Jerry Parker

@rjpjr12

Followers

31K

Following

10K

Media

1K

Statuses

23K

Trend following ideologue, never a pragmatist.

Florida

Joined March 2009

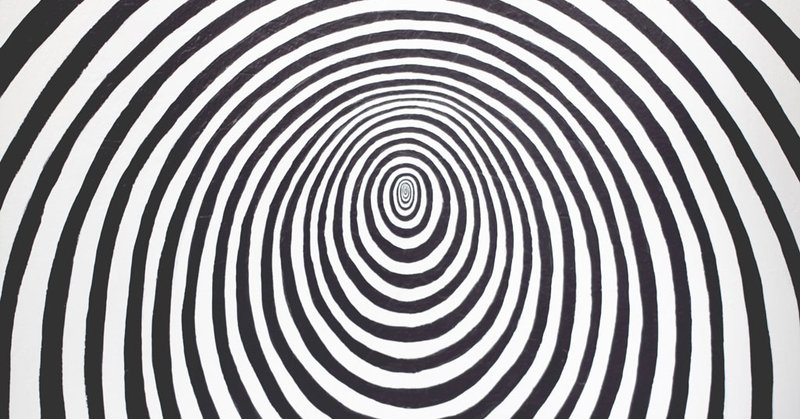

"The pod shop platforms are the LTCMs of 2025. They're underwriting massive amounts of tail risk with massive amounts of leverage to achieve short-term high Sharpe ratios."

1

1

9

"History alone is a poor measure of risk. Future states are fatter tailed than past states. Errors on errors."

The October Update is up at the Convex Strategies website - "History Matters". Quick look at ongoing rhetoric coming out of Fed, EU, BOJ. Some good. Some bad. Some thoughts on ABMs, SOC, and CAIA's note on TPA. Acronym stew! https://t.co/2FJrZHf1B7

0

0

13

"If you believe what you’re feeding guys, you don’t pivot, you don’t move. This is what it is. Consistency is the name of the game. Whatever the message is, be consistent and stick to it." https://t.co/8l855hBoLZ

nytimes.com

As a rookie in 2008, Cliff Avril was on the 0-16 Detroit Lions. He then won a Super Bowl with the 2013 Seattle Seahawks.

1

0

10

"Rent control only makes rental “affordable” for the lucky recipient. It does not make rental housing more “affordable” for society as a whole. It does not increase the number of people who have housing. It reduces that number."

Another typically brilliant (insightful) piece by John Cochrane on Price Controls https://t.co/FAlJNeNgNx

0

1

17

"The oddly good feature of a 0.2, if your prior is right, is it can last forever as it’s not so attractive to be arbed from 0.2 to 0.0."

@ptuomov All true. Though 2.0 sharpe ratios tend not to last that long (because who doesn’t want a 2.0 sharpe ratio?). The oddly good feature of a 0.2, if your prior is right, is it can last forever as it’s not so attractive to be arbed from 0.2 to 0.0. Also 0.2 Sharpe ratio strategies

0

0

7

"A key Atlantic current could be pushed to the brink of collapse within decades, supposedly ushering in a new ice age and dramatically raising sea levels, climate scientists have claimed in a controversial new study published in the journal Communications Earth & Environment."

The Gulf Stream is near collapse, scientists warn — inviting a new ice age and rising sea levels https://t.co/mtZqDdQwce

0

0

6

Or, this is the ultimate advertisement for trend following individual stocks. With trend following, almost all of the markets in the portfolio will materially contribute to wealth creation.

The top 3.6% companies have created 100% of the lifetime wealth for investors. The bottom 96.4% of companies (27k stocks) have created zero wealth. This is the ultimate advertisement for passive or active depending on one’s POV. Mind melting chart from @Gloeschi

0

3

17

"Now is not the time to bet on a soft landing without a parachute by abandoning risk management. Our investing systems provide a natural buffer to the most unpredictable events – the parachute that will engage regardless of our feelings or optimism." @Blueprint_IP

blueprintip.com

Risk management real talk amidst a U.S. equity market that is seemingly in an endless bull run.

0

2

15

How do mutual funds spin their buying ETFs instead of a mutual fund equivalent?

0

0

7

"The whole trend following world doesn't trade individual equities. We do. They tend to trend also. In our trend following, we trade those, and that's been really good."

1

0

12

"I like trend following strategies and I like them a little more than average because I think the world has a little more uncertainty than average."

1

0

3

#trendfollowingtuesday from my friends at @blueprint_IP. Interesting data on Formula One Group. https://t.co/nXgyBXCBIY No compensation for this endorsement and I am not a client of Blueprint Investment Partners (“Blueprint”). Conflict of interests: my firm sub-advises an ETF of

Formula One Group ( $FWONA ) has lapped some of its competitors YTD with a stock price on autopilot. #trendfollowingtuesday

0

0

7

"If I had told you we're going to have tariffs, profligate deficit spending, shutdowns, wouldn't it have scared you away from this market?" "It would have and thank God we follow models and don't listen to me. Sometimes when things are scary, it's a good time to invest."

1

0

13

"The new DBMF clone ETF will charge investors 35 basis points. DBMF, which seeks to mimic the SG CTA Index, has outperformed its benchmark by 29 percentage points since its inception. DBMF’s outperformance has made it a thorn in the side of trend followers."

0

3

22

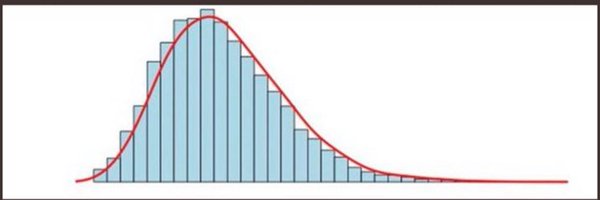

"The Sharpe is a source of systematic error. It can be a valuable tool only if properly adjusted and interpreted. Researