Yiqin Shen

@yiqinsh

Followers

3K

Following

7K

Media

313

Statuses

3K

Equities reporter @business, merger arb, event-driven & nerdy stuff. Ex-@Mergermarket @Dealreporter. From Shanghai to NYC. 📧[email protected]

New York

Joined August 2014

FLEX- a type of bespoke options that let users, not exchanges, set contract terms - has existed since 1993, but only started to gain traction in recent years. @bernardgoyder & I on all their unique features, why vital to defined-outcome ETFs, synthetic short & revcon trades

1

0

4

RT @csreinicke: Absolutely huge news from @yiqinsh - Nasdaq is revamping rules for companies pursuing small ipos, including additional requ….

bloomberg.com

Nasdaq Inc. is revamping rules that companies pursuing small initial public offerings must follow to list and continue to be traded on its exchanges, the latest effort to protect investors from wild...

0

1

0

Turn old photos into videos and see friends and family come to life. Try Grok Imagine, free for a limited time.

733

1K

5K

RT @MrMojoRisinX: @JulianKlymochko Merger arb is generally a high sharpe strategy due to 90%+ deals closing, and it used to be the largest….

0

2

0

RT @nishantkumar07: Are podshops natural homes for merger arb traders? A number of them are rebooting their event-driven strategies outside….

bloomberg.com

Five years ago, veteran hedge fund trader Ed Cooper gave up his independence to join a group of peers betting on corporate deals at industry titan Millennium Management. Now he’s back on his own...

0

4

0

Convert arb strategy is having a moment, with market forces aligning to create ideal conditions for trading the hybrid securities. High single-stock vol, stable credit, plus a boom of new deals-- a "perfect environment" per Man Group. W/@denitsa_tsekova .

0

2

9

A popular user case is in buffer ETFs (a huge boom in its own), as FLEX allows issuers to pick custom strike prices, expiration dates that help build a specific strategy. Exchange-listed, OCC-cleared, also means more liquidity, less counterpart credit risk to OTC contracts.

1

0

2

RT @dliedtka: Michael Saylor has built a career on testing how far conviction can bend markets — part financier, part preacher. Now the Str….

bloomberg.com

Michael Saylor has built a career on testing how far conviction can bend markets — part financier, part preacher. Now the Strategy Inc. chairman is betting that same belief on what may be his...

0

2

0

RT @annmarie: Breaking news— Meat is back on the menu at Eleven Madison Park .

nytimes.com

The Manhattan restaurant drew global praise and skepticism with its climate-minded, all-plant menu. Now its chef wants to be more welcoming — and popular.

0

5

0

RT @nishantkumar07: Ex-Millennium Trader Ed Cooper to Manage Money for CPP, Partners Capital and in talks with a multistrategy hedge fund f….

0

10

0

RT @geoffreymorgan: A story for Opendoor investors and goldendoodle owners.

0

4

0

Eclipsing the massive volume seen in $OPEN Monday…. with no apparent news.

0

0

0

Another day, another wild movement in a little-known penny stock. Today it’s Healthcare Triangle, a healthcare IT firm that more than doubled in price (to 5 cents 😂) with over 3 billion shares changed hands—that’s~ 15% of the total US stock market trading volume $HCTI

5

9

25

RT @dailychartbook: "The 10-day average of retail participation in non-profitable technology companies reached 23% — the highest level sinc….

0

27

0

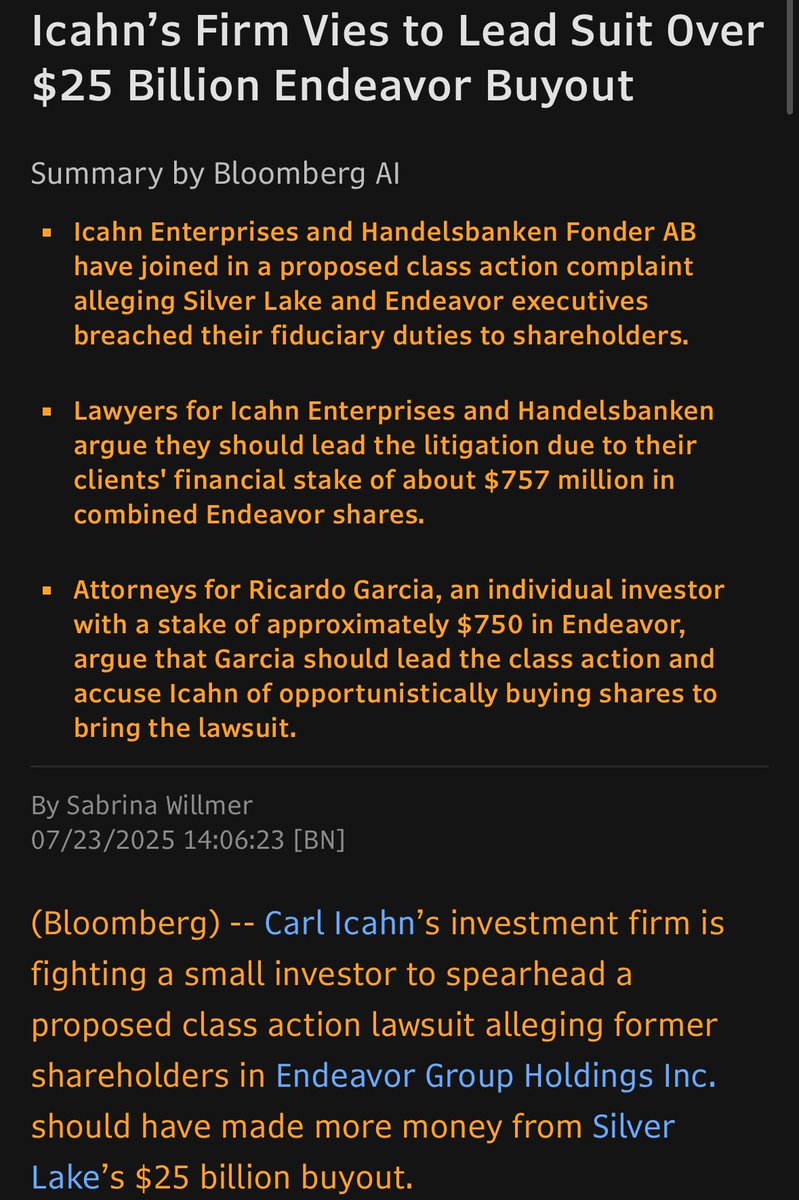

$EDR $TKO More details emerged: Icahn purchased its shares between March 3 and March 21, “with deep conviction” the buyout was “unfair”. His firm proposed a class action lawsuit, in parallel to the price appraisal case many other hedge funds took .

$TKO curious move from Carl Icahn, he disclosed 8.4% ownership of stock as of Friday, right before close

1

1

7

And. It's a two-way flow: dealers buy into rallies and sell into reversals. The $OPEN call volume is losing steam today

0

0

3