sealaunch.xyz

@sealaunch_

Followers

8K

Following

24K

Media

977

Statuses

3K

We partner with leading crypto teams to deliver strategic onchain data advisory. Drive decisions backed by onchain data. 🧙 https://t.co/3LCrcS4fFP

onchain sea

Joined October 2021

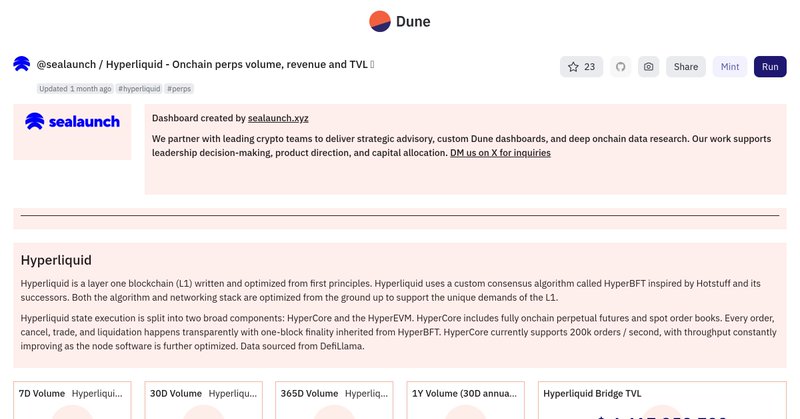

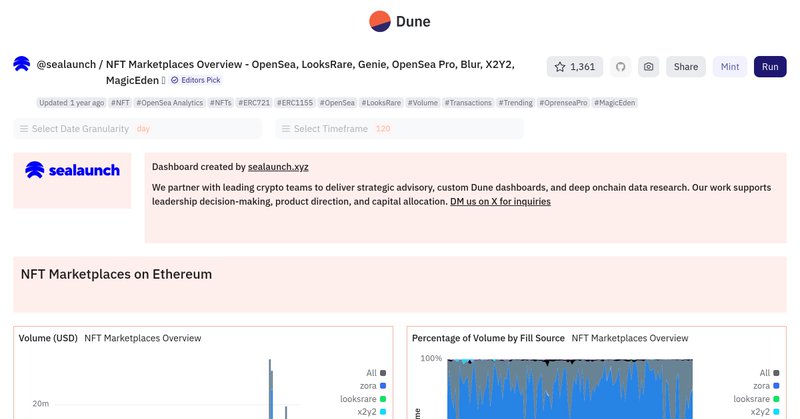

1/.Some of the topics we’ve been tracking lately + @Dune dashboards below:. → Shopify & Coinbase Commerce Payments Protocol adoption.→ Who’s generating money in crypto & the emerging verticals.→ Hyperliquid growth & revenue.→ Polymarket activity as signal & intel.→ USD₮0.

4

4

37

A thread we wrote on the topic .

A clear way to understand onchain liquidity flows is by analyzing the top holders of major tokens. For WBTC on Ethereum, Aave protocol leads holding 32% of the total supply, driven by users depositing WBTC as collateral to borrow other assets (net of borrowed WBTC). It’s the

1

0

2

The visualisations below of the top contracts holding WBTC and cbBTC on Ethereum clearly show this effect.

3

1

11

Across all chains, @bunni_xyz and @AegisMarkets now lead @Uniswap v4 hooked pools with 36% of the volume each, followed by @zora with 15%. With the increase of volume on @zora in the last weeks the protocol emerged to the top in volume using @uniswap v4 hooks on @base (with +80%

2

2

10

To learn more about @ethena_labs liquid leverage on @aave read below: .

Introducing Liquid Leverage, a new Ethena integration on money markets enabled by partners, launching first on @aave 👻. Users can now deposit 50% sUSDe & 50% USDe into Aave and earn promotional rewards for USDe (currently ~12% APY), in addition to the normal USDe lending rate

0

0

3

DeFi has entered the interoperability era (already a while ago), where distribution through other frontends is becoming foundational. For deposits on lending protocols to generate yield, there needs to be capacity to absorb liquidity. Currently, no other protocol has the same.

The world's leading DeFi protocol, meets the world's leading crypto wallet. Earn with Aave, directly on @MetaMask.

1

0

4

This tweet refers to @zora Network used previously on the minting protocol. Currently activity happens on Zora Coins on @base, which is showing growth and can tracked in the @Dune dashboard below .

