Stock.Logging

@stock_logging

Followers

704

Following

1K

Media

70

Statuses

249

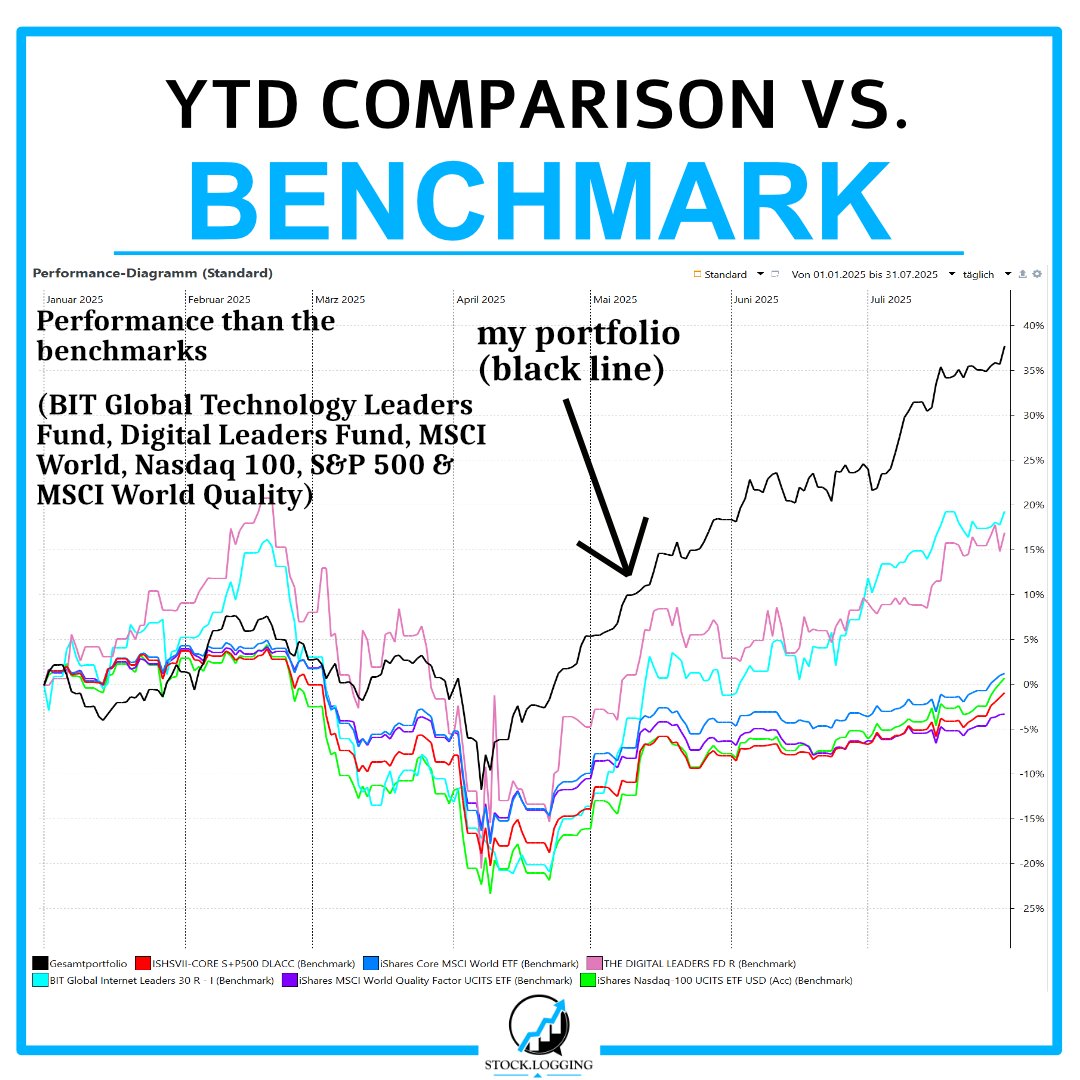

▶️ Quality GARP investor. ▶️ Looking for (potential) high-margin & capital-light compounders. ▶️ Aiming for 15-20 % portfolio return pa. ▶️ Based in 🇩🇪

