TN | Pendle

@tn_pendle

Followers

13K

Following

19K

Media

181

Statuses

3K

Co-founder, cooking @pendle_fi

Pendlehouse

Joined July 2017

RT @PendleIntern: Ethena PTs are serving up 7.5%–8.5% Fixed APY. To put that into TradFi terms, that’s right between bond yields with a B….

0

8

0

RT @thelearningpill: You know how Pill occasionally spotlights compelling yield opportunities on @pendle_fi ?. Well, today's focus is on so….

0

12

0

RT @k3_capital: 🆕 Just launched: PendleLend, a purpose-built money market for @Pendle_fi LP & PT tokens, powered by @MorphoLabs. If you’re….

0

17

0

RT @pendle_fi: It’s simple - stake GHO on Aave and earn even more GHO. Introducing stkGHO (30 Oct 2025)

0

13

0

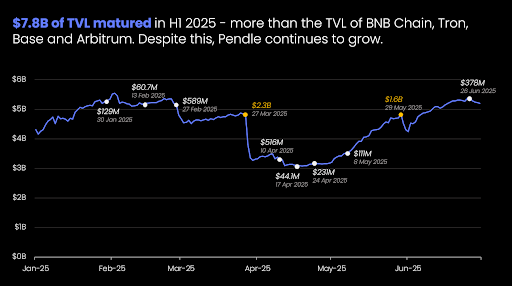

RT @Neoo_Nav: Pendle Spotlight #7 - Resilience and stickiness. $378m in TVL on @pendle_fi matured end week of June. Yet the TVL increased $….

0

20

0

Most recently, we’ve laid the groundwork for Pendle LP tokens to be supported as collateral, with Silo Finance being the first to deploy this integration. LP collateral caters to a different set of risk profiles from PT collaterals, enabling users to leverage yield while.

Everybody remembers their first time - for @pendle_fi enjoyers, that's today. With the launch of Silo Ethereum, it's also the first time Pendle's LP-eUSDe and LP-sUSDe are usable as collateral. This is enabled by Pendle's native LP Token wrapper for money markets. 👇

2

3

30

As we enter the second half of 2025, it’s worth taking a moment to reflect on what @pendle_fi has accomplished, and what lies ahead for us.

41

47

229

RT @pendle_grandma: Can’t predict the future, but I have unshakable confidence in Pendle. Always have, always will. Not for what Pendle h….

0

8

0

RT @pivotglobal_xyz: Pendle Finance @pendle_fi : 10x Growth, Stablecoin Tailwinds & New DeFi Primitive . Why We Believe Pendle is on the….

0

9

0

RT @pendle_fi: New pools, old friends ~. Here are all the markets that are getting a renewed maturity this week 👇

0

5

0

RT @pendle_fi: 4 years ago, we set out to transform DeFi yields. Much has happened since then. We've seen all the highs and lows and every….

0

24

0