Russ From Frens🙂↔️

@russellonchain

Followers

23K

Following

53K

Media

243

Statuses

6K

Man in finance, 6.2, blue eyes; CEO/Product at @Liquidity_Land, GP of @frenssyndicate

Lisboa

Joined April 2013

Unlock Hidden Yield: How to Boost Farming Rewards by 15-25% in 10+ Tier1 Protocols. There is a thread 🧵

3

16

85

RT @zerion: Welcoming @Liquidity_Land to the ZERϴ network ecosystem!. Top 1000 Zerion XP holders get discounted price for the liquidio coll….

0

9

0

Just in case if you would not be happy with rewards for @TacBuild by @turtleclubhouse tonight . come to @Liquidity_Land, we know how to select cool projects for boosts x evaluate APY properly! . 100% rewards goes to users directly

3

0

5

RT @Altcoin_Edge: 🚨 Retail DeFi myth: You’re doomed to 2-8% yields. And no access to top-tier tokens? Wrong!. @Liquidity_Land unlocks 15-50….

0

187

0

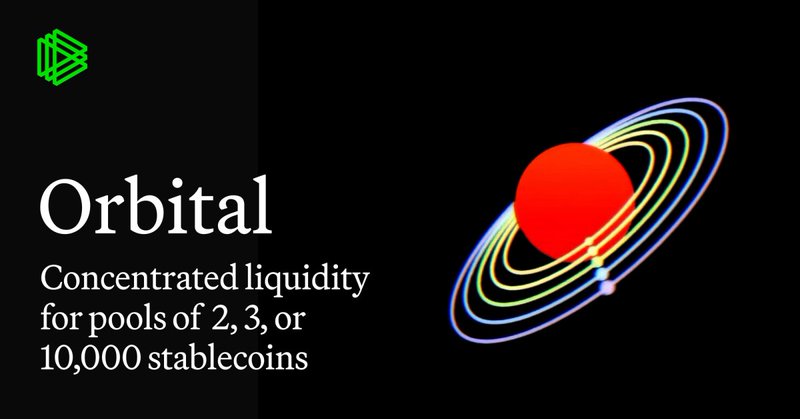

RT @_Dave__White_: Today, Orbital is just a design, but we're excited to see how it might change the stablecoin liquidity landscape. If yo….

paradigm.xyz

The future holds a million stablecoins. Today's infrastructure isn't ready. This paper introduces Orbital, an automated market maker for pools of 2, 3, or 10,000 stablecoins. Orbital unlocks capital...

0

16

0

RT @Liquidity_Land: 📔Activities Tab . We’re continuing to tell about new features on our dApp! Now, on every offering page, you’ll find a t….

0

3

0

RT @AsafNadler: Did @cookiedotfun "borrow" @KaitoAI users and blueprint?. Or did they expose the truth that your users were never really yo….

0

49

0

RT @Liquidity_Land: What if we put @Liquidity_Land, @zerodotnetwork and @zerion together? . Right, new NFT collection, dropping at the end….

0

4

0

RT @ASvanevik: instead of launching worthless coins. how about: building fucking great products.

0

106

0