Del Johnson

@DelJohnsonVC

Followers

22K

Following

23K

Media

719

Statuses

29K

"The Most contrarian thinker in VC" & Father of Modern Venture Capital. VC, Angel, LP. prev: @Google @Oracle @ucberkeley @Columbialaw

New York, NY

Joined September 2012

Venture capital advancement is based on friendship/ network centrality, not performance The problem with network based advancement in VC is it fills the entire space with incompetence, which eventually leads to a shrinking market and fewer good companies being funded.

9

48

183

i think a lot of people have hypnotized themselves into thinking that doing things is the same as expressing agency

21

8

259

Calamos is pioneering Bitcoin for institutional investors with our Protected Bitcoin ETFs! Spoke about that and more - with @David_FBailey at @bitcoinmenaconf - the world's largest Bitcoin forum.

2

10

74

Nearly half of US VCs in middle to senior positions have no successful investments

24

69

874

@JoshConstine The barrier to VC is not accredited investor status, which they automatically qualify for. As an individual, you can take Series 65 exam to qualify already. The deal act is bad for the industry. https://t.co/WURxdjN7Nl

@ChrisHarveyEsq The DEAL Act must be defeated. Enmeshment is a main reason for asset level decline and VC capital concentration. https://t.co/rGWhoh4l1F

1

1

7

Big VCs will rather jump into seed and foie gras startups that fit their thesis Importantly, even if you can produce returns despite this, when you go out to raise your 2nd fund, LPs will ignore returns and invest in the Big VCs they have longer established "relationships" with

0

0

2

Metro Cat Rescue needs your help to save sick cats. Every day, we face heartbreaking decisions because we lack the funds to provide immediate medical care. Many cats with chronic illnesses rely on us, but the costs are overwhelming. Your support can make a difference.

0

2

5

For aspiring VCs, it should be obvious why relationship investing is bad for you. As Big VCs suck up LP capital, there will be little left for you. If you decide to pursue a traditional venture strategy, your investments will be too small/grow too slowly to justify follow on.

1

0

1

If you are a pre-seed or true seed founder, you should be massively against megafunds. Structurally speaking, the existence of megafunds will theoretically decimate early stage investing, and capital will accumulate further and further towards the center of the network.

1

1

2

VC capital accumulation has BOTH social AND economic ramifications. VCs are biased, but even if they weren't, outsiders would suffer because as money accumulates in the nodes, the more money each investment needs to produce a decent return, meaning fewer founders will get funded.

2

0

3

The reason I called for reforms like banning warm introductions was financial in nature. It was primarily because relationship based investing accumulates early stage capital into the central nodes of the network -- Big VCs get more money. Everyone else gets less.

1

0

3

Icarus International Consulting Group | Strategic Human Terrain Brief The Neglected Face of Power: Why Nations, Markets, and Institutions Fail When They Forget the People Who Carry Them There is a persistent and dangerous illusion shared by governments, corporations, and

0

1

7

"It's going to get a lot harder for startups to raise venture capital in the coming years." Good summation here. The thing is, I told founders and emerging managers this was going to happen, and they mostly said it wasn't their problem. Do you all see now how it kinda is?

It's going to get a lot harder for startups to raise venture capital in the coming years. By Q3 2025, VC fund managers raised ~$45B this year, down -75% from the peak in 2022, back to levels 8yrs ago. Meanwhile, ~$330B of capital was deployed last 4Qs, almost as much as the

2

1

9

@DelJohnsonVC @Katie_Roof THAT we can agree on for sure. Capital for EM is drying up quickly and it's scary for what that means for the future of venture. smaller funds play such a large role in our ecosystem.

