0xEvan🐽🎃

@EvanDeKim

Followers

1K

Following

2K

Media

171

Statuses

1K

decentralized bankster data scientist @ Mysten Labs

Joined October 2012

How is @steammfi, the open sourced @SolFiAMM on @SuiNetwork doing? 8/10 top performing pools were OMM (oracle market maker) pools. Top pools and their 7 day ROI:

1

3

23

RT @bluefinapp: 1/ The Great Migration is here. Bluefin pioneered perps trading on @SuiNetwork, and over the past 648 days, Bluefin Perps B….

0

47

0

RT @Tuuxxdotsol: Gmet. Update on my @Meteora copy-DLMM test using @SOL_Decoder Valhalla:. 📈 +55.33 SOL in 30 days (+32%).🚫 No bug, no activ….

0

44

0

RT @JimMyersTech: After years of working directly with leading blockchain ecosystems on growth, two truths emerged: data-driven growth is t….

0

9

0

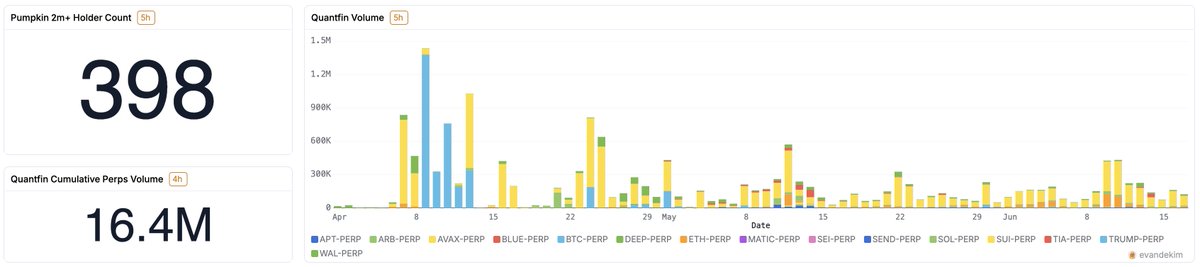

Quantfin @ThePumpkinToken is decentralizing perp dex market making on @bluefinapp for almost 400 users, filling $16.4m in maker only orders already

5

11

31

RT @ournetwork__: A look at Jito DAO –. 📍 Earns 2.7% of all MEV tips on @Solana. 📍 48% of revenue is TipRouter fees. 📍 $36M in annualized r….

0

4

0

RT @kklas_: Last year, I was fortunate to have an opportunity to work with @AsymptoticTech in giving them feedback on the Sui Prover. I wro….

0

7

0

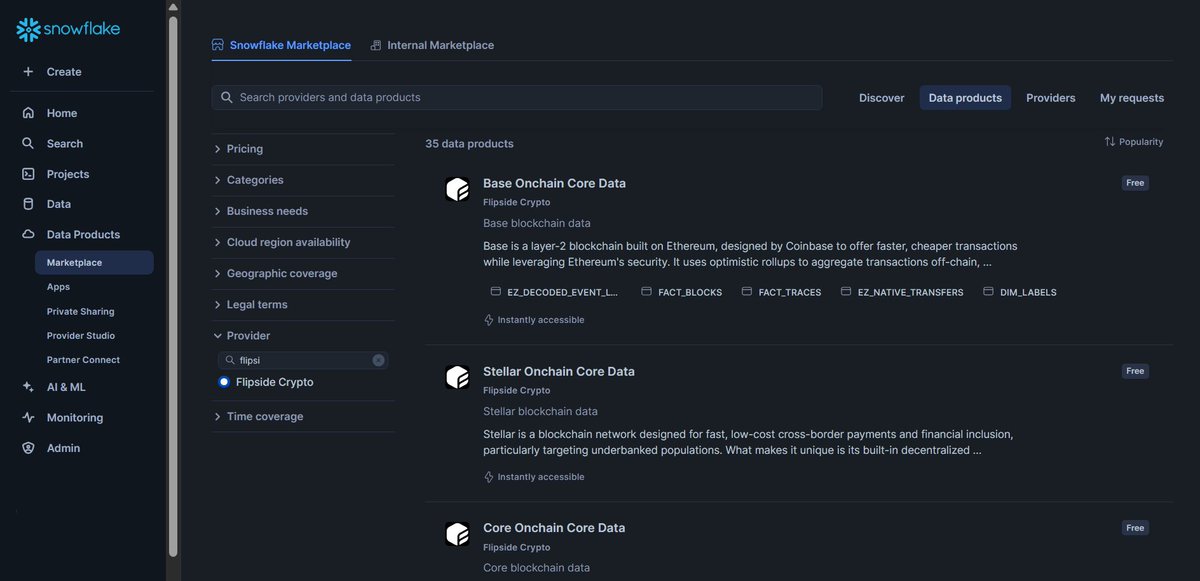

Snowflake Flipside data share. Great way to sync a crypto snowflake db.

Still paying @Dune massive fees for blockchain data on @Snowflake?. What if I told you that you can get it for absolutely FREE?. To enable onchain growth, Flipside has curated Core Data from 35+ blockchains. These including Bitcoin, Ethereum, Solana, Avalanche, Polygon,

1

0

2

RT @_deeptrade: Now it's time for us to share what's we've being done since the release:. 1) We've bring a fresh look to Deeptrade, redesig….

0

16

0

RT @web3_analyst: Just published a new SDK: solana-walrus. It lets Solana-native dApps upload, download, and manage @Mysten_Labs Walrus blo….

0

42

0

RT @blockworksres: 7/ Ethereum has around $20B in tokenized Bitcoin onchain. Base and Arbitrum are the next largest chains. .

0

3

0

RT @yulesa: 🍒 Decoding Solana Data with Cherry. On Ethereum, decoding TX data is easy: ABIs, signatures, and tools. Solana? No ABI or decod….

0

6

0

Went to the 8th floor hibachi last night at @ThePumpkinToken hibachi feat. @bluefinapp . I got the market making long only special for $500. It's been half a day and that $500 perp account has done 50k volume 🫨

1

0

4

RT @_smkotaro: 🎁 GIVEAWAY 🎁. @xocietyofficial has blessed me with 5 WL spots for their upcoming @adidas collab mint! 3 spots will be reserv….

0

367

0

RT @0xSharples: Bitcoin volume on Solana has been dominated by three DEXs: @orca_so, @MeteoraAG, and SolFi. Most of the volume is from BT….

0

5

0