Julian Komar 🚨 Market Update Premium

@BlogJulianKomar

Followers

144K

Following

49K

Media

6K

Statuses

35K

Growth & Momentum Stocks Trader | I’ll teach you how to trade high-potential stocks | Get my free eBook below ↓

Join 150k people →

Joined February 2013

🔎 Free for you: Learn to find the right stocks now!. Download the FREE 360° Stock Selection Checklist now! ⬇️. ✅ Proven stock selection criteria to find high-potential stocks. ✅ Technicals, fundamentals & story criteria. ✅ Examples and pictures. 👉

20

27

97

Want to trade with more confidence? 📈.I’ve put together my Top 5 videos on risk management & trading process — the core skills most traders ignore. 1️⃣ How To Master Risk Management in Stock Trading | Never go bankrupt – .2️⃣ TOP 5 Trading Mistakes That

24

8

53

PS: I created a Checklist for you to select high-potential stocks. Download it for FREE 👇. ✅ Proven stock selection criteria – find high-potential stocks. ✅ Technicals, fundamentals & story criteria. ✅ Examples and pictures. 👉

5

1

6

Most traders chase noise. Pros wait for A+ setups. I’ve taught this checklist to thousands of traders. These patterns repeat. You can learn them too.

3

0

10

8. Structure Over Hype:.Don’t buy news spikes. Wait for proper structure. The best entries feel boring — not thrilling.

1

1

10

RT @KalshiSports: Aliens are 3x more likely to exist than the Cowboys chances of winning the Super Bowl this year

0

46

0

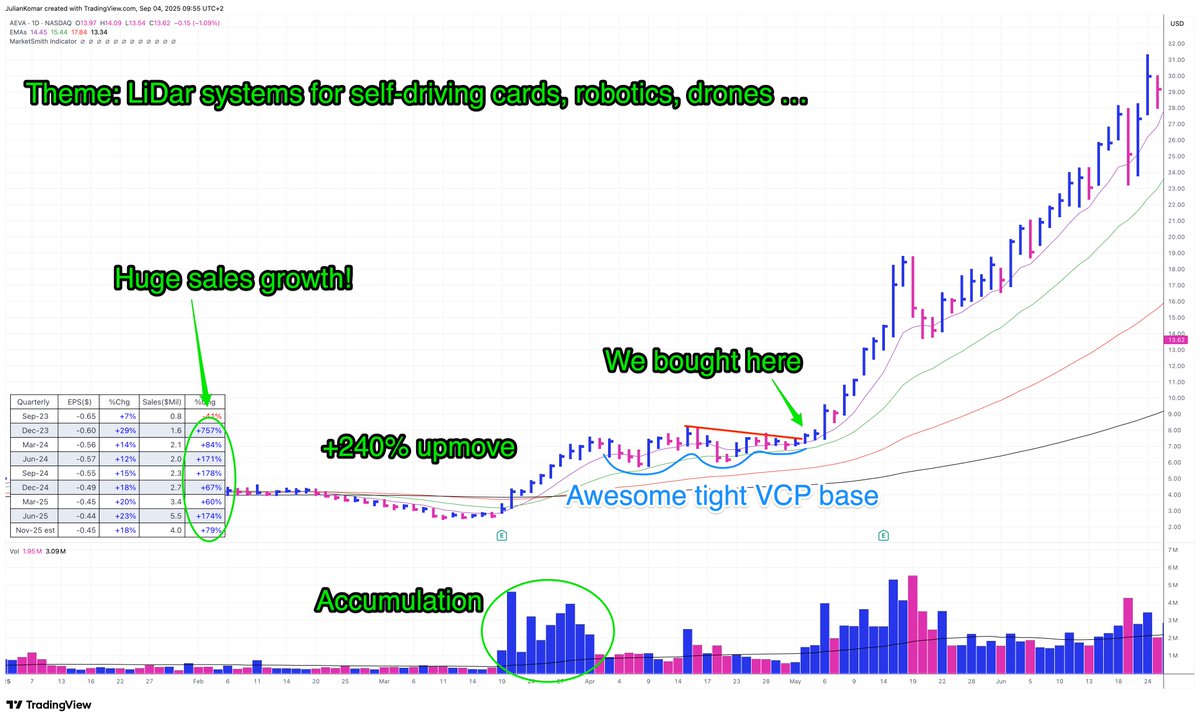

7. Current Theme:.AI, battery tech, crypto miners, defense … Narrative drives money flow. Strong setups often sit inside strong themes.

2

0

9

6. Liquidity:.Avoid thin names. Minimum $10M daily turnover. You need size and flexibility — not stuck in illiquid stocks.

1

0

10

5. Risk/Reward:.Setup must offer at least 5:1 or 10:1 potential. If risk is $5, target should be $15–20+. Otherwise, skip it.

1

0

9

4. Explosive Growth:.EPS +50-100%, sales +20-40% YoY. Strong fundamentals support strong technicals. Weak earnings = weak conviction. Not all stocks have that, but the best ones.

1

0

11

Always curious and full of energy, Beagles turn every walk into an adventure 🐾🎉.

99

394

7K

3. Relative Strength:.The stock must already outperform the market. RS line hitting highs while indexes chop = institutional demand.

2

0

8

2. Volume Clues:.Look for repeated big up-days on 1.5–2x average volume. That’s funds stepping in. Down-days should be quiet.

1

0

8

1. Clean Base:.The chart should show a tight consolidation or flat base near highs. No sloppy patterns or high volatility.

1

0

12

Most traders buy random charts. Pros only buy A+ setups. Here’s my 5-Star Setup Checklist 👇

28

55

363

Trend following is one of the oldest ideas in trading. But how does it perform in crypto across all market regimes?. We tested it. Here's what we found:

68

209

2K

Entries get the attention. Sizing keeps you alive. I’ve taught this formula to thousands of traders. You can learn it too. Structure beats randomness — every time.

7

0

11

7. Add Only on Strength:.Add 10–20% more after the stock reclaims levels with power. Never average down.

7

0

9

6. Scale by Quality:.A+ setups deserve normal size (10–15% of account). Mediocre setups don’t get a discount — they get skipped.

1

0

4

5. Correlation Control:.Three AI stocks = one big position. Cap sector exposure at 30–50% of your account to avoid hidden oversizing.

1

0

5

Bloating isn't just food sensitivity. 80% of your immune system lives in your gut. When bad bacteria take over, your entire body suffers. Here's everything you need to know about gut health (& how to fix it naturally): 🧵

9

3

23

4. Volatility Matters:.High-ADR stocks demand smaller size. A 10% swing in a day isn’t rare — size down or the stock will size you out. I trade a max 5-10% position size in very volatile stocks.

1

0

5

3. Smaller Stops = Bigger Size:.If your stop is $2 instead of $5, you can take more shares with the same risk. Tight setups give leverage without extra danger. But don't go too big. Max. size of 20-25%.

1

0

6

2. The Stop Distance Formula:.Position size = (Capital × Risk%) ÷ Stop distance. Example: $50k account, 1% risk ($500), $5 stop = 100 shares.

1

0

6

1. Start With Risk, Not Size:.Define your max risk per trade first (1% of capital is common). If you can’t calculate risk, you’re not ready to enter. I often use a risk less than 0.6% of my trading capital!.

1

0

5

BIG NEWS, Dragon Ball Fans!.Pre-register now and join Goku on day one!.Get exclusive launch rewards and rare items.Will you be the first to experience it?.

5

8

89