Yevhen

@yevhenx

Followers

1K

Following

12K

Media

61

Statuses

622

How to hedge impermanent loss and boost your trading fees by 3x with @Uniswap V4 hooks and @eulerfinance lending protocol TLDR: synthetic ETH vault as a combination of leveraged long 3x and short 2x positions achieved via looping to provide liquidity for the ETH-USDC pool to

8

9

136

Thanks @AtriumAcademy and @UniswapFND for this amazing accelerator! @eshita is the goat! 6 weeks of deep work on our product, which we are about to be released by the end of September Audit is done and it's time for launch!

Hook Product Accelerator's Demo Day has arrived! HPA is designed to support teams who are past the earliest ideation stage and now face the next big hurdle: turning momentum into sustained adoption. Today we had 11 trailblazing builders showcase their contributions to the

1

4

6

Join us to hear about the upcoming Berlin ETH Vault - bold, risky, edgy play on ETH volatility with 20-30% APY against ETH UniV4 + Euler to fight impermanent loss

The Hook Product Accelerator is a 6-week program for DeFi founders building the next wave of products on Uniswap. As we close out the current cohort, our Demo Day on Sep 4 will highlight what they've built, where they're headed, and how you can connect with them. Run by Atrium +

2

4

16

✨Introducing Eulerscan - An explorer for Euler V2 with complete historical yield data for every vault! Wanted to backtest on Euler's historical data but couldn't find a good source, so decided to build one myself. Eulerscan includes CSV exports as well! link below 👇

20

13

147

Angstrom is finally here!

0

0

2

ethcc was fantastic this year! insanely hot? yes! both temp and convo quality! good to meet old friends and connect with a new builders, LPs, and VCs. the only conf with so heavy focus on the tech and playing a long-term game! the best conf! thx everybody and see you next year!

0

0

3

Thanks @UniswapFND @ocandocrypto @aaron_lamphere for this amazing builder space in Berlin! It was a special place where you could not only meet other fellow hook builders but also get all the necessary support! Which was so valuable and insightful that I hope to have more

If you’re building community in #crypto or #tech, remember: it’s not about you. Your job is to listen, process, build, and iterate — based on real feedback. Memes and content are fun, sure. But if you ask your builders, they’d rather be heard. Start there. 🛠️

1

1

12

1/ Together with @UniswapFND, we're introducing Areta Market -> https://t.co/ofm4b351FG > Marketplace to connect builders to whitelisted auditors > Gives builders 10-12 service quotes per request and full price transparency > Reduces audit costs by 20–30% and shortens service

46

95

276

this is much less important than tweeting about agi, but it is nevertheless amazing to me that the entire DEX industry can (in aggregate) lose money on IMP LOSS for so long and keep getting funded. i am very curious why LPs do it.

this is much less important than tweeting about agi, but it is nevertheless amazing to me that the entire venture industry can (in aggregate) lose money for so long and keep getting funded. i am very curious why LPs do it. (obviously if you can fund the top funds you should!)

0

0

9

The funny thing is that we're finishing our audits for almost identical functionality, but with a permissionless pool creation for any pair of tokens from day 1. Powered by @eulerfinance and @Uniswap V4.

Introducing Fluid DEX v2 🌊 We’ve taken inspiration from everything in DeFi to build something beyond just a better DEX — we're creating the most advanced decentralized exchange the crypto space has ever seen. 🧵 👇

