Anand Shah

@Anand_shah07

Followers

4K

Following

866

Media

228

Statuses

4K

Every buy or sell decision, no matter how small, leaves a trace..shaping the contours of one’s investing future. When these choices are made with thoughtfulness and maturity, they stop being mere transactions and become catalysts for evolution.

2

1

17

Cardinal rule in markets ... Never be too early to the party. Arrive too soon, and the wait drains your patience. You’ll lose conviction watching others dismiss what you saw too early, and by the time the real excitement begins, you’ll likely have exited, tired and skeptical.

5

10

78

If the government truly wants to support retail investors, it’s time for an MSP(V) ...Minimum Support Valuations. Investors too need a safety net. No MSV, no vote...😉😉

0

0

10

Most things in markets are seldom black or white. Prices, narratives, and even data often reside in the grey ...shifting, blending, and refusing to be pinned down. Yet, many investors crave certainty and construct rigid frameworks to classify everything as good or bad, cheap or

0

2

13

We’d all do far better if we could remember Bhasmasura’s lesson: to hold our understanding gently, and never let it touch our head.

0

1

13

Cataloguing one’s learnings and experiences isn’t for everyone. Most of us, in fact, get caught in the comfort of cataloguing rather than internalising. We build neat mental libraries , notes, frameworks, quotes, insights .. mistaking their collection for growth. It feels

0

3

24

The decision to buy, sell, or hold — that’s where everything converges. All your intellect, your years of experience, and your studied understanding of markets ultimately compress into that one moment. It’s the crucible where logic meets emotion. Yet, for most of us, that’s

0

2

16

Wild Swings of the Bat Every investor occasionally needs a wild swing of the bat. Not as an act of recklessness, but to breathe life back into a framework that’s grown too rigid. Discipline and structure anchor us, yet over time they begin to harden .. turning process into

0

2

22

Getting In Is Easier Than Getting Out Getting in is much easier than getting out ....psychologically. When you’re entering a stock, you’re fuelled by conviction, curiosity, or that whisper of opportunity everyone seems to hear at once. The mind is eager, primed for narrative.

1

3

26

Buy businesses where you have a clear vision for at least the next 1–2 years, or stocks where you genuinely believe the coming few quarters could be a game changer. Build that conviction by tracking management guidance, capex plans, promoter activity, volume trends, and other key

57

31

567

Drowning in Data There is increasingly a trend towards drowning oneself in irrelevant data points..especially in the pursuit of making money in the markets. It gives the illusion of control. The comfort of activity. The satisfaction of “doing the work.” But much of this

1

2

16

"बाज़ार आजकल गधे को घोड़ा दिखा रहे हैं, और घोड़े को गधा।" धुंध इतनी गहरी है कि नज़र का भरोसा ही नहीं रहा। हर ‘रैली’ में चमक है, पर असली ताक़त कहाँ है..यह समझने के लिए आँख से ज़्यादा अनुभव चाहिए। शोर, नैरेटिव और सोशल मीडिया की हाइप ने भेद मिटा दिया है। कौशल अब सिर्फ़ नंबर पहचानने

0

1

17

Do not shrink into your mistakes. Shrinking turns energy inward, feeding guilt and paralysis. Expand instead .. into inquiry, into clarity, into the logic that is always in flux. Every mistake is a mirror of your current understanding, not a measure of your worth. Study it.

0

2

22

Earn Your Bread. Don’t Piggyback. Markets have a peculiar way of testing more than just capital..they test the very essence of your independence. It is easy to be tempted by shortcuts: following someone else’s trades, echoing popular analysis, or leaning on the comfort of

0

1

21

Investing Made Easy... 50% growth CAGR — that would be interesting to see. For a few years? No, no, let’s make it a decadal theme. Government spends? Oh, they’re notoriously fickle. But wait — what am I saying? Atmanirbhar is in the air! The spends are a given. Orders are

1

0

26

Every cycle, every correction, every surprise...is an invitation to adjust your lens.

0

0

17

Reading the tea leaves in the markets is underappreciated..often even ridiculed by intellectuals who prefer the solidity of data, models, and balance sheets. Yet markets are not mechanical constructs; they are human theaters where psychology, fear, and collective imagination play

0

1

17

Guarding the Success Quadrant If you are doing well in markets, that is precisely the moment to be wary. Comfort is deceptive. Success is not a resting place but a testing ground, because markets are relentless in their search for weaknesses. They do not attack when you are

0

0

15

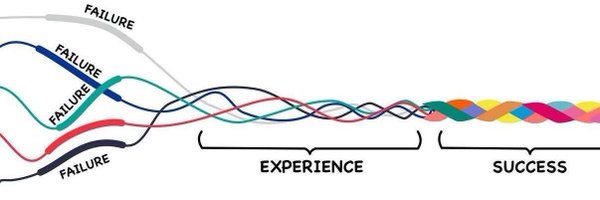

If there is anything I'd rate higher in market then it's temperament & it comes only from experience of seeing multiple cycles. Power co once thrashed is now darling. Many instances in the past & will come in future too. Businesses have their own trajectories.

8

2

81

Brave-heart investors are quickly moving from oh wow to oh no. Illusions seldom last.

0

0

16