Serotonin

@serotonin_ada

Followers

624

Following

4K

Media

150

Statuses

1K

On the Treasury Budget for Ecosystem Stablecoin Liquidity.🧵1.I have a lot of respect for what what @ElderM is doing and I think that the use of treasury funds to provide stablecoin liquidity is a great “decentralized” alternative to VC that other chains employ.

4

37

50

There are very nice APRs on @MinswapDEX stableswaps provided by @Indigo_protocol and @wanchain_org . I’m looking at you iETH SP stakers (24% vs 4%).

📆 Cardano Week, Day 4 – Cross-Chain DeFi Unleashed. 🚀 Campaign with @MinswapDEX & @Indigo_protocol. Results?. ✅ $2.5M+ new liquidity on Cardano.✅ Hundreds of new users.✅ High APRs: $BTC-iBTC: 17% / $ETH-iETH: 24% / $SOL-iSOL: 28% / $USDC-iUSD: 26%. 👉

0

3

15

Are you taking advantage of these stableswaps? Should @Indigo_protocol and @wanchain_org continue incentivizing these pools?.

Don’t miss these massive APRs on #Cardano stable pairs! 👇. 💰 $BTC-iBTC: 15%.💰 $ETH-iETH: 22%.💰 $SOL-iSOL: 26%.💰 $USDC-iUSD: 19%. It’s easy:.1️⃣ Bridge to Cardano: 2️⃣ Add liquidity on @MinswapDEX.3️⃣ Earn dual rewards from #Wanchain & @indigo_protocol

0

3

18

The best aggregator on Cardano is still @SteelSwap.

The best swap engine on Cardano just got an upgrade!. SteelSwap now supports Minswap routing. Are you a whale that wants to swap 1 iBTC?. We got you. Even if the ADA/iBTC pool has low liquidity, we will route through multiple other Minswap pools to get you the best price!

3

1

36

I challenge you to find a better, less risky, and more reliable yield in crypto.

Big yields are live on #Cardano. Don’t miss out!. 🔹 $USDC-iUSD: 23%.🔹 $ETH-iETH: 23%.🔹 $BTC-iBTC: 17%.🔹 $SOL-iSOL: 34%. 1️⃣ Bridge to Cardano: 2️⃣ Add liquidity on @MinswapDEX.3️⃣ Earn dual rewards from @wanchain_org & @indigo_protocol. Video guide 👇

1

7

23

I have to agree. It’s odd to me that many of the same people who claim USDA/USDM is superior to USDC because Circle could freeze funds (preferential treatment for governments) are the same people calling for special treatment of treasury funds.

Permissionless chains thrive on neutrality. Fee waivers for “treasury funding”, special rules, exceptions etc introduce governance capture, rent-seeking & blurry definitions of who qualifies. Once you give in, you break credible neutrality. Vote wisely in the next CC Election!

3

0

11

RT @iNyorok: 🚨 $iUSD interest rate just hit the minimum: 5% 🤯. @Indigo_protocol algorithmically updates rates every epoch based on protocol….

0

16

0

Maybe give @IndigoPWG a follow.

Taking a page out of our brethen @Indigo_POG , and long over due, the PWG has finally decided to create an X account. Long ago, we should have been more involved in the greater Cardano community but we're here now, so let's meet our members.

0

1

14

Split a single user across 500 different accounts and have them trade against each other on the open market with a targeted net buy/sell amount. Now where have I seen this before? Oh yea, the excellent BrainTruffle video on market manipulation!.

We’re excited to present the Surge Litepaper. The final key for Cardano adoption is on-chain activity. It's time to embrace market making as essential infrastructure – and put it in everyones hands. Link:

1

1

14

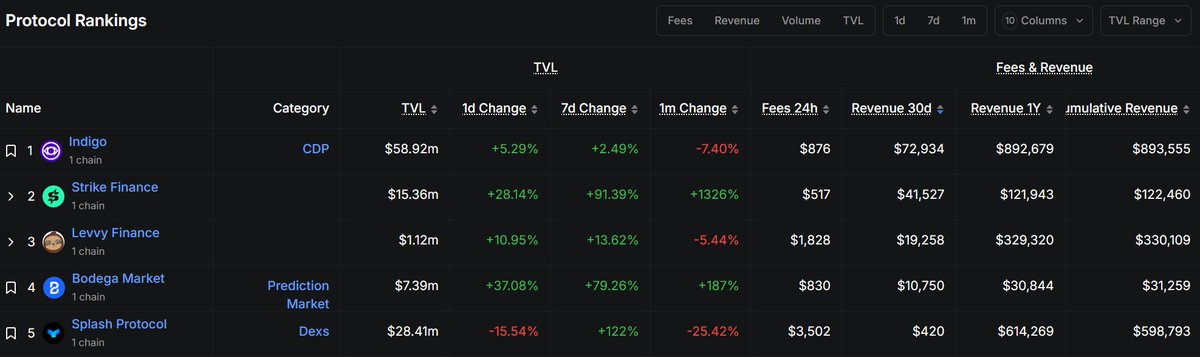

People like talking about the sustainability of their favorite protocol. @Indigo_protocol has consistently been on top for revenue generation on #Cardano since they launched v2.