$ZORA is going absolute bonkers, but the metrics aren’t matching the pump at all. - New addresses per month dropped from over 60k at launch to under 10k now.- Retention is falling off most new cohorts stick around for barely 1-2 months.-Contract creation peaked above 100k, now

4

5

39

July is now the highest month on record for perps volume on @HyperliquidX, on track to surpass $300B. Recent days also saw daily revenue reach new highs.

4

2

11

4/ .Current @aave yields for EURC: .→ 4.94% APY on Ethereum .→ 3.74% APY on Base.Both exceed typical EUR rates offered by EU banks or neobanks. When paired with a positive or neutral EUR/USD outlook, EURC presents a differentiated risk-return profile.

2

0

2

Since launching perps on @HyperliquidX in the beginning of the month, @phantom generated ~$1M in revenue from builder codes.

The wallets revenue share chart looks a lot like the first browser wars in the 90s and early 2000s: one dominant player (@MetaMask) holds nearly all market share until better UX, chain-specific momentum, and distribution like @phantom shift users to alternatives. Just like

0

0

14

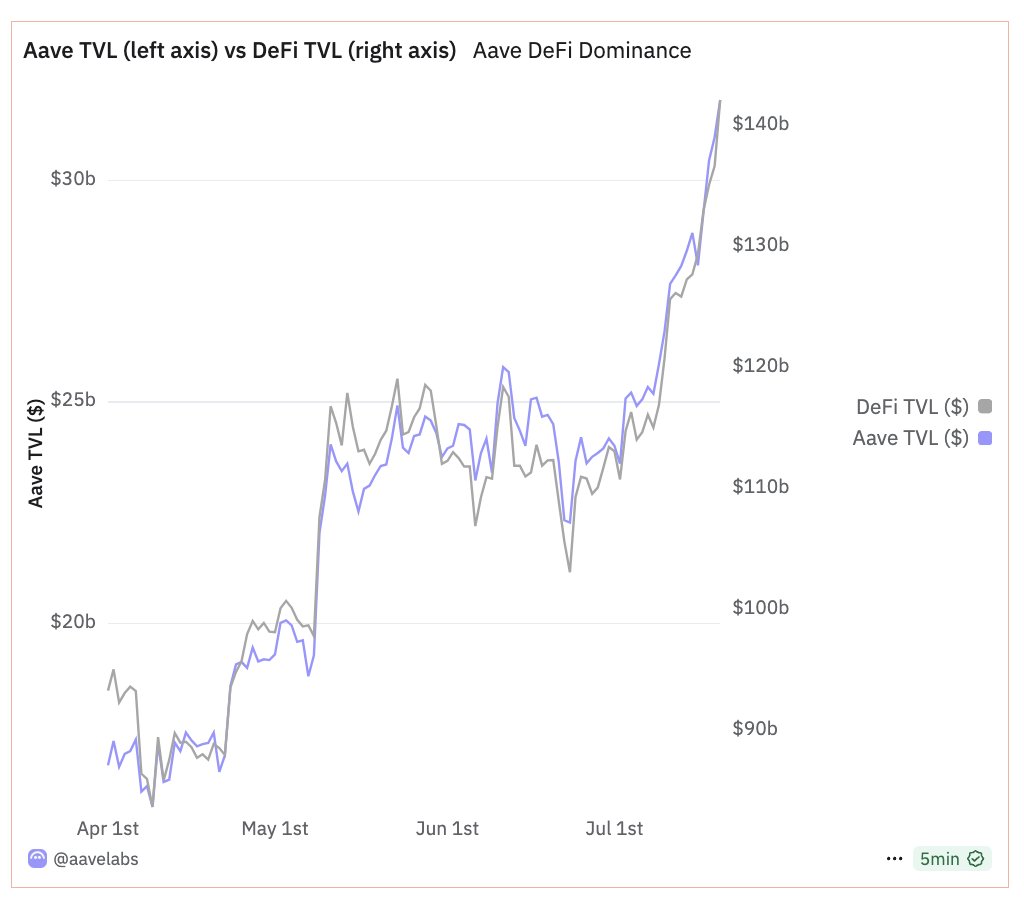

Since April, DeFi net TVL has grown by ~$49B. Of that, @aave captured ~$15B, roughly 31% of the total increase. For every $10B added to DeFi TVL, Aave contributed $3B.

8

21

122