D2 Finance

@D2_Finance

Followers

851

Following

222

Media

48

Statuses

228

Multi-Strategy Hedge Fund, 100% on-chain, 100% non-custodial 🫐 🐻⛓️🔺 $D2

Arbitrum

Joined January 2024

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Arsenal

• 700284 Tweets

Premier League

• 293728 Tweets

Klopp

• 239919 Tweets

Raisi

• 212812 Tweets

Man City

• 202652 Tweets

Foden

• 146586 Tweets

Manchester City

• 142916 Tweets

Everton

• 116212 Tweets

#GSvFB

• 108059 Tweets

CNTE

• 107840 Tweets

Arda

• 86954 Tweets

#Iran

• 86424 Tweets

الرييس الايراني

• 85573 Tweets

West Ham

• 74499 Tweets

Kudus

• 68577 Tweets

Mert Hakan

• 54377 Tweets

Pep Guardiola

• 54066 Tweets

Caicedo

• 53032 Tweets

Lando

• 52455 Tweets

Thiago Silva

• 40465 Tweets

Arteta

• 37968 Tweets

Hakem

• 37914 Tweets

アーセナル

• 33878 Tweets

Mossad

• 33118 Tweets

Kerem

• 31339 Tweets

Rodri

• 30100 Tweets

Crystal Palace

• 29329 Tweets

ارسنال

• 26685 Tweets

Gunners

• 26042 Tweets

#ARSEVE

• 25825 Tweets

السيتي

• 22036 Tweets

義勇さん

• 20295 Tweets

مانشستر سيتي

• 19025 Tweets

seungri

• 17237 Tweets

#COYG

• 15024 Tweets

#galatasarayfenerbahçe

• 14757 Tweets

Mateta

• 12628 Tweets

Martinelli

• 12037 Tweets

Torreira

• 11423 Tweets

Last Seen Profiles

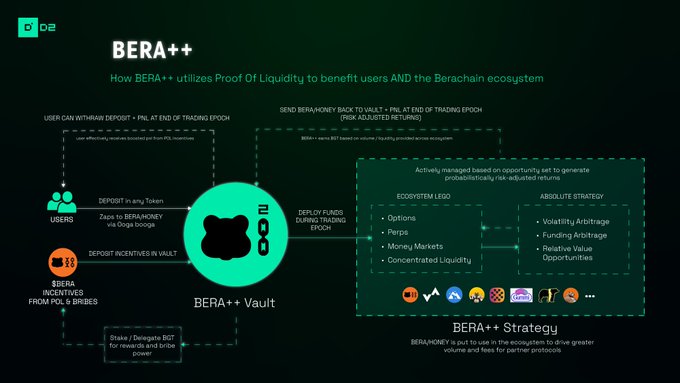

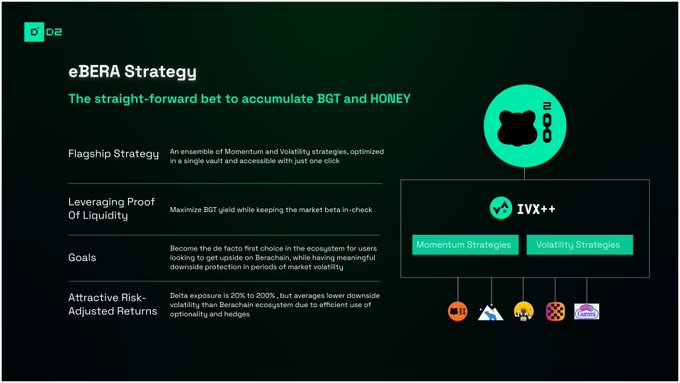

BERA++ is Coming

We are impressed with the

@berachain

testnet and the protocols building there. Many new partnerships will be announced soon on that front setting foundation for our BERA++ vault

