GST Hyderabad Zone

@GST_HydZone

Followers

171

Following

20

Media

0

Statuses

31

Joined July 2017

Restaurants should pass on the ITC benefit to consumers by revising the rates, says @adhia03 #GSTForCommonMan

25

71

101

Generally HSN upto 4 digit have been used. Five petro products (HSD, petrol, ATF, gas & crude) are not in GST

1

17

12

Buyer's turnover not relevant for supplier for declaring HSN code by supplier.

@askGST_GoI Exemption of HSN code by below RS.1.5 cr turnover has no meaning as byer's Turnover may be above 1.5cr

1

12

17

Only that attracting highest rate. HSN code is to be provided in terms of Not No 12/2017-Central Tax.

@askGST_GoI in case of mixed supply which hsn code should be provided in invoice? All items or only the one which has the highest gst%

3

24

31

He can do so as it is his responsibility to declare proper HSN.

@askGST_GoI In GST regime whether the dealer can modify the HSN code from what he has purchased to what he is selling please clarify

0

16

16

HSN code not required if aggregate turnover below Rs 1.5 crore. Pl see Not No 12/2017- Central tax

@askGST_GoI will small kirana retailer require to maintain hsn codewise data for return fileing as he is dealing in multiple item..

0

20

16

Above method seems alright.

7

13

13

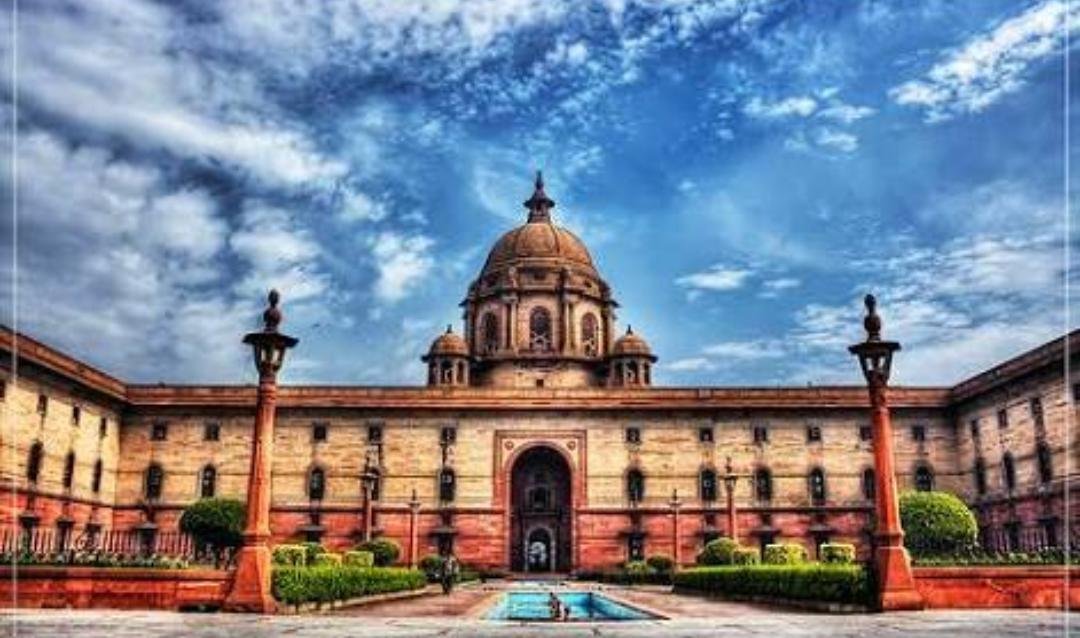

Union MoS @naqvimukhtar & Chief Commissioner GST Hyderabad Zone Sh. B B Agarwal at a GST seminar organised by @icsi_cs & Hyderabad zone #GST

0

7

17

Exports r zero rated. U can export on payment of IGST or under bond / LUT. Pl see Rule 96 & 96A of CGST Rules.

@askGST_GoI If i export goods, do i have to pay gst in cash like we do in RCM and then later claim input when goods leave the port

2

7

10

Attention Taxpayers!! Get registered by 30th July, 2017 if you come under GST laws. More details on registration as per press note attached.

16

88

84

To give feedback to respective Nodal officers please visit https://t.co/UUo7LNPBu3.

@FinMinIndia @CBEC_India @askGST_GoI @adhia03

#GST

#Taxpayers can directly their feedback on https://t.co/w5VX2gkNZe to their nodal officers. #GST #Hyderabad #India @CBEC_India @adhia03

0

0

0

#Taxpayers can directly their feedback on https://t.co/w5VX2gkNZe to their nodal officers. #GST #Hyderabad #India @CBEC_India @adhia03

0

0

0

Clarification on Migration, New Registration, Opting for Composition Scheme and Issue of Bills of Supply.

2

15

11