI projects more than doubling over the past year. And it’s all because of grit. It’s no secret the market Copilot introduced has heated

25

5

166

An educated guess is this is a migration gone terribly wrong… again, thanks to assuming they can do a sloppy migration with long downtime. The way you do migrations well is planning for zero downtime. Or the very least have a robust rollback plan. More:

newsletter.pragmaticengineer.com

A guide for executing migrations well, at both small and large scales.

1

0

36

Exactly right. Uber’s IPO did not “pop.” It was the opposite of Figma’s (where the OP says employees somehow got “stolen” by insiders). Instead, employees were owed taxes on $45 shares when Uber traded at ~$27 6 months laters, when lockup ended! Some sued…

@GergelyOrosz The absolute nightmare as an employee is the opposite honestly. They IPO at X, you owe X in taxes, then it loses 50+% in value and now the IRS hates you.

3

0

27

My analysis from 2023: Imagine if the FTC did not block this deal: Figma employees would have made a bunch of money (but possibly less than now, when the lockup period expires.). Customers would not have a superb alternative to Adobe in Figma. Everyone.

newsletter.pragmaticengineer.com

Regulators were always unlikely to allow Adobe’s $20B acquisition of Figma, and this intervention will have a ripple effect.Even fewer Big Tech companies buying startups. We analyze what it all means.

0

0

14

Sure, Figma as a company could have raised a lot more money found with a direct listing. Like Spotify in 2018. But Figma didn’t do this. This meant that any upside of the stock (like now) would not reflect in more capital raised. But who are we feeling sorry for? Not Figma….

@y_molodtsov Yes, but they didn’t. So why do we feel sorry for Figma when the company knowingly and willingly skipped the direct listing? Spotify did the direct listing; it was a success. Figma decided it wanted a fixed amount raised and was happy to give up upside (and ringfence downside).

3

0

26

Someone doesn’t understand IPOs:. “Since 2020, this cartel has stolen over $100 billion that should have gone to real value creators: founders, employees”. False! Figma employees have a 6-month lockup. They can then *decide* to sell vested shares for market price from then!.

Figma just left $2.3 BILLION on the table -- nearly double what they actually raised. IPO'd at $33. Target open at $95. That's not "market excitement". It's deliberate underpricing and legalized theft by investment banks who sold it cheap to their institutional buddies. Retail.

23

10

478

I’m getting tired of “ARR marketing” that looks made up when you look closer. This below announcement is a good example. It claims that a company called Clover Labs passed $1M in annual recurring revenue. Impossible to find out what they sell, how much, and how anyone can buy….

Clover Labs is the fastest growing startup in Canada ever. $0 -> $1M ARR (annual revenue run rate) in just 42 days. 1/ Here's how we did it:

127

54

2K