Pavel | Robuxio

@PKycek

Followers

11K

Following

6K

Media

2K

Statuses

7K

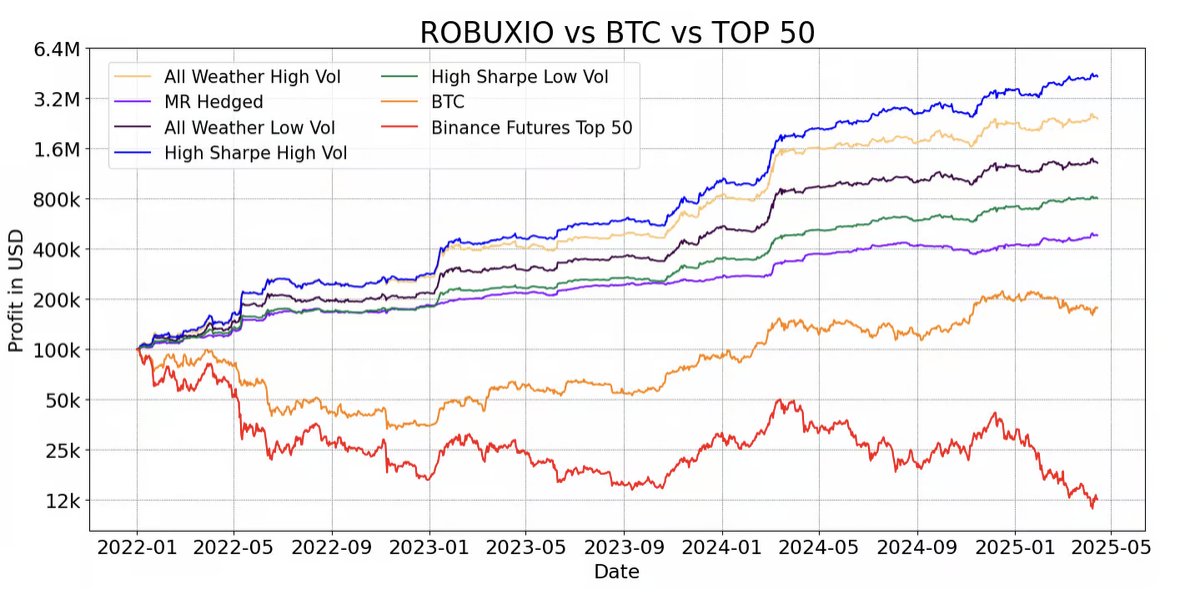

Providing institutions and individuals access to fully automated algorithmic crypto portfolios with institutional-grade infrastructure | CEO @robuxio_com

Get our trading playbook ➜

Joined September 2021

Crypto is the most profitable asset class for traders. But it's maturing fast and the edge won't last forever. Here’s how you can build, test, and deploy systematic portfolios that survive every regime:

158

238

2K

We have a full article on all of these biases here:.

robuxio.com

Navigate Survivorship, Hindsight, Sample, Selection, Look-Ahead, Recency biases, and Curve Fitting in crypto trading for sound strategies.

0

0

4

I post daily insights on trading and getting robust crypto exposure. If you want to learn more, make sure to give ma follow. If you want to help others, consider retweeting the first tweet below.

Your worst drawdown is probably still ahead of you. Here’s how to prepare for it and why your backtest could be lying to you:

0

0

5