Celsius Energy

@CelsiusEnergyFM

Followers

20K

Following

2K

Media

4K

Statuses

8K

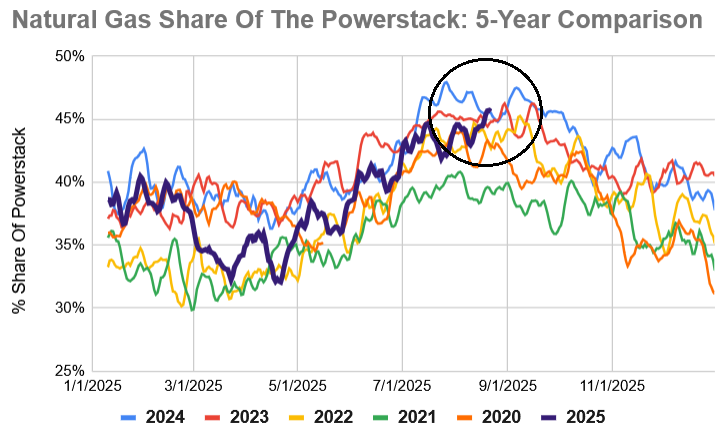

After lagging behind multiple years for much of the Summer due to higher coal & renewable generation, the #natgas share of the powerstack is averaging 45.6% over the past week, a 5-yr high, courtesy of very weak wind generation. This will be short lived as cooler temperatures &

1

5

54

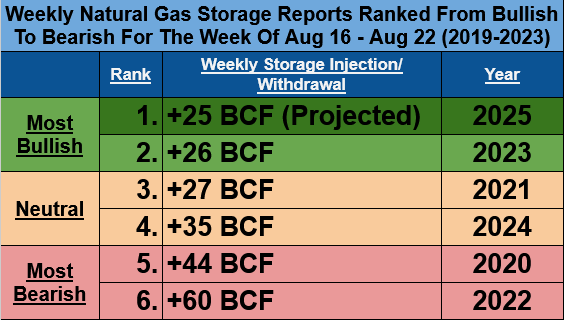

For the #natgas storage week of August 16-22 that ends today, I’m projecting a preliminary +25 BCF injection, 14 BCF bullish vs the 5-yr avg & once gain the single smallest build for the week in the last 5 yrs. The EIA will release its official number next Thursday, August 28.

7

4

49

After dropping to as low as 14.2 BCF/d earlier in the week, LNG feedgas demand has recovered courtesy of stronger flows to Freeport & Cameron. Per today’s early-cycle data, flows will reach 16.2 BCF/d, up +3.2 BCF/d vs 2024. #Natgas

2

2

43

For today’s EIA #Natgas Storage Report for August 9-15, I’m projecting a +24 BCF injection, a moderate 11 BCF bullish vs the 5-yr avg & 5 BCF smaller than last year. It would be the single smallest build for the week in the last 5 years.

3

5

43

Wind generation came in at an anemic 514 GWh yesterday, a 2025 low. This allowed #natgas powerburn to claim a strong 47% share of the powerstack, topping 48 BCF/d, up nearly 3 BCF/d vs 2025. Wind generation is slightly stronger today, but remains well below year-ago levels.

2

3

38

I continue to monitor #natgas production which has extended its pullback and, per today’s early-cycle data, stands at 106.0 BCF/d, "only" up +5.0 BCF/d vs 2024 & down around 3 BCF/d from last month’s highs. The majority of the declines come from the South Central Region.

5

4

59

Temperature is less important of a driver for #natgas prices in the Summer as it is during the winter, but this is just painful to watch as the near-term Gas-Weighted Degree Day (GWDD) outlook remains in freefall. My 146 accumulated GWDD forecast for Aug 20-Sep 2 is a 5-yr low

7

6

58

While LNG export demand has dropped, I also estimate that #natgas production has also weakened, dropping from record highs near 110 BCF/d in late July to 106.7 BCF/d per today’s early-cycle pipeline numbers (subject to late-cycle upward revision), still up +4.8 BCF/d vs 2024.

5

2

55

After falling to just 14.2 BCF/d in yesterday’s late-cycle data—down over 3 BCF/d from last week’s lows—LNG feedgas demand will recovering to a still-soft 15.3 BCF/d, up “only” +2.4 BCF/d vs yesterday, if it even holds through today’s late-cycle data. #Natgas

1

2

27

Over the weekend, the near-term temperature & GWDD outlook as forecast by both the GFS & ECWMF trended cooler and lower, respectively, while LNG export demand dropped below 16 BCF/d. I expect #natgas prices to trade lower to start the week in response.

3

3

46

For the #natgas storage week of August 9-15 that ends today, I’m projecting a preliminary +28 BCF injection, a slight 7 BCF bullish vs the 5-yr avg & the 2nd smallest build for the week in the last 5 yrs. The EIA will release official numbers next Thursday, August 21.

2

3

38

Why is the 1x #natgas ETF UNG (+0.7%) up slightly today while the 2x ETF BOIL (-0.4%) is down slightly? BOIL now holds exclusively November 2025 futures contracts, which are in the red today, while UNG still holds front-month September contracts, which are still positive.

2

2

33

For today’s EIA #Natgas Storage Report, I’m projecting a +59 BCF injection, 26 BCF bearish vs the 5-yr avg & the single largest build for the week in the last 5 years, just topping 2020’s +59 BCF. Last year registered a rare weekly withdrawal.

5

3

41

For subscribers: All #natgas commentaries & daily supply/demand data (LNG exports, production, imports, etc) are updated through today and will continue to be moving forwards.

0

1

28

The 2x #natgas ETF BOIL (as well as KOLD) now holds 80% of its futures exposure in November 2025 contracts. The fund will complete the rollover today. While bearish long-term due to steep contango between the contracts, the most noticeable near-term impact will be decreased

1

5

40

Per today’s prelim pipeline data, LNG feedgas demand will rise to 16.4 BCF/d, the highest since July 15 & up +3.3 BCF/d vs last year. The year-over-year gain is primarily being driven by flows to Plaquemines, which will reach a new high of 3.02 BCF/d today. #Natgas

7

7

80

For the #natgas storage week of July 26-August 1 that ends today, I’m projecting a preliminary +16 BCF injection, 14 BCF bullish vs the 5-yr avg & the single smallest build for the week in the last 5 yrs. The bullishness comes courtesy of hot temperatures & tighter supply/demand

6

2

51

For today’s EIA #Natgas Storage Report, I’m projecting a +42 BCF injection, 18 BCF bearish vs the 5-yr avg & easily the single largest build for the week in the last 5 yrs. Due to record production & strong wind generation during the week, this will be a very loose Report from a

3

5

40