Sifchain

@sifchain

Followers

33K

Following

4K

Media

357

Statuses

3K

The leading Omni-Chain Dex on Cosmos. Swap, stake, and bridge between Ethereum & Cosmos with faster transactions & lower fees. | https://t.co/B52aHPtI2X

The Cosmoverse

Joined August 2020

Yes! GTK is now functional and capable of accepting liquidity from matchers/lenders and trades from traders. Let’s see how volume changes over time at

@sifchain Did this go to prod?.

8

2

32

We're working on an infra upgrade for GTK that should take no more than 2-3 days. Once that happens, we should see increased volumes and liquidity on GTK from interested supporters! Then institutions like the ones we've mentioned can scale in as traction develops.

@sifchain Any update on GTK since the API launch? Whatever happened with the company that wanted to integrate?.

7

1

25

GTK Trading API Up!.

npmjs.com

The `@sifchain/gtk-api` package provides a wrapper for the internal API client to manage and execute trade operations. This README will guide you through the installation, usage, and API methods...

A sizable trading firm offered to run trading volume through GTK if it had a conventional API. They have the capital to oversubscribe the current limited liquidity on GTK, which could then attract more lending, leading to a virtuous cycle of growth and yield for Rowan holders.

6

4

24

First PR for Storehouse and Wheat was submitted a few days ago We are very serious about burning up to 90% of the tokens and going hyper deflationary 😤.

github.com

Storehouse and Wheat is now our main crypto dev focus. It would land take 2-5 weeks from now, but we are hoping STF will cut a lot of that time down and be a good case study. It’s launch date would be a definitive date by when Rowan will reduce inflation or go deflationary.

11

9

50

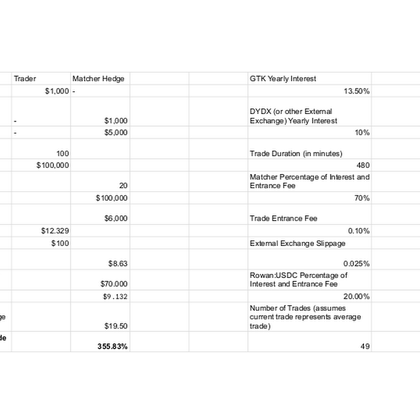

The yield a matcher gets varies depending on how much leverage the trader uses and how much the matcher hedges, but it should always be much larger than if they actually lent all 100% of the capital. This is explained more here and

Still, the margin dapp charges interest to traders *as though* they borrowed the entire $450. This liquidity concentration means they will end up with dramatically more interest revenue by lending on our platform.

1

0

2

Because GTK has concentrated lending, matchers/lenders do not have to provide all the capital that traders borrow. In the example in this spreadsheet they provide just 6%.

docs.google.com

1

1

1

Matcher APR stats now the GTK UI!. Matchers/lenders can now check the stats on multiple pages at to get insights on how much yield others are earning. This can increase the amount of liquidity provided if it comes with a commensurate amount of trading.

We are so close on these Matcher APR calcs; in the mean time, Rowan:USDC yield on SifDEX is at 700%+ APR paid in USDC 🚀🚀.

3

3

15

We are so close on these Matcher APR calcs; in the mean time, Rowan:USDC yield on SifDEX is at 700%+ APR paid in USDC 🚀🚀.

Great question! GTK’s Match Trades page already has Matcher APR per trade but we’re working through tests on getting an average version of that stat on multiple pages (maybe 2-7 days away). More on STF and Storehouse and Wheat below.

4

3

24

Great question! GTK’s Match Trades page already has Matcher APR per trade but we’re working through tests on getting an average version of that stat on multiple pages (maybe 2-7 days away). More on STF and Storehouse and Wheat below.

@sifchain What's the development timeline? Are we talking weeks, months, or years before we see all 3 of these in action?.

2

2

15