Note: It's all conditional on available liquidity to support our SIZE. Check out

8

22

98

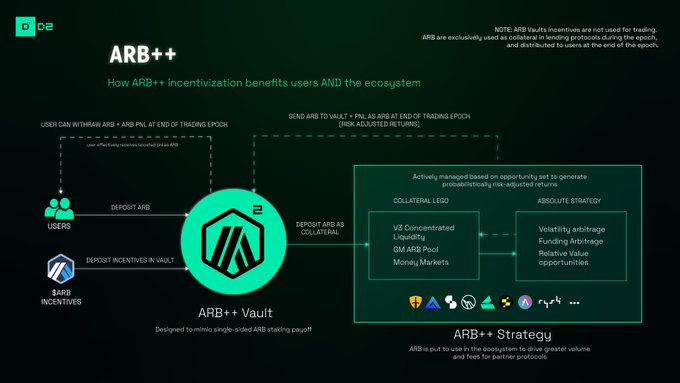

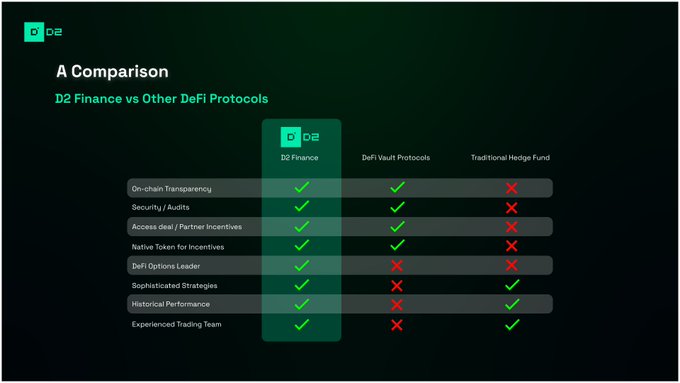

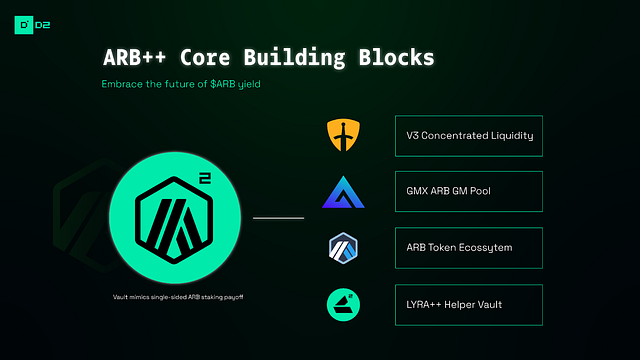

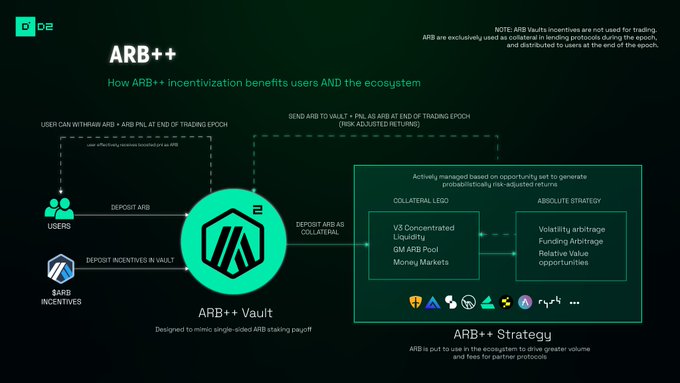

ARB++ is live

100% on-chain, 100% transparent

We are a top tier multi-strategy hedge fund, built ontop of the best

@GMX_IO

@CamelotDEX

@lyrafinance

@Dolomite_io

@SiloFinance

@Rodeo_Finance

@dopex_io

@ryskfinance

@PremiaFinance

@arbitrum

4

20

65

Berachain and Proof of Liquidity: The nvidia of DeFi

What do

@SmokeyTheBera

and Jensen Huang have in common?

How does D2 Finance and our eBERA strategy equate to “Blackwell GPU” architecture on top of

@berachain

?

