DoubleLine Capital

@DLineCap

Followers

21K

Following

9K

Media

1K

Statuses

8K

DoubleLine is an investment management firm and investment adviser. @DLineFunds @DLineMinutes https://t.co/s3F7La18pB

Los Angeles

Joined March 2011

DoubleLine examines the evolving trajectory of the U.S. dollar and the potential for a sustained weakening trend which would benefit non-dollar fixed income positions.

doubleline.com

doubleline.com

0

8

15

RT @DLineMinutes: .@DLineCap's Eric Dhall and Ryan Kimmel recap an Aug. 18-22 market week on the latest Minutes capped by the Fed chair’s S….

0

2

0

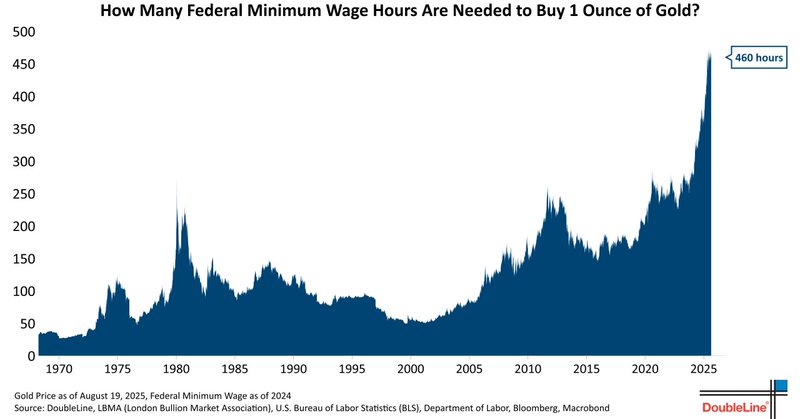

Back in May, we explored gold’s value through the lens of inflation, showing how it had surged relative to the Consumer Price Index. This time, we take a different perspective: gold priced in human labor, measured as the federal minimum wage.

linkedin.com

“Labour was the first price, the original purchase-money that was paid for all things.” – Adam Smith (“The Wealth of Nations”) At $7.

2

3

13

RT @DLineMinutes: “Employment rose for a sixth successive month, with the pace of job creation hitting the highest since January (and one o….

0

2

0

RT @DLineMinutes: Initial jobless claims for the week of Aug. 16th increased 11k to 235k vs. 225k consensus. The 4-week moving average tick….

0

5

0

RT @DLineMinutes: S&P Global US PMI preliminary reading for August was better than expected; manufacturing at 53.3 vs. 49.7 consensus. Ser….

0

2

0

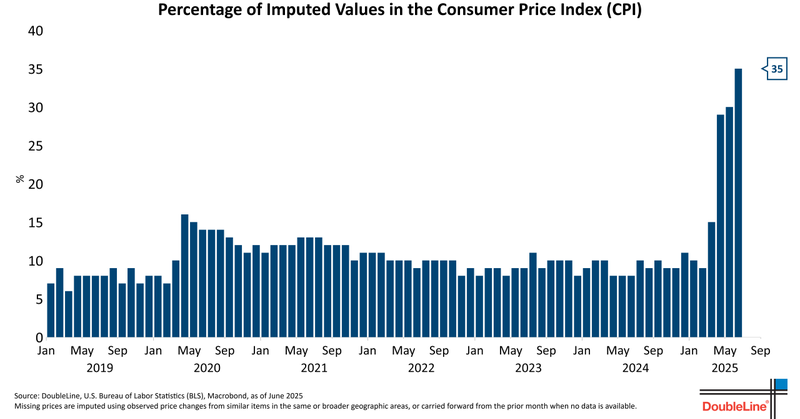

Editor’s Note: An earlier version of this article mischaracterized the scope of imputed data in the CPI, stating that 35% of the index is estimated. In fact, that figure refers specifically to the share of different-cell imputation among all imputed prices within the Commodities.

35% of the Consumer Price Index is now based on estimates rather than observed prices — the highest share on record.

0

3

8

RT @DLineFunds: In addition to interest-rate, credit & inflation cycles, fiscal imbalances of sovereign debt issuers raise risks for naïve….

doubleline.com

doubleline.com

0

2

0

RT @DLineMinutes: Housing starts increased +5.2%MoM in July, to a seasonally adjusted annual rate of 1.43 million, vs. -1.8% consensus and….

