Adrien d'Avernas

@AdriendAvernas

Followers

108

Following

110

Media

1

Statuses

24

You can be pro- or anti-climate policy -- but, either way, regulation is not the job of central bankers.

I am deeply grateful to be recognised on the third annual #TIME100Climate list. At the @ecb, we show that accelerating the clean energy transition is essential for a secure, sustainable and affordable future for Europe, and for safeguarding our price stability mandate.

8

14

192

Great piece by LUIS GARICANO & KLAUS MASUCH! They emphasise the big losses central banks booked in 2023-24 but don’t mention the hefty gains from the first QE rounds. In the US those early gains fully offset the recent losses. Does that mean QE is cost-free? We think not. 🧵

1/10 🧵 @masuch_klaus have written a post arguing the late 2010s QE was a big mistake. The debate sounds technical--central banks sold is as technical fine-tuning. But it's massive fiscal policy by unelected officials, creating perverse incentives and wealth transfers.

2

13

66

Let’s walk through the new Brookings paper on the basis trade and especially their proposal that, in stress, the Fed should take over basis trade positions. I'll link to related work (including ours) in a QT.

3

18

81

What’s coming? And what does the RRP Facility serve as a barometer for? Our recent Journal of Finance paper with @AdriendAvernas , “Treasury Bill Shortages and the Pricing of Short-Term Assets” explains it. (TL;DR and thread below) https://t.co/jpy1oIYeW2

onlinelibrary.wiley.com

We propose a model of post-Great Financial Crisis (GFC) money markets and monetary policy implementation. In our framework, capital regulation may deter banks from intermediating liquidity derived...

BREAKING NEWS: The Federal Reserve's Reverse Repo Facility hit their lowest inventory in 1,385 days, today. Do you know what's coming?

1

16

63

1/🧵 We just put out a new paper putting numbers to a mystery I've been working on since 2020: who is behind the almost $2 trillion increase in long Treasury futures positions? Spoiler alert: it's mostly mutual funds but the cool thing is why. Link here: https://t.co/VgTS8Y0qrr

11

68

264

Pegging the value of stablecoins to traditional currencies sounds good, but in practice it doesn’t always work, suggests research by @handels_sse’ @AdriendAvernas, @HECParis’s Vincent Maurin, and @ChicagoBooth’s @QuentinVandewe2. https://t.co/LPPgkHGQg6

#crypto

chicagobooth.edu

Pegging the value of stablecoins to traditional currencies sounds good, but in practice it doesn’t always work.

0

2

2

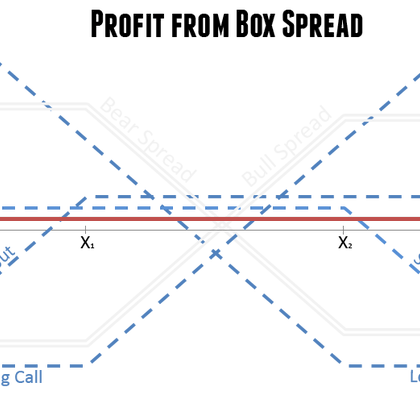

Summary in FT Alphaville of my work (with Jules Van Binsbergen, Marco Grotteria, Peter Van Tassel) on convenience yields. Our conv yield estimate: spread between gov bond rates and higher risk-free rates implicit in option prices ( https://t.co/HzdnGvLG0J).

en.wikipedia.org

0

10

57

A thread on a revised version of: "A Model of Credit, Money, Interest, and Prices" with Sannikov Main message: "Large Central Bank Balance Sheets reduce macroeconomic insurance: they increase the effects of financial shocks and reduce the power of monetary policy."

2

31

106

Remember that time Zoltan Pozsar mapped the Shadow Banking system? We need to get him onto the crypto equivalent.

3

19

77

We spent the last year figuring out what algorithmic stablecoins are and came up with a dynamic model that might help us understand what’s going on with #Terra_Luna . Here are our main takeaways. THREAD.

7

88

513

I missed this tweet from a few months ago. In the referenced paper, @AdriendAvernas and I argue that banking crises are lengthier because the capacity to intermediate breaks down and the recapitalization of banks slows down.

1

9

55

The third day of the MONEY MARKETS IN A NEW ERA OF CENTRAL BANK POLICIES conference starts now! Program (and link) is here:

0

2

1

Excited to start the second day of our MONEY MARKETS IN A NEW ERA OF CENTRAL BANK POLICIES conference with @HyunSongShin and Monika Piazzesi at the @SHouseofFinance. https://t.co/QFHIds7uSu

0

4

21

Coming up soon: @HyunSongShin speaks about non-bank financial intermediaries in the post-pandemic landscape at @SHouseofFinance. #NBFI #FinancialStability

https://t.co/bXTXTrviqc

1

12

22

Great keynote presentations by Darrell Duffie and Imène Rahmouni-Rousseau today at the Money Markets in a New Era of Central Bank Policies conference today. Join us now or tomorrow to listen to Monika Piazzesi and Hyun Song Shin. Register here:

hhs.se

The Swedish House of Finance was pleased to invite interested academics and practitioners to a conference on “Money Markets in a New Era of Central Bank Policies” on August 23-24, 2021, in Stockholm

1

7

14

The @federalreserve just made permanent its repo facility. Why did it do so? Most likely: to avoid 2019-type repo spikes. @AdriendAvernas and I just finished writing up a paper with a theory explaining these spikes and why a repo facility may be helpful. Thread below. (1/14)

2

19

88

Thoughts on learning to "fail fast" in research. When you have a new idea, and the project is worthwhile only if P, then you need to check P first, not last. Examples: 1. You can only establish causality with a certain kind of data. 🧵

10

188

983

Call for papers: SHoF conference on “MONEY MARKETS IN A NEW ERA OF CENTRAL BANK POLICIES” Don't forget to send us your paper by April 1! https://t.co/3nEo2RYt44

0

1

0

The last paper at the 16th MFS Workshop - "Intraday Liquidity and Money Market Dislocation", presented by Adrien D'avernas, @AdriendAvernas (SSE) - https://t.co/GQRozFVF1W, tune in to livestream here - https://t.co/oo0oOUwDzF. Arvind Krishnamurthy (Sranford) is discussing.

0

1

4

The growth of non-bank finance and new monetary policy tools | VOX, CEPR Policy Portal

0

0

1