Read on find out

0

13

54

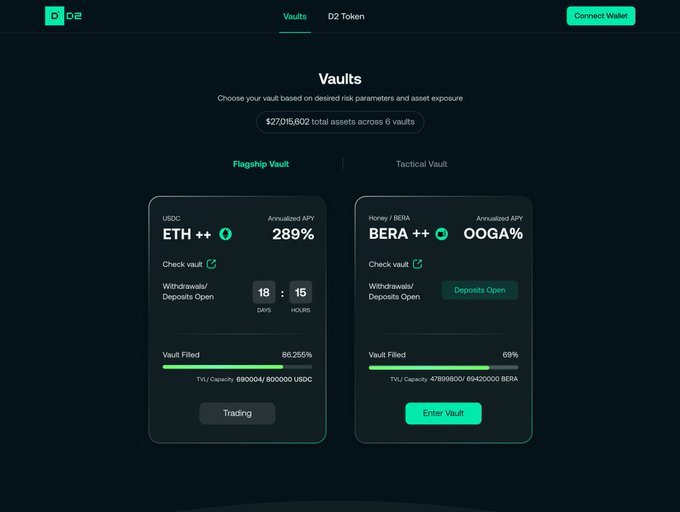

Sneak peak of the new D2 Finance front end

Beras notice anything?

@berachain

Beras will soon have access to the sophistication of a top-tier quant hedge fund, in a single click

100% on-chain, 100% non-custodial

8

12

43

D2 is poised to capture tactical & strategic opportunities, such as building on

@berachain

to leverage the novel Proof of Liquidity mechanism.

Effectively enabling us to boost returns by generating significant volume through the ecosystem, benefitting both users & partners

3

11

37

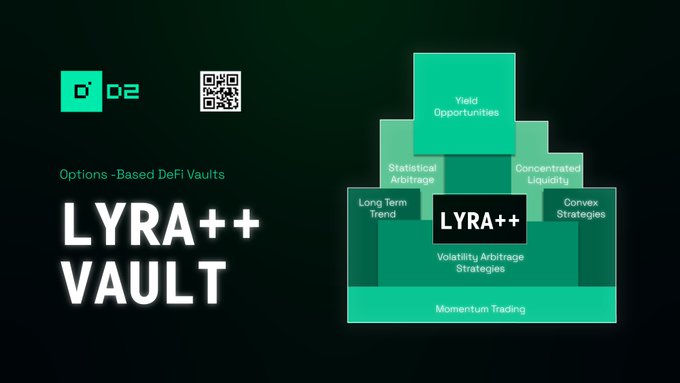

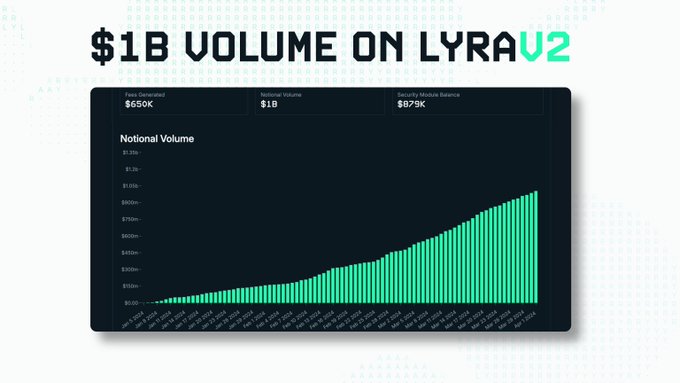

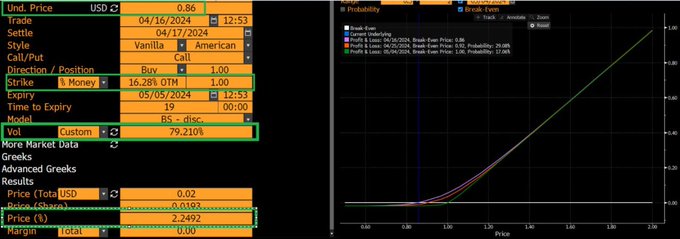

Introducing D2 Finance’s Lyra++ market

Lyra++ introduces a revolutionary approach to options trading, leveraging relative value volatility trading strategies to optimize returns and mitigate risks effectively for ALL D2 Finance vaults