10

1

58

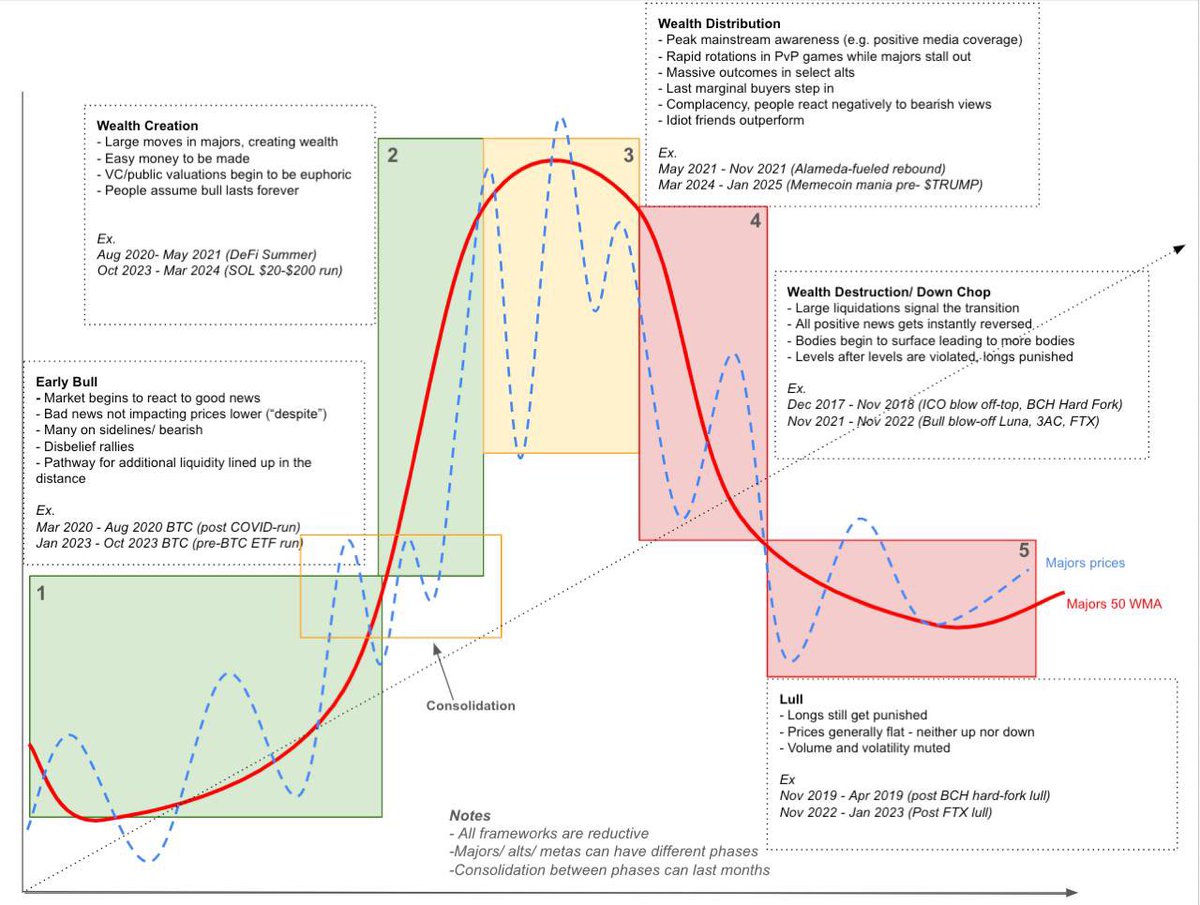

The ultimate market opportunity is building directional volatility-harvesting vaults that will be able to capitalize on both secular growth (black line) and short-term volatility swings (blue line) coming soon from @lumisfi_

Since some of you found this framework helpful, here’s an updated version All frameworks are by definition reductive but this gives me clarity on navigating time frames and is part of the reason I limited significant drawdowns to 2 (2017 end and May 2021) in the past 7 years in

0

0

11

Today the day 🔥🔥🔥

Uniswap v4 is here🦄 Users can LP on v4 through the Uniswap web app and swapping is rolling out over the coming days on web and wallet as liquidity migrates to v4 Live on Ethereum, Polygon, Arbitrum, OP Mainnet, Base, BNB Chain, Blast, World Chain, Avalanche, and Zora Network

0

0

16

With @Uniswap V4 just around the mainnet launch, we are proud to announce grant from @UniswapFND that will help up to get top-tier audits before launching our long-awaited Uniswap V4 hook! Thanks for your support and let's build! ✨👽✨

⭐ In the first cohort, 9 hooks have been selected to receive subsidized audits, each representing various use cases for Uniswap v4: → @bunni_xyz → @CollarProtocol → @Corkprotocol → @GammaStrategies → @likwid_fi → @lumisfi_ → @TenorFinance → @Paladin_vote → Unicord

0

1

8

Opyn is back!

BREAKING: OPYN MARKETS TESTNET LAUNCH IN JAN 2025! Permissionless. Composable. Powerful. Stay tuned: https://t.co/pDlsL3hgxb

1

0

1

Just imagine that with Uni V4 hooks, you can also add here a mirroring delta-neutral vault and atomically rebalance between them to further increase capital efficiency and performance With @Uniswap intents, cheap L2s, and open-source liquidity indexer from @PropellerSwap it's no

This is genuinely impressive, lending markets enabling institutional-grade capital efficiency on @eulerfinance through V4 hooks. Dynamic LTV optimization + IV-based liquidity multipliers. This validates the thesis on modular lending primitives as DeFi infrastructure.

0

1

9

Unicord is coming soon! Proudly mentioned by @UniswapFND for early Uni V4 innovation and it's almost ready for launching and boosting your stablecoin yields 🔥🔥🔥 Stay tuned, as we also have a lot of cool stuff including perfect imp loss hedging and will announce it shortly! ✨

⭐ Accelerating DeFi Innovation Huge shout out to some of the early teams building on Uniswap v4: @ArrakisFinance @0x94305 @SemanticLayer @gordonliao @kaili_jenner @bunni_xyz @flaunchgg @SorellaLabs @FWBtweets @Paladin_vote @TenorFinance and more.

0

1

8

👀👀👀

Announcing Tycho: The open source liquidity indexer. Tycho integrates DEXs – so you don't have to. Full announcement: https://t.co/poChUuOTK8

0

0

2

It’s over guys… Squeeth is about to retire soon( It’s been an exciting journey full of fun, drive and adrenaline 😜 It’s hard to count how many times a day we said the word “Squeeth” but now it’s time to say bye 👋 Thx for everything and good luck with your new protocol 🫡

Our beloved Squeeth is retiring. 🔹One of the greatest experiments in the history of Defi & power perps. 🔹 Traded $1.2 billion+ of ETH exposure since launch. Squeeth will shut down on Nov 4 2024, 16:00 UTC as Opyn Markets prepares for launch. More details below ⤵️

1

1

14

This and intent-based DEX architecture it’s a killer combo that opens so much possibilities for next-gen structured products *goosebumps*

Opyn Markets brings TradFi capital efficiency to DeFi. DeFi often struggles with capital efficiency, requiring more capital to put on the same trade as in traditional finance. The key to fix this issue is to give proper credit for risk reducing trades. If your portfolio

1

0

4