Joined June 2025

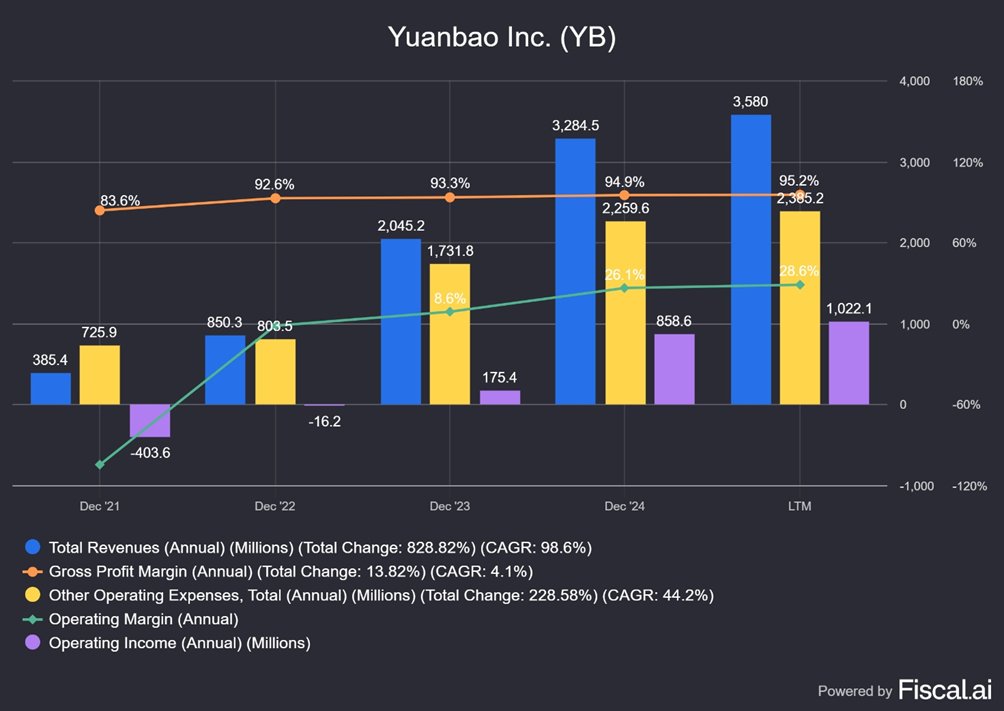

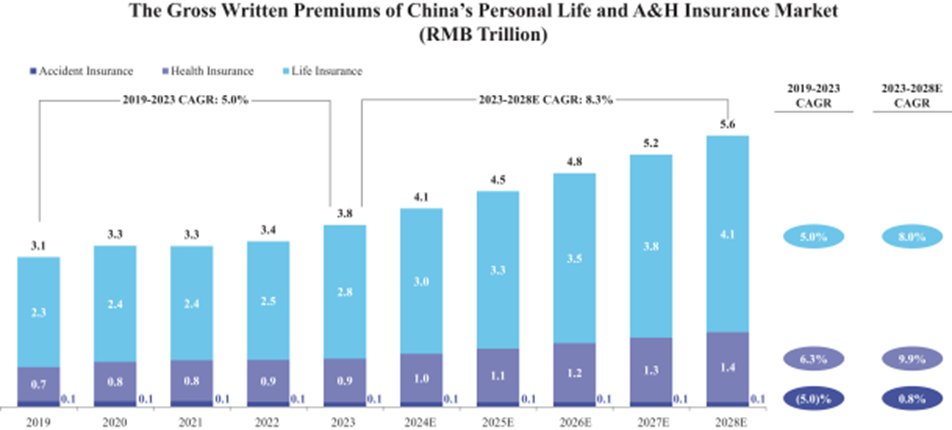

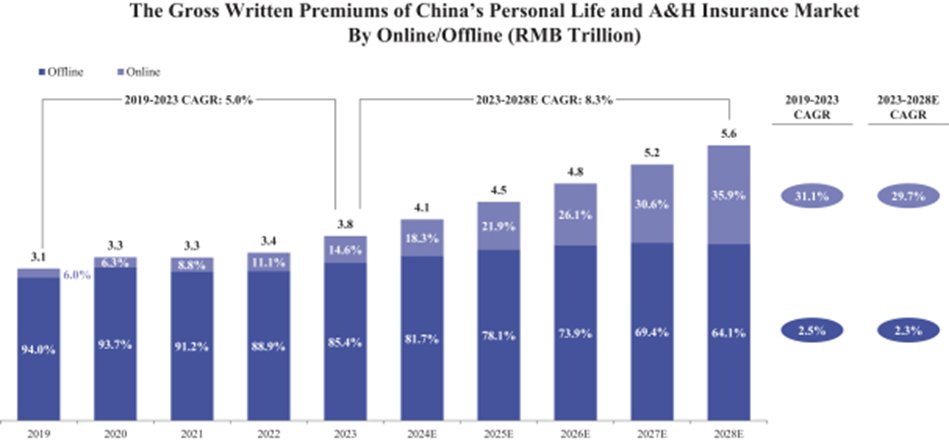

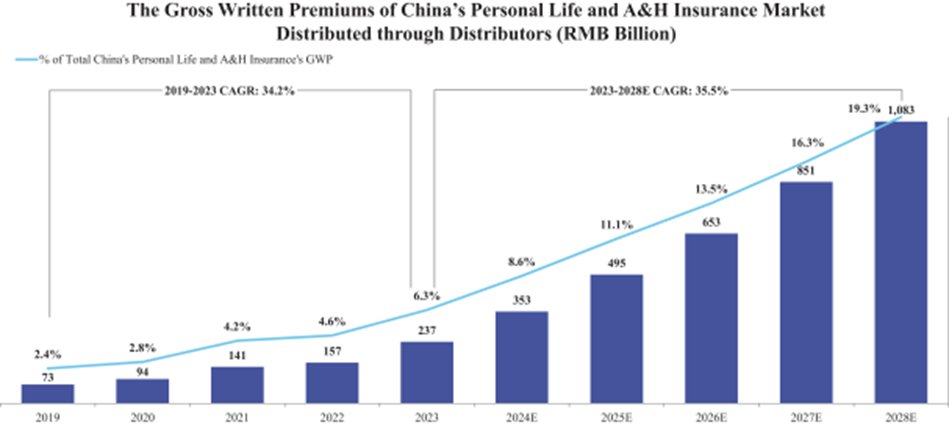

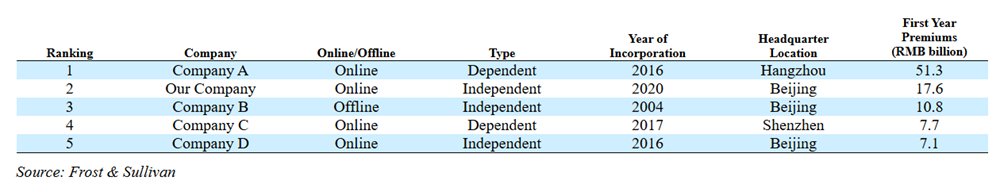

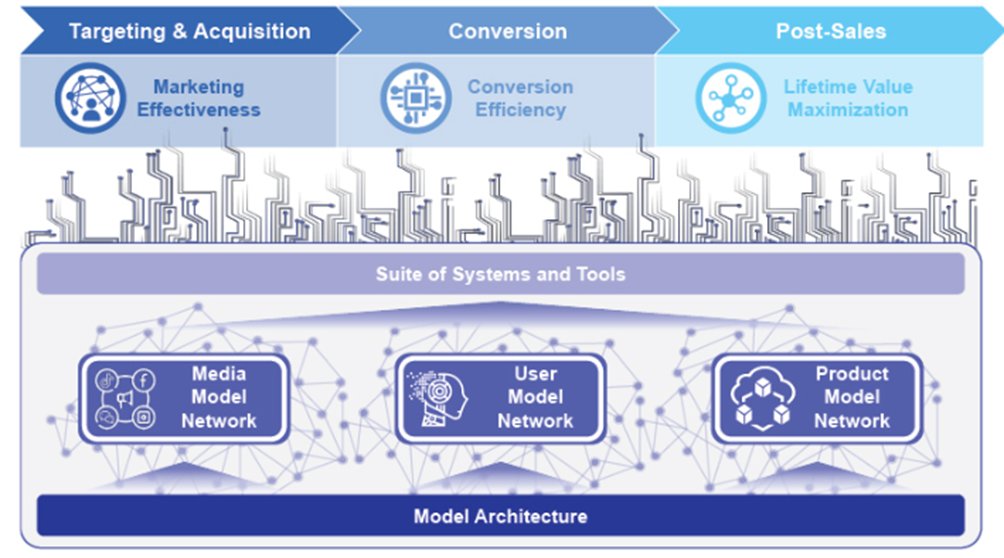

One of the most interesting stocks I’ve found in months. ➢ Chinese online insurance broker & tech platform.➢ Recent Nasdaq IPO.➢ Ex-NetEase C-suite.➢ 104% rev CAGR (3y), 43% Q1/25 rev growth.➢ 95% GM | 28.6% OM | 47% ROCE.➢ 2025 fwd P/E: 7.8. 📌 A thread on Yuanbao $YB 🧵