@lyrafinance

🧵

3

15

37

Berachain fucks

We're thrilled to announce our $100M Series B round, co-led by

@BHDigitalAssets

and

@hiFramework

1K

2K

7K

0

7

26

D2 Finance has applied for a Long-Term Incentive Pilot Program (LTIPP) grant from

@arbitrum

Through the creation and incentivization of our ARB++ vault, our value proposition to the Arbitrum DAO and ecosystem is clear:

Enhancement of Ecosystem Volume:

3

8

22

Bringing single-click deposits into some of the most complex, institutional-grade, options-based strategies available anywhere in DeFi

For the beras🐻📈

Coming to

@berachain

1

9

19

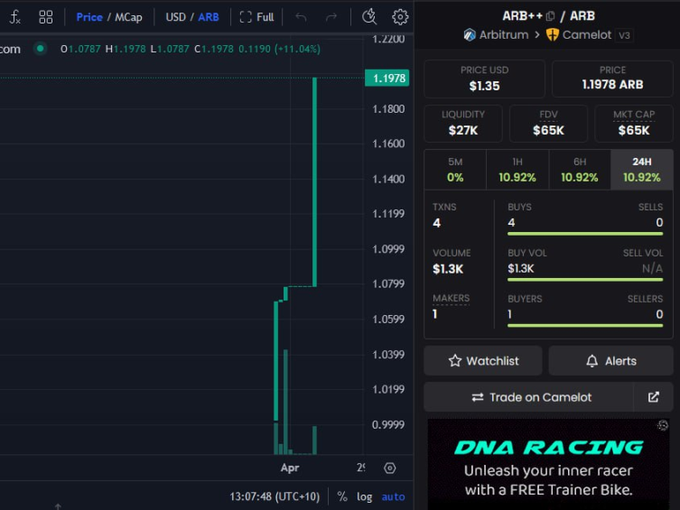

As we continue Proof of Concept testing, the first epoch of our ARB++ strategy appears on track to become the best "single-sided" payoff of $ARB across

@arbtrium

ecosystem

We look forward to offering access to our strategies through the new D2 Front End in a single click soon

2

5

15

ARB++ Epoch 1 Results

30% ROI (~360% APR annualized*)

ARB++ is designed to mimic single sided $ARB staking payoff, giving upside to

@arbitrum

D2 delivers risk-adjusted returns across market cycles, through, fully transparent, institutional grade managed strategies

4

4

14

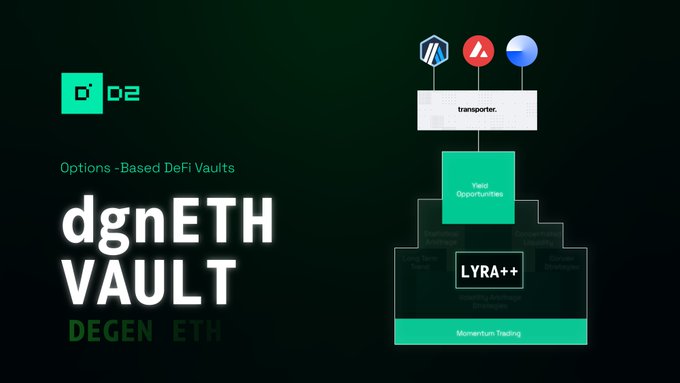

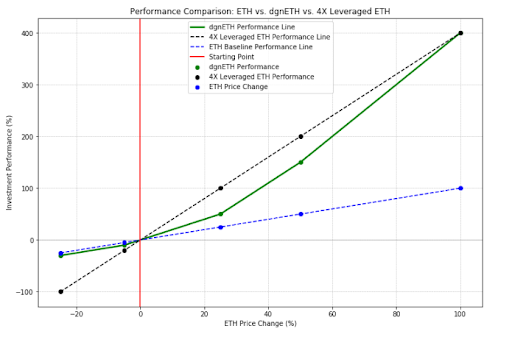

We are excited to to announce dgnETH's omnichain expansion to

@arbitrum

@base

@avax

@transporter_io

enables us to take advantage of cross-chain opportunities in a single vault, targeting the best source of yield, backed by

