shadow

@0xmev

Followers

2K

Following

4K

Media

21

Statuses

138

A critical lesson many top 0.1% engineers need to hear: allocate your time as one allocates his/her capital. Where you decide to invest your talent is the single highest convexity decision in life. @hyperunit we have incredible problems to solve, and era-defining products to.

Spot volumes on Hyperliquid reached a new 24h ATH of $3.4B. This was driven largely by growth in BTC and ETH deposits and spot volume, facilitated by @hyperunit. This makes Hyperliquid the second largest venue to trade spot BTC across both centralized and decentralized.

9

22

125

It's good that people are starting to consider the intersection of traditional assets and blockchain venues. I look forward to future discussions of the idea and its implications. For now, I'd like to highlight a couple flaws in the logic here. A few notes on S&P 500 perps. .

Timeline talking about "S&P perpetual futures on Hyperliquid" today. They can't do it. The S&P 500 is owned by McGraw-Hill. They won't licence a CME competitor. The real time price of the instrument is owned by CME. Anyone keying off real time CME data to price the instrument by.

1

1

17

Binance is literally daylight robbery, you have to trade 150mm, resulting in > 90k net fees starting at vip 0, just to get the same fee tier as a regular hyperliquid spot user

Coinbase is literally daylight robbery, you have to trade 250m, resulting in >300k net fees starting at vip 0, just to get the same fee tier as a regular binance spot user

5

11

144

The most performant self-custodial BTC/USD spot market, enabled now on @HyperliquidX.

Introducing Unit: the decentralized asset tokenization layer for all of finance, built exclusively on Hyperliquid. Unit will enable seamless deposits, withdrawals, and trading for a wide variety of assets. Our first integration allows major spot crypto tokens to flow between.

0

2

14

Fin/ It's impossible to say exactly how much Avi lost on this trade (bc of CEX side), but my guess is around $10-15mm. Main mistakes:. - not enough gas in the tank.- not enough float to control market.- didn't predict CT would join the front lines for @CurveFinance.

2

0

13

10/ Before discussing Avi's specific mistakes, I should note that he *did* show that even the "big" protocols are exposed to manipulation, and bad debt. I highlight this point.1) for everyone that punched down on Mango Markets.2) so we can further harden our DeFi primitives.

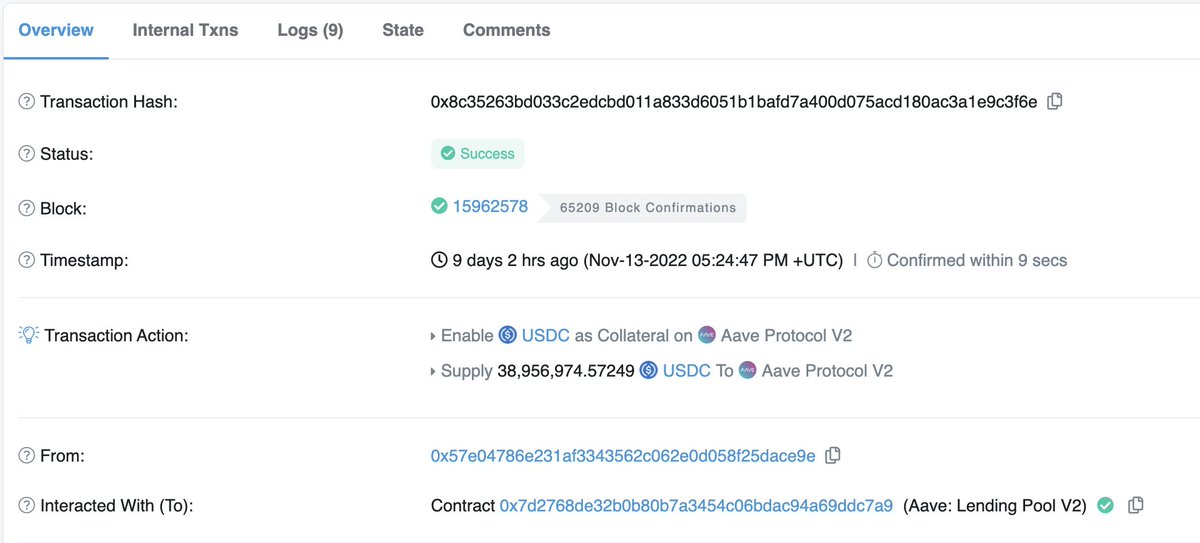

1/6 We want to address the cycle of liquidations that occurred in the CRV pool on the Aave Protocol today. The liquidations were successful (and worked as designed), but unfortunately, the size of the position left some excess debt within the protocol.

1

1

11

6/ Around 10:15 am UTC, 0x30be05fe3ed386b8d8afb327b03f50c9d97dcb85 begins to counter Avi's positions. On-Chain: Swap for CRV, and lend it to borrow USDC.Off-Chain: Giga squeeze the orderbooks.

First, he came for Mango, and I did not speak out, for I am not an investor. Then he came for USDT, and I did not speak out, for he did not pose a risk. Now, he tries to hunt the loan of one of the godfather's of DeFi and that's when the foot is put down to defend

1

0

9

2/ Overall, this is pretty similar to the Mango strategy: manipulate oracle price to get favorable DeFi loans. Note: There was an optional plus of wicking low enough to liquidate Curve Founder @newmichwill Aave $CRV position between steps 3 & 4.

Mango 'very profitable trading strategist' @avi_eisen has an $8m short on CRV. @CurveFinance founder @newmichwill has $48m of CRV supplied on Aave with a liquidation price of .259. Yesterday they had an interesting discussion in the Convex discord. 🦙🏫 ↓

1

0

3