Aziz Sunderji

@AzizSunderji

Followers

3K

Following

3K

Media

1K

Statuses

3K

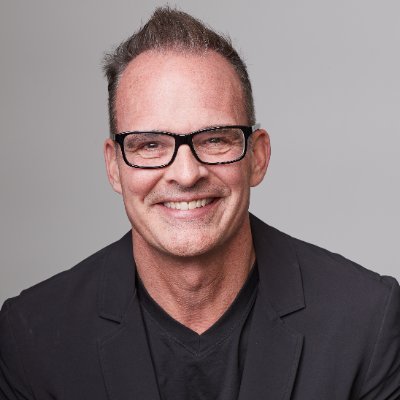

Analyzing American housing at https://t.co/LO8JxtJWp8 14 years of Strategy Research at Barclays Investment Bank (credit/macro/EM). Formerly reporting @WSJ

Brooklyn, NY

Joined March 2009

If you work in the business of housing and you love data, I want to introduce you to Home Economics. It’s my newsletter where I analyze residential real estate through a macro lens using data visualization. I’d love your support:

5

6

35

two basic problems with YIMBY theory: 1) in reality, zoning is not typically the binding constraint on building quantity, it’s profit and rent growth 2) actually lowering development costs is difficult, most of the cost is land and wages which are very location specific

85

32

306

Migrants out of NY city area: mostly leaving Manhattan, Brooklyn, Queens...

0

0

1

On June 10th Home Economics published an analysis arguing that San Francisco was deeply undervalued. Our reasoning was simple: incomes are the best determinant of home prices, and incomes had stagnated in SF, but not nearly enough to justify the price action.

San Francisco is the strongest housing market in America right now. Home sales are 12% above the long-term average. While inventory is -28% below the long-term average. The AI boom has flipped SF on its head, and Reventure is now forecasting rising prices over the next 12

1

2

16

Data nerds, this is amazing:

data-is-plural.com

The full newsletter archive of Data Is Plural.

0

0

1

NYC is losing population. Are they going to better functioning Republican places? Well, leavers from more R parts of NYC eg Staten Island do go to a balance of areas—many R-leaning—but most leavers are D, and they go to at least D-leaning if not strongly D places...

1

0

1

Great post by @MikeFellman, in which he analogizes housing and trucking: "Like in trucking, whether the public sector should step in to smooth out these cycles is a key policy question in the housing space that gets little attention." His excellent Substack is 'Housing Hell':

0

1

1

What is the right level for the home price to income ratio? @conorsen argues we should go back to 2010s levels. Others think ~2015ish was the right level. I think the price-to-income ratio is in secular ascent and the best we can expect is a return to trend.

Adding a chart to @conorsen's writing: "The assumption should instead be that elevated inventory levels, poor affordability and weak consumer confidence will continue to put downward pressure on home prices until we’re much closer to the affordability we had in the 2010s." My

9

2

19

36 hours in San Antonio TX sounds pretty nice. Another plus for livability: the city hasn't seen the same kind of home price growth over the last decade as other TX cities... (screenshot from Home Economics Pro Map, Global Mode, 10y change) https://t.co/4ZLcNrLLBB

2

0

3

New York (state) is growing again. But surging international migration seems likely to cool. The question is therefore on the domestic migration side: do New Yorkers continue to leave in droves for other states? If so, it's hard to see this growth lasting much longer.

1

0

1

Don't underestimate the lock-in effect. It explains a lot of what's happening in housing today...

2

2

21

Adding a chart to @conorsen's writing: "The assumption should instead be that elevated inventory levels, poor affordability and weak consumer confidence will continue to put downward pressure on home prices until we’re much closer to the affordability we had in the 2010s." My

2

2

6

“My hope is that I am building a future for Omie in which A.I. helps create a world where we have two varieties of everything: one that is automated and easily created; the other that is painstakingly made only by humans, and is therefore cherished.” How to Prepare Your Kids for

nytimes.com

I help to build A.I. systems, and even I know there are real reasons to be concerned about how A.I. affects our children.

0

0

2

Boomers graduated college during a war, GenX a recession; Millennials a financial crisis. GenZ is coming of age in an era of AI and high mortgage rates. We all had our challenges, waiting longer to buy (esp when rents are falling) isn’t the end of the world.

Going years and years without being able to afford to buy a house is what connects the early 2010’s (slow labor market recovery) with the 2022+ period (housing unaffordability).

2

0

8

2 years old or so but an interesting read for finance minded folks 👍

The @BLS_gov Consumer Expenditure Report has tracked household budgets since 1984. How is the median household doing today vs then? In short: incomes are $16k higher, and food and clothing are cheaper. But the avg household is spending $5k more on #housing. (1/10)

0

3

3

An excellent read here from @DrCameronMurray — showing cross country + historical evidence for the homotheticity of housing.

I should have called today’s deep dive article at FET “Sunderji’s Paradox” https://t.co/hhN2A6PLRA

0

5

8

Sunderji’s paradox: within countries, the rich spend a lower portion of their budget on housing than the poor. But as countries grow richer, they don’t spend any less on housing.

1

2

6

I blather a lot about housing being *homothetic*: as incomes rise, people spend more on it, keeping the % of their budget on housing roughly constant. That’s weird! Most have a limited appetite for food, clothing etc—but housing is odd in many ways, and this is one of them.

The @BLS_gov Consumer Expenditure Report has tracked household budgets since 1984. How is the median household doing today vs then? In short: incomes are $16k higher, and food and clothing are cheaper. But the avg household is spending $5k more on #housing. (1/10)

3

3

6

I wonder how the increased availability of high quality housing market data is changing the behavior of buyers and sellers. It’s way better now than it was even 5 years ago.

When you look at the weekly changes in active inventory, you can really see how the seasonality of the real estate market has changed over time. What do you notice?

6

6

66