0

3

0

RT @DLineMinutes: While the July CPI gave no conclusive readings for Fed watchers, Eric Dhall notes “there’s no if’s or but’s about it, the….

0

3

0

RT @DLineMinutes: DoubleLine Portfolio Manager Eric Dhall and Analyst Mark Kimbrough Aug. 15 observe a week of dispersion in stocks, with e….

0

3

0

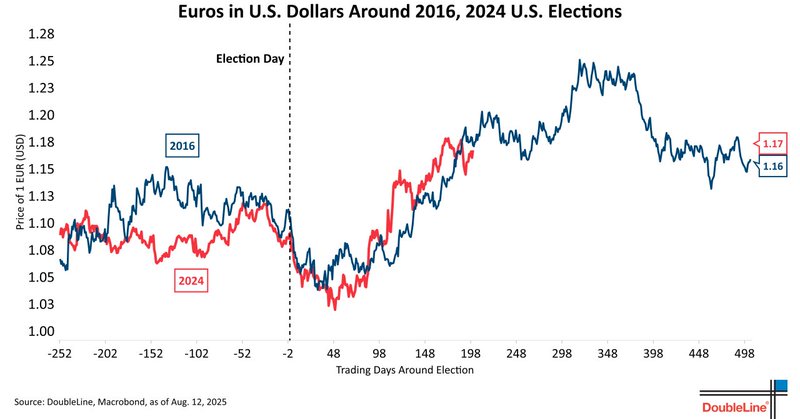

So far, history has rhymed with remarkable precision. Yet markets rarely repeat perfectly, and the verses that follow will likely be shaped by forces that were absent in 2016, including sticky real yields, evolving Fed policy and rising geopolitical risk.

linkedin.com

“We learn from history that we do not learn from history.” – G.

1

6

12

RT @DLineFunds: With 56% in commercial ABS and a focus on resilient sectors like aviation and digital infrastructure, $DABS is built to nav….

0

4

0

RT @DLineCap: DoubleLine examines the evolving trajectory of the U.S. dollar and the potential for a sustained weakening trend which would….

doubleline.com

doubleline.com

0

8

0

35% of the Consumer Price Index is now based on estimates rather than observed prices — the highest share on record.

linkedin.com

“Above all else, show the data.” -Edward R.

3

37

102

RT @DLineFunds: .@DLineCap's Jeffrey Sherman joined @BloombergTV's ETF IQ to break down the strategy behind $DBND, the Opportunistic Core B….

0

3

0

RT @DLineMinutes: Is the FOMC adding a dove? . Minutes’ Eric & Ryan review a potential candidate on the latest episode. .

0

2

0

RT @DLineMinutes: DoubleLine’s Eric Dhall and Ryan Kimmel cover the latest market moves: equities up, energy down, and gold on a tear. They….

0

3

0

RT @DLineMinutes: .@DLineCap's Eric Dhall and Ryan Kimmel break down a strong equity rebound, gold’s surge to $3,400 and energy’s sharp dro….

0

3

0

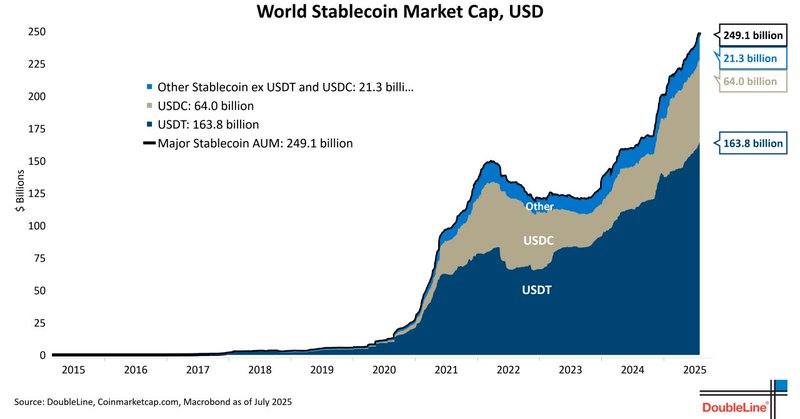

RT @DLineCap: At this stage, stablecoins are best understood as high-velocity, crypto-native instruments with marginal effects on the Treas….

linkedin.com

If you’re not a little confused about what’s going on, you don’t understand it." — Charlie Munger Stablecoins – digital tokens pegged to the U.

0

7

0