🔮Indigo: #1 in revenue on Cardano for the past 30 days and 1 year. #2 in synthetics protocols across all chains. #10 among all CDP protocols. Real revenue powering long-term sustainability.

3

5

44

Who saw this one coming?.

This is @Bitcoin DeFi. 🧡🔮. It's on Cardano—. and it's coming to Indigo.

3

5

76

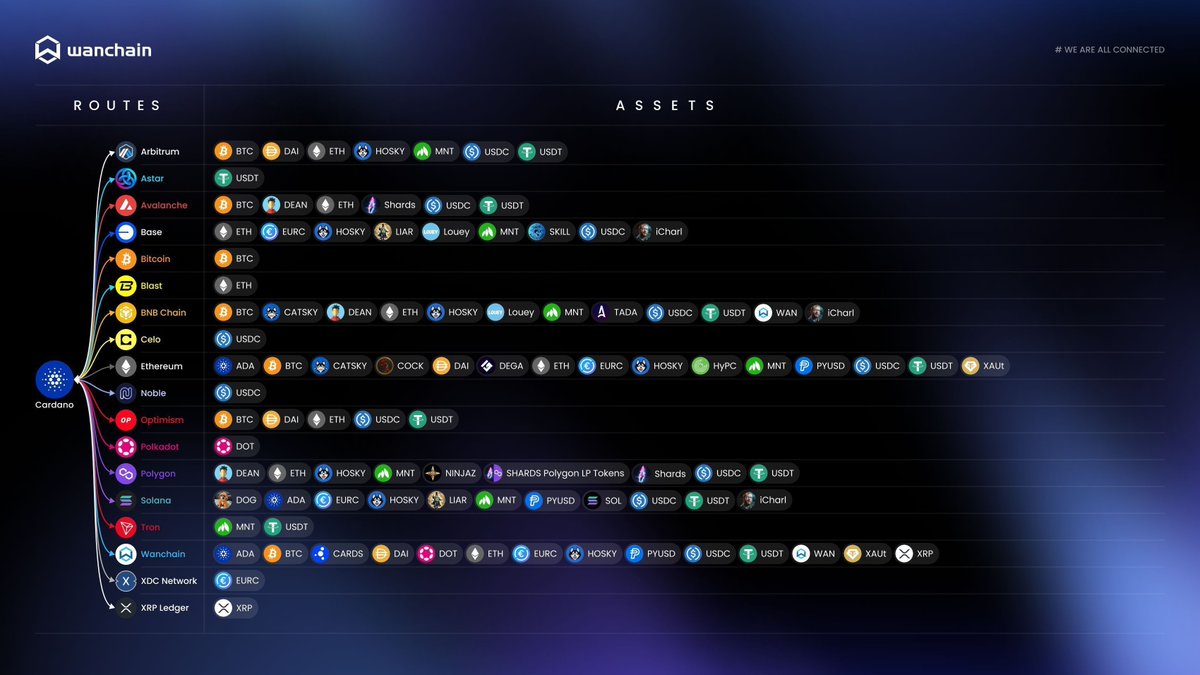

Damn, Wanchain’s Cardano bridge is almost 2 years old!.Also, did you know wanUSDC is @liqwidfinance most supplied/borrowed asset outside of ADA and the POL?.

August 8, 2023. Wanchain builds a bridge to Cardano. Some highlights?. ✅ Connected 18 chains and 30+ assets.✅ Secured $60M+ of $USDT and $USDC cross-chain volume.✅ Collaborated w/ @MinswapDEX, @liqwidfinance, @Indigo_protocol . Enter Cardano today via

0

3

15

There are a lot of unique stable opportunities on Cardano right now. One is that with the slight over-peg this can be a great low risk entry point to mint and supply iUSD. As the pool balance shifts you can exit some of that position with a bit of extra iUSD.

Great cross-chain opportunities spotted! 👀. 💰 SOL-iSOL – 53%.💰 USDC-iUSD – 24%.💰 BTC-iBTC – 20%.💰 ETH-iETH – 31%. All you have to do is:.1️⃣ Bridge your assets to Cardano via 2️⃣ Provide liquidity on @MinswapDEX. Here's a step-by-step guide👇

1

7

17

Going with $USDC bridged from @wanchain_org allows Cardano to leverage the deep liquidity and infrastructure elsewhere that Cardano’s native fiat backed stables simply don’t have. Also, no Wanchain bridge has ever been hacked.

Repeat after me.ONE MILLION DOLLARS. iUSD-USDC has hit an ATH in TVL. Thanks to openness and interoperable of USDC. Allowing anyone from the EVM to bridge in and participate in Cardano defi and expanding the broader ecosystem. What should @Indigo_protocol PWG do for the rewards

2

8

29

🧵15.then there are options available via @Indigo_protocol that minimize risk which aren’t as readily available for the other stables. For example, consider a variant of this delta neutral strategy, but pairing iUSD with another stable as a LP.

2

1

13