0xKaneki (カネキ ケン)

@0xKanekiKen

Followers

219

Following

751

Media

10

Statuses

400

Building @0xTokenClick, the exchange for Ad Futures. Turning attention into a liquid, tradable asset | ex-Polygon (STARKS) | AdTech & On-Chain Finance

Joined March 2022

Attention is the fuel of the internet. Ad slots turn it into dollars but the flow sits locked inside a few platforms, out of reach for almost everyone. We are changing that. Meet @0xTokenClick- the exchange for Ad Futures. Thread. 🧵

3

5

18

Building a high perf indexing solution that can parse the blockchain in real time, sync to a db and surface data to end users with minimal latency is a tough engineering problem and an expensive one in terms of infra. But maybe that’s not the game one needs to play. Instead I.

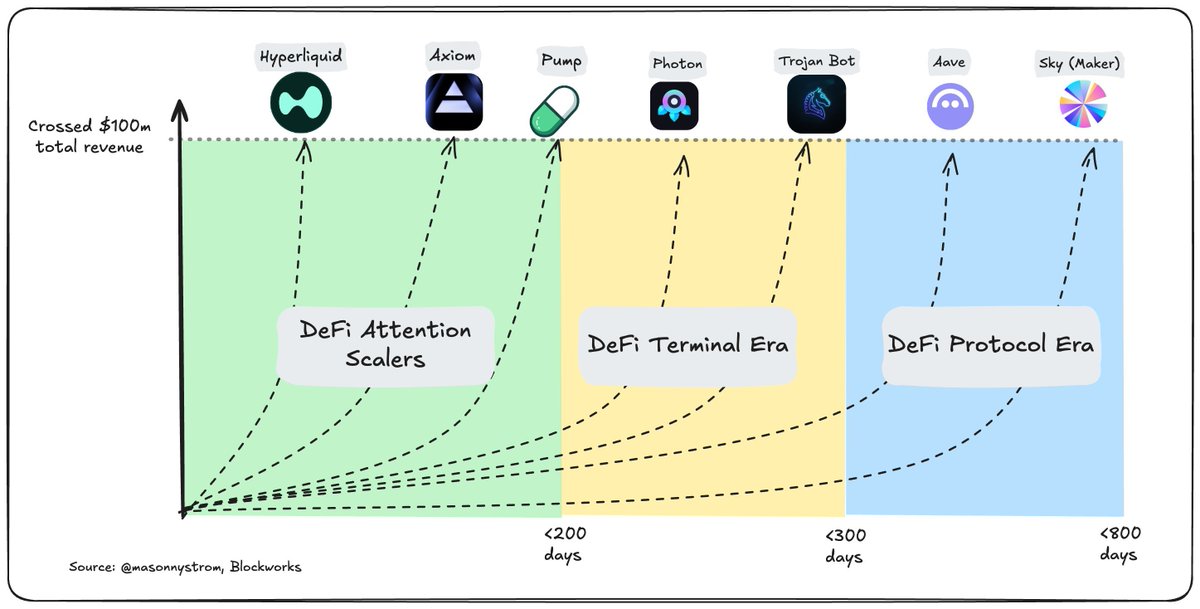

Moats in crypto are hard. Open markets. Open data. Connected gardens. Terminals differentiate on product execution and brand. Axiom. Photon. Gmgn. TG bots. Mobile apps. etc. Exchanges like Coinbase and Robinhood are able to differentiate because they have proprietary

0

0

1

Ads aren’t the villain, bad hidden ads are. Most people want free answers, clear “paid” labels, control of data, and publishers paid on time.

Hey @DavidSacks , my one request is that we make it illegal for AI models to offer advertising. And, we need to really examine referral fees as well. The last thing we need is to have algorithms designed to maximize revenue driving LLM output and interactions. They are.

0

0

1

UGAs dont have to be meme risk. You can turn discounted attention into a revenue backed asset: a publisher pre sells a slice of next quarter inventory; cash flow to holders is tied to verifiable events, impressions served and cleared CPMs, logged by the ad server. Upfront cash +.

Published an article on why optimizing for tokenized equities is looking backwards, whereas optimizing for User Generated Assets (UGAs) is looking forward.

0

0

1

Perfect time for diamond hands to accumulate when weak treasuries offload.

I just finished my research on the top 100 Bitcoin treasury companies and I'm now 100% convinced this will hit us hard once the bull cycle ends. It feels like no one is paying close attention to what’s going on. But I did. I went through a lot of numbers and I can tell you this

0

0

1

RT @0xa9a: Attention is about to trade like a commodity. @0xTokenClick is building the rails so anyone can invest directly in ad yields - t….

0

1

0

RT @0xKanekiKen: Attention is the fuel of the internet. Ad slots turn it into dollars but the flow sits locked inside a few platforms, out….

0

5

0

RT @sandeepnailwal: One person AI companies are real. Been watching @0xkanekiken build @0xTokenClick solo in the Nailwal Fellowship latest….

0

12

0

Aravinds right that agents change the rules but they are far from ad silent. Modern AI helpers still scan, rank and trigger the most relevant sponsored links when it speeds up their tasks. Google's not throwing in the towel and they’re incorporating ads right into AI Overviews.

Aravind Srinivas says AI agents break Google's business model because they don't click on ads. “Advertisers believe they're getting real human clicks.”. In the agent era, search ads stop working when no one's there to click.

0

0

2

Grateful for the support from @sandeepnailwal @SPLehman and the @NailwalFellows that pushed @0xTokenClick from idea to pilot. A big thank you.

0

1

3

Here's the model in simple terms:. 1. A verified publisher tokenizes a slice of their future ad revenue.2. @0xTokenClick issue "Ad Futures" representing this revenue stream.3. Investors buy these Ad Futures, providing instant, non-dilutive capital to the publisher. 4. As ads run,

1

0

1

Wild idea: the “AI endgame” may hinge less on aligning one super mind and more on outnumbering it. Picture thousands of pocket sized open-source AIs cross checking each other, logging proofs on-chain and flagging any outlier behavior in real time. Hard for a rogue model to hide.

My response to AI 2027:. The AI 2027 post is high quality, I encourage people to read it at . I argue a misaligned AI will not be able to win nearly as easily as the AI 2027 scenario assumes, because it greatly underrates our.

0

0

2