0

1

1

Venture capital concentration and relationship based funding made the eventual decline of the asset inevitable Decline is what happens when you structure assetsexplicitly on the precepts of crony capitalism (everyone needs to be friends/in the same cities and networks to get $$

Venture fundraising is the worse it’s been in at least a decade! And I don’t mean for startups, which are seeing an AI boom (bubble?) The firms themselves are often struggling - we are seeing the lowest number of venture funds raised in at least 10 years. https://t.co/HjM6eYo5YY

0

4

11

There is no great turn in culture. There is just a realization that there was no "shift" to begin with. We lived through a short-lived, artificially induced vibe mirage, and people are slowly realizing it.

1

1

11

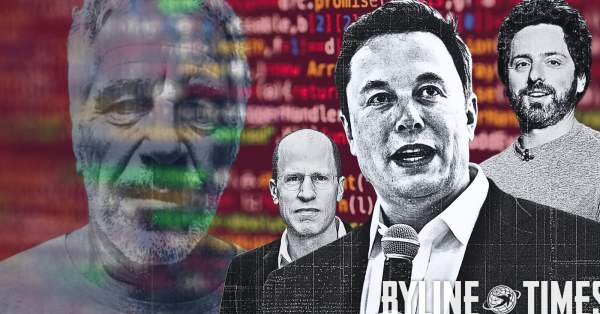

EXCLUSIVE: 1/ Epstein didn’t just prey on children. He helped bankroll and embed a worldview of race science, climate “culling” and eugenics inside Silicon Valley’s elite AI networks. Tonight we publish the final part of my @BylineTimes investigation🧵 https://t.co/acIzo60XHF

bylinetimes.com

The Epstein files expose how racial hierarchy, genetic “optimisation” and even climate-driven population culling circulated inside Big Tech circles

46

2K

3K

"FOMO is so big among VCs and the desire for social proofing that they'll take the deal." The higher dimensional solution to VC FOMO is to systematically fund new VCs who don't like nor care about other VCs.

Can confirm is true! Founders raised at $40m from Naval, pre anything, straight out of school Then they told me $80m and I asked when did Naval invest? Answer was yesterday but they have so much demand, they don’t want to dilute themselves I passed and they seemed

1

1

17

College questions? IRNI’s got answers. Use code IRNIFREE for a free month of Irnerius.

0

1

11

Like if it were possible at all to not have funds invest in other funds, or prevent incumbent VCs from investing in new funds, you would want that if you wanted the asset to be maximally value producing. Insiders don't want a maximized asset, they want to give to their friends.

0

0

5

People think it's good when a new VC just spun out of a Sequoia/A16z or is funded by a big name in Silicon Valley, but it's actually devastating for returns, which eventually forces money out of the asset. You actually want new VCs to be socially separate from incumbents.

1

0

3

"FOMO is so big among VCs and the desire for social proofing that they'll take the deal." The higher dimensional solution to VC FOMO is to systematically fund new VCs who don't like nor care about other VCs.

Can confirm is true! Founders raised at $40m from Naval, pre anything, straight out of school Then they told me $80m and I asked when did Naval invest? Answer was yesterday but they have so much demand, they don’t want to dilute themselves I passed and they seemed

1

1

17

Yeah, this is why venture capital is not very socially productive anymore. Once SV realized they could spend their money to make illegal things legal then fill the new empty market, they shattered a lot of presuppositions that made the asset broadly beneficial.

“We spent a ton of money paying off people with lots of influence in government to help change the law.” Admittedly, it is a notch above breaking the law outright.

1

5

23

"the ballad of Betty and Teddy" an original song by: Cousin Joe Twoshacks Cartoon Shields. dig it! at least twice or maybe three times.

2

8

46

When you create an asset that incentivizes people to find low probability, high reward outsized payoffs, you need to have the imagination necessary to model what low probability high payoff strategies actually look like. Lots of times they will look socially egregious.

0

0

4

We kind of created the laws and regs that make VC possible with the idea in mind that funds and their startups would work within established legal frameworks to outcompete incumbents, and produce outsized profits, but what if it's easier to break the law or pay people off?

1

1

3