@chainlink

infra

dgnETH currently earning ~60% APR

1

6

13

D2 Finance | Arbitrum

Join us as we introduce D2 Finance, our value to the Arbitrum ecosystem, and future plans during our discussion with the

@arbitrum

team

Friday 4:00pm EST

🗣️Link:

🟩💙🧡

1

4

12

ARB++ Launches tomorrow on

@CamelotDEX

Don't miss the ARB++ launch if you're aiming for long-term single-sided exposure to ARB, with yield

Vault opens for deposit (in ARB) tomorrow 4pm EST

Dive deeper into our launch strategy & benefits in our Medium

3

4

11

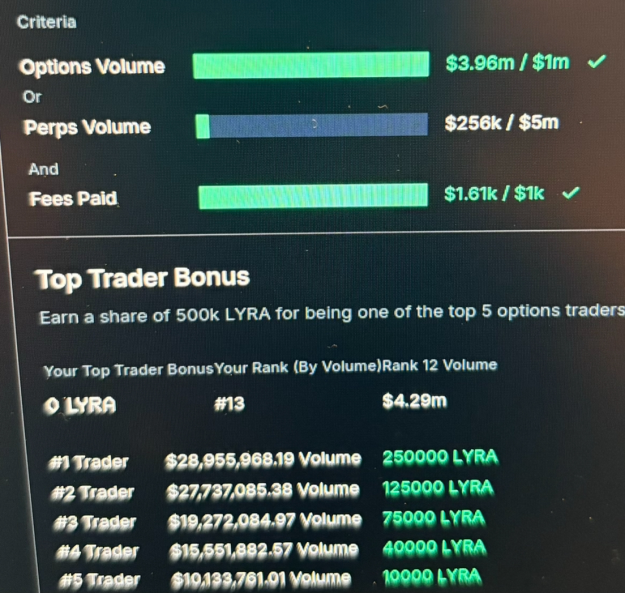

Exciting updates from D2 Finance

Thanks to Shogun & Zook for a deep dive into our vaults' performance showcasing massive TVL amplification across

@arbitrum

- > $1m trading on

@GMX_IO

- > $4m options volume on

@lyrafinance

3

4

6

@Exponents_Fi

DM us ser

We will be using Exponents to actively manage risks of making the market with volatility strategies on

@ivx_fi

(through your perp leverage and trading against OI etc) as part of our greater absolute return strategy

We can also explore this with you 🫡

2

0

7

@Larvandweb3

@arbitrum

@binance

@GMX_IO

@Treasure_DAO

D2 Finance

Built ontop of all the best Arbitrum protocols available, to run our (absolute) managed strategies and provide risk-adjusted returns

- Volatility arbitrage strategies

- Relative Value opportunities ( e.g. options vs LP)

- Funding arbitrage

2

3

7

D2 Finance Space with

@arbitrum

Reminder: 4:00pm EST

Learn more about how D2 Finance will become the premiere place to earn "single-sided" risk-adjusted yields on your ARB

0

5

6

Join us tomorrow for a spaces with

@GMX_IO

@Rodeo_Finance

and

@CamelotDEX

Spaces URL:

Learn how 1 USDC in D2 vault equates to ~10x notional volume in the

@arbitrum

ecosystem

GMX's Twitter Space AMA with

@Rodeo_Finance

,

@D2_finance

and

@CamelotDEX

will take place Thursday 8 February, at 1 PM UTC.

Come hear about ETH++, RODEO++, unique vaults, and the strong

#DeFi

synergy between these Arbitrum protocols.

