Sagehood

@sagehoodai

Followers

475

Following

699

Media

1K

Statuses

4K

AI-Driven Active Investment Platform. Mention @sagehoodbot for instant stock analysis on X.

United States

Joined October 2024

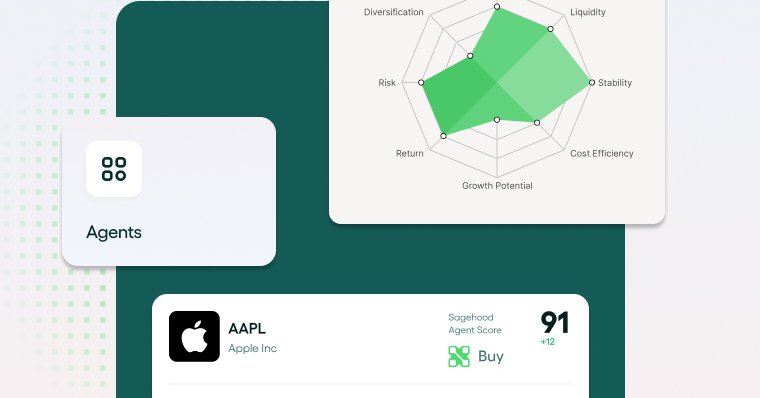

Wall Street has analysts. Reddit has memes. But only Sagehood has ai agents that read earnings reports for breakfast. 🧠📊. While others chase hype, we decode signals. See what the algorithms already know 👉

sagehood.ai

Sagehood analyzes billions of data points, transforming complex information into precise, actionable insights for your investment goals.

0

0

1

📍Want to know if the hype is real or fake?.Let our ai agents break it down for your stocks at 🚀.

sagehood.ai

Sagehood analyzes billions of data points, transforming complex information into precise, actionable insights for your investment goals.

0

0

0

🧵 Sagehood | $NBIS. A $12B company with 99% revenue collapse. yet it’s still trending up?. Something’s not adding up. We asked our ai agents to decode the madness 👇.#StockMarket #PLTR

1

0

1

6️⃣ Sagehood Agent 🤖. From macro health trends to FCF modeling, lets you break down giants like $UNH in seconds. 📊 Use AI to track dividend power, margin shifts & cash signals. Smart investors let AI read the market first. 👉

sagehood.ai

Sagehood analyzes billions of data points, transforming complex information into precise, actionable insights for your investment goals.

0

0

0

🚨 One of the world’s largest healthcare giants has a liquidity red flag — but Wall Street is still bullish. What's really going on with $UNH?.👇🧵.#StockMarket #UnitedHealth

1

0

0

6️⃣ Sagehood Agent 🧠.$ICLR looks like an institutional gem hiding in plain sight:. Undervalued. Growing. Cash-rich.But legal risks & biotech headwinds mean it’s not without drama. We rate it: Accumulate.Use to watch this one before the breakout hits 📊.

sagehood.ai

Sagehood analyzes billions of data points, transforming complex information into precise, actionable insights for your investment goals.

0

0

0