Fire ETFs

@FireEtfs

Followers

2K

Following

44

Media

73

Statuses

179

Your goals. Your path. Your FIRE. The first ETFs designed specifically to help support the FIRE community. Disclosures: https://t.co/LJPSZbBeWc

Joined October 2024

Introducing the FIRE ETFs — two unique funds designed to help fuel your journey to early retirement. Let’s dig into what makes these funds different:

16

17

45

🔔REMINDER: . FIRE ETF Portfolio Managers @michael_venuto and @ETFProfessor will join @WOLF_Financial and @StockMKTNewz on X to discuss the #FIREmovement 🔥. Tune in Today @ 12pm EST! . Visit to learn more.

fire-etfs.com

FIRE ETFs: Empowering your journey in seeking financial freedom and early retirement. Learn more about FIRE ETFs here.

2

0

2

🔔REMINDER: . FIRE ETFs Portfolio Managers @michael_venuto and @ETFProfessor will join @WOLF_Financial, @StockMKTNewz and @fundstrat on X to discuss the #FIREmovement 🔥. Tune in Today @ 12pm EST! . Visit to learn more.

fire-etfs.com

FIRE ETFs: Empowering your journey in seeking financial freedom and early retirement. Learn more about FIRE ETFs here.

2

0

2

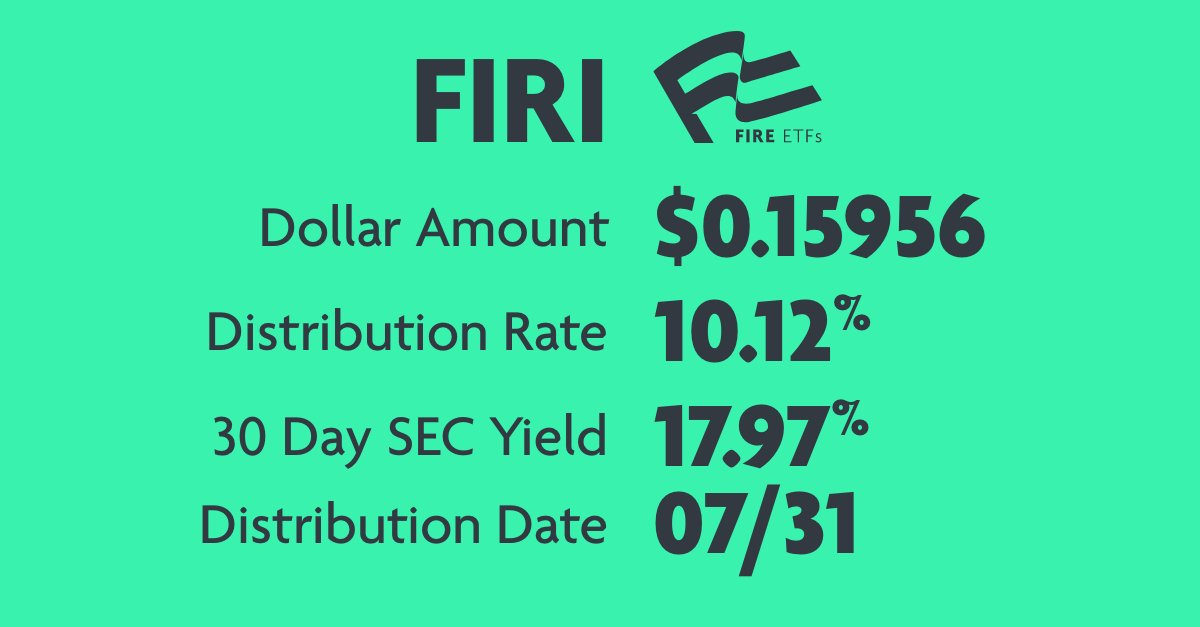

Want to learn more about the FIRE Funds™ Income Target ETF $FIRI?. Check out current performance, holdings, and fund details at:

fire-etfs.com

FIRI is an actively-managed fund that seeks current income, targeting a minimum 4% annual income level.

0

0

0