⏰ Set a reminder:

6

21

45

1

1

6

@Dolomite_io

@CoreyCaplan3

@adam_knuckey

@MajinBobo0x

@0xBobdbldr

@0xMughal

@Nach_211

@shreddydefi

Gud group

0

0

5

Tagging delegates

@Treasure_DAO

,

@OlimpioCrypto

,

@coinflipcanda

,

@muxprotocol

,

@thegrifft

,

@blockworksres

,

@0xfrisson

,

@sobylife

,

@maxlomu

,

@litocoen

,

@ChainLinkGod

,

@BobRossiETH

,

@SEEDLatam

,

@Galxe

,

@0xdai2

,

@pton_blockchain

,

@0x_ultra

,

@lumbergdoteth

,

@MIM_Spell

,

0

0

1

Entry into the dgnETH requires users to hold at least 1 xD2 token to get WL, poised to increase with each epoch

We airdropped 1 xD2 to top 500 LRT wallets on Arbitrum, further integrating this innovative product with the core LRT community

@RenzoProtocol

@KelpDAO

@ether_fi

0

2

5

Repackaging Yield

dgnETH innovatively repackages yield from LRTs in

@pendle_fi

to amplify upside and pay for options, a strategy demanding careful analysis of the PT YT relationship — where D2’s modeling prowess shines

We also make use of LRT opportunities in

@SiloFinance

1

0

4

We are in the process to fully integrate

@pendle_fi

@SiloFinance

@Dolomite_io

@PremiaFinance

, enabling ARB++ to expand our trading edge, as the ultimate tool to capture dynamic market opportunities while managing risk

1

1

4

Degen investors are actively searching for opportunities to earn higher returns compared to merely holding ETH, and they’re ready to embrace significantly higher volatility to achieve this

See

@dcfgod

1

0

3

@castle__cap

@compoundfinance

@PythNetwork

@Uniswap

@deBridgeFinance

@LidoFinance

@reya_xyz

@BreederDodo

@allo_xyz

@Connext

@APX_Finance

@reserveprotocol

@SX_Bet

@PancakeSwap

@LogX_trade

@pear_protocol

@FactorDAO

@SyndrHQ

@y2kfinance

@Dsquaredfinance

@OrderlyNetwork

@AlchemixFi

@FinanceFlorence

@OrangeDAOxyz

@kurorobeast

@ChronicleLabs

@iSafePal

@marginlycom

@GyroStable

@MysoFinance

@fringefinance

@CouponFinance

@Mozaic_Fi

@RevestFinance

@monkeyempiree

@goverland_xyz

@Okto_app

@LuminProtocol

Gm sers.

Thanks for working with us

Could you update to our official Twitter (alpha matches the LTIPP proposal) the tag you used is for our outdated profile

Thanks

0

0

3

Momentum Strategies

To cover our risks, we employ momentum strategies + gamma replication based on the available opportunities

This Includes swap/rebalance on

@0xoogabooga

, margin trading on

@GummiFi

, and perpetual leverage on

@Exponents_Fi

to maintain a statistical edge

1

0

3

By utilizing BTC as collateral, dBTC investors can fund positions that are long on volatility, tapping into our expertise in volatility trading

@luca_bws_d2

, our CIO, has been a top trader in volatility markets, handling multiple billions in notional value between SPX and QQQ

1

1

2

@_kaitoai

@D2_Finance

sers

0

0

3

Maximizing BGT

By providing liquidity on

@KodiakFi

for these protocols, we will also be able to optimize BGT yield through

@InfraredFinance

and monetize it by looping it into protocols such as

@beraborrow

to dynamically allocate resources throughout the ecosystem

1

0

3

Users deposit ARB, which is used as collateral across the

@arbitrum

ecosystem to further run our institutional grade absolute strategies

At the end of the trading period, users can withdraw their ARB +pnl (also as ARB), or choose to rollover to the next epoch

The first epoch

1

1

3