YAM 🌱

@yieldsandmore

Followers

7K

Following

4K

Media

126

Statuses

545

A syndicate of DeFi power users, sharing thoughts on DeFi and tweets of fellow members. Hosted by @SaulCapital and friends.

Joined November 2022

$YU

We're seeing some red flags about @yalaorg’s stablecoin $YU. Back in September, $YU's backing lost around $7.6M as a result of a faulty OFT LayerZero bridge setup where an attacker gained unauthorized access to mint $YU. The Yala team claims that they found the exploiter and

19

9

149

We're seeing some red flags about @yalaorg’s stablecoin $YU. Back in September, $YU's backing lost around $7.6M as a result of a faulty OFT LayerZero bridge setup where an attacker gained unauthorized access to mint $YU. The Yala team claims that they found the exploiter and

app.euler.finance

The Lending Super App

36

16

185

@MorphoLabs Deposits are now disabled. They were previously turned off on November 6th, then re-enabled on November 10th for unknown reasons. Perhaps MEV Capital thought the delisting and debt socialization wasn't timelocked?

0

0

37

STOP DEPOSITING! 💀 @MorphoLabs can you temporarily stop new deposits into this vault until the socialization of losses happens? You're leading lambs to the slaughter.

2

0

77

The MEV Capital USDC Market on Morpho has 12% exposure to xUSD, and there's 4.69M of liquidity to withdraw. You should do so ASAP, as the transaction to remove the xUSD Vault from NAV and socialize the losses went out 2d ago, and the timelock is 3d long. https://t.co/OTOF54k4nt

17

37

185

There is a https://t.co/6uFzDWEARQ arbitrum USDC market with bad debt caused by the Silo Swaap Lend market (sUSDx 127). $1.24M USDC of instantly withdrawable liquidity is available. If you have funds in this market, you should withdraw immediately. https://t.co/p1f1TYr7zg

summer.fi

Get effortless access to crypto's best DeFi yields. Continually rebalanced by AI powered Keepers to earn you more while saving you time and reducing costs.

11

15

84

@k3_capital @elixir Screenshots come from the k3-capital channel in the @eulerfinance discord. Discord:

discord.com

Check out the Euler community on Discord - hang out with 28135 other members and enjoy free voice and text chat.

1

0

16

The saga continues. @k3_capital is threatening legal action on @elixir, claiming Elixir is a 'coordinated fraudulent scheme' orchestrated by Philip Forte (founder of Elixir) and facilitated by Caleb from Stream Finance'. K3 alledges Elixir misrepresented their product by lending

Elixir has worked tirelessly over the previous 48 hours and has successfully processed redemptions of 80% of all deUSD holders thus far (not including Stream). As it stands now, Stream holds roughly 90% of the deUSD supply (~$75m), while Elixir holds a similar proportion of its

31

47

389

Ethena's S4 airdrop is finally claimable: https://t.co/LSNR2nKiar 3.5% total: 1.5% claimable now, 1% claimable when @hyenatrade goes live, 1% claimable if you're outside of top 2000, otherwise vested. Vesting claim: https://t.co/Fd2JCAvRiv Details on S5:

9

4

142

important shitshow; elixir saying that the deusd collateralized by stream on money markets is effectively siloed and claims dependent on stream repaying (ofc they won't) the issue is, stream borrowed money from other ppl against this deusd - so the collateral that people lent

Elixir has worked tirelessly over the previous 48 hours and has successfully processed redemptions of 80% of all deUSD holders thus far (not including Stream). As it stands now, Stream holds roughly 90% of the deUSD supply (~$75m), while Elixir holds a similar proportion of its

16

13

176

We’re told by the @Alchemy team that the Hourglass frontend was not on a free tier. Apologies. It seems their frontend got DDOSd, and their API was and is massively struggling.

0

1

17

Today's deposit into @stable was chaotic. Signing Terms of Service did not work even if you signed in your wallet, as the Hourglass website used a free Alchemy RPC and got overwhelmed. This made people deposit through @etherscan. But not everyone has experience using block

etherscan.io

Token Rep: Neutral | Price: $0.00 | Onchain Market Cap: $0.00 | Holders: 22,871 | As at Nov-13-2025 02:42:07 PM (UTC)

22

15

174

This is a massive loss. It's unclear how this will be settled in between xUSD/xBTC/xETH holders and lenders against these tokens, so let’s go over all stablecoins/vaults that have (in)direct exposure to Stream. Best we can tell, these stablecoins have indirect exposure: Elixir’s

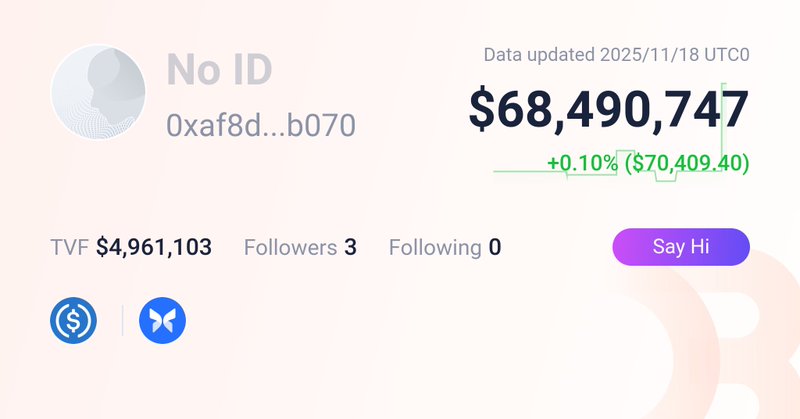

debank.com

Your go-to portfolio tracker for Ethereum and EVM

Yesterday, an external fund manager overseeing Stream funds disclosed the loss of approximately $93 million in Stream fund assets. In response, Stream is in the process of engaging Keith Miller and Joseph Cutler of the law firm Perkins Coie LLP, to lead a comprehensive

96

229

764

Not everyone knows this, but you can lend directly to individual Morpho markets through @monarchlend, a third-party Morpho interface. This is useful for a few reasons: - Depositing into a single market lets you earn the APY of just that market. Useful when the borrow rates are

3

6

71

Yield farming changed a lot this year. We went from trying to find alpha in exotic chains, new underfarmed protocols, illiquidity premiums, and outperforming loops to gated private deals and incestuous cronyism. Recent examples, such as Stable's pre-deposit vault and rising

21

22

213

Be VERY careful interacting with unverified @merkl_xyz campaigns. A bad actor is creating triple digit APR incentives on Sonic for depositing USDC into an Euler vault, and drains all deposits. This is how it works: Because Euler is permissionless, the attacker was able to

16

71

346

As a general risk framework, if you suspect that an asset, exchange, or any place holding your funds might be insolvent, the most rational decision is to exit first and ask questions later. The cost of exiting is typically far lower compared to the risk-adjusted loss

all these incestuous self-backed ponzis rn: if you are lending to a vault with any exposure at all to this circus for anything less than 50% APR, you are getting fucked and should really reassess your entire strategy. you can get 7% for lending against solely cbBTC (Morpho

2

8

88