DoubleLine Minutes

@DLineMinutes

Followers

6K

Following

7K

Media

2K

Statuses

5K

A weekly market discussion with DoubleLine's Macro Asset Allocation team recorded Friday afternoon for your Monday morning commute, or anytime in between.

Los Angeles

Joined January 2021

.@DLineCap's Eric Dhall and Ryan Kimmel recap an Aug. 18-22 market week on the latest Minutes capped by the Fed chair’s S&P 500-boosting Jackson Hole speech.

0

2

8

RT @DLineFunds: In addition to interest-rate, credit & inflation cycles, fiscal imbalances of sovereign debt issuers raise risks for naïve….

doubleline.com

doubleline.com

0

4

0

“….consumers’ appraisal of current job availability declined for the eighth consecutive month, but stronger views of current business conditions mitigated the retreat in the Present Situation Index. Meanwhile, pessimism about future job availability inched up and optimism about.

0

3

7

RT @DLineFunds: With 56% in commercial ABS and a focus on resilient sectors like aviation and digital infrastructure, $DABS is built to nav….

0

6

0

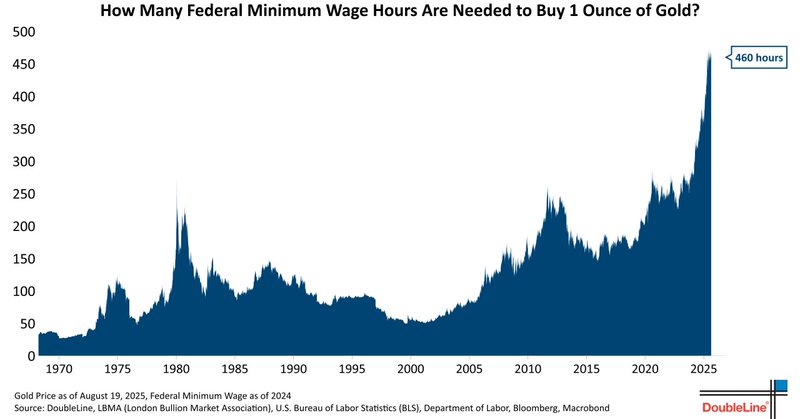

RT @DLineCap: Back in May, we explored gold’s value through the lens of inflation, showing how it had surged relative to the Consumer Price….

linkedin.com

“Labour was the first price, the original purchase-money that was paid for all things.” – Adam Smith (“The Wealth of Nations”) At $7.

0

4

0

“Employment rose for a sixth successive month, with the pace of job creation hitting the highest since January (and one of the strongest rates seen for over three years). Service providers took on staff at the fastest pace for seven months while factory job gains reached the.

S&P Global US PMI preliminary reading for August was better than expected; manufacturing at 53.3 vs. 49.7 consensus. Services ticked lower to 55.4 vs. 54.2 consensus and 55.7 the previous month. This brings the composite to 55.4 vs. 55.1 the previous month.

0

2

6