7

4

78

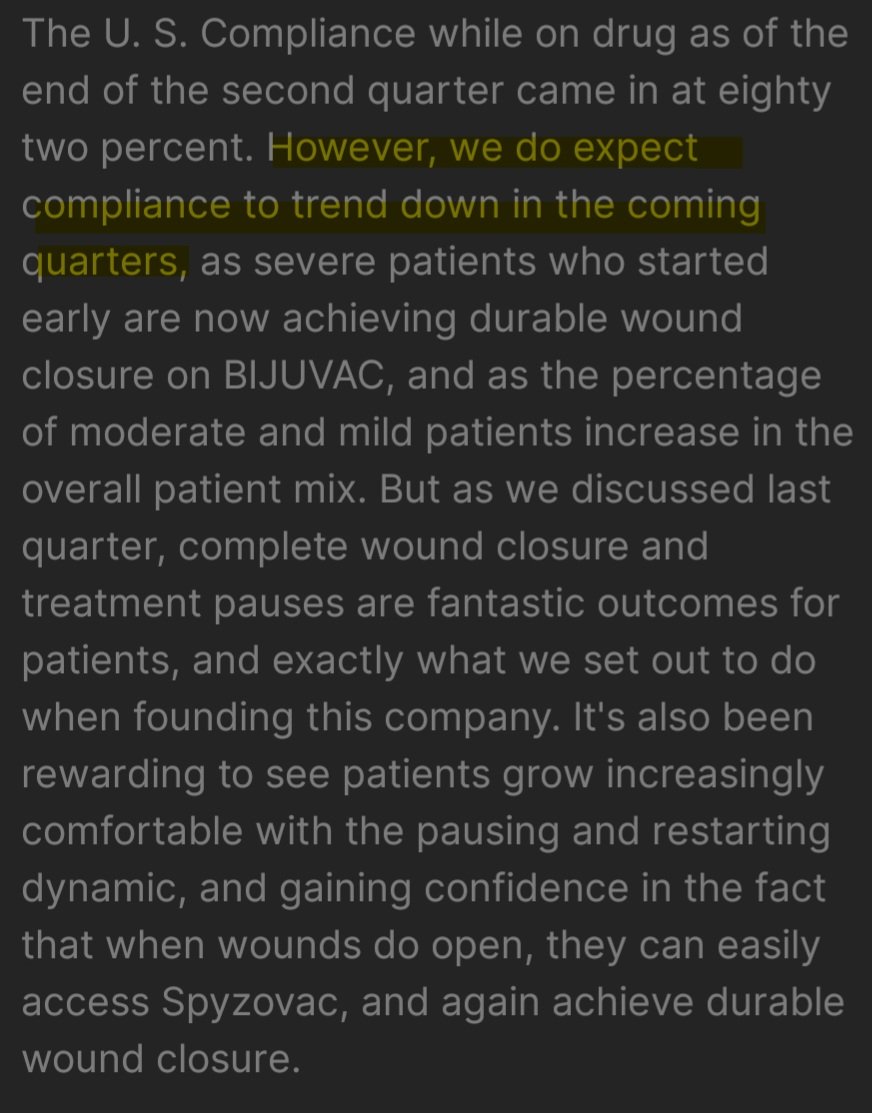

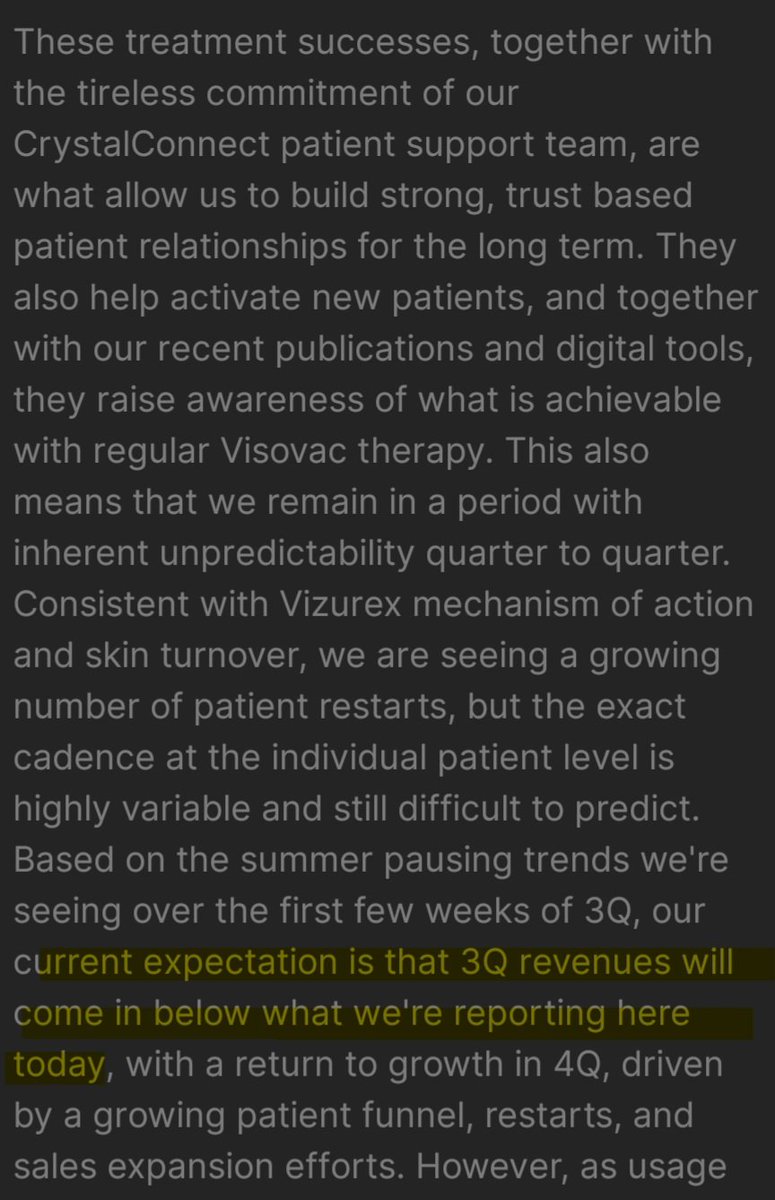

$KRYS.Sold my position today. Very disappointing management commentary on the call. Declining patient compliance makes growth impossible to predict. Sales have also been on a kind of plateau for several quarters now. IMO analyst expectations for the next years seem too high,

$KRYS.Strong study results for Krystal Biotech and its subsidiary Jeune Aesthetics. In a randomized, double-blind and placebo-controlled Phase 1 study, pipeline candidate KB301 showed significant improvements in severe wrinkles in the décolleté area over 1–3 months – as assessed

0

0

6

$ARYT $ARYT.TA .Aryt has been on a tear lately, already up 32% since my post 2 weeks ago and +47% since I bought around 3 weeks ago. Forward P/E for 2025 should now be around 20, assuming about 90% backlog conversion and slightly improving margins (as per scenario 2 in my post).

This defense company is a market leader in electronic fuzes for ammunition - yet it remains completely overlooked by most investors. The recent track record: a 154% revenue CAGR and 203% EPS CAGR over the past 3 years. Investment highlights:. ▪️ Revenue growth of over 200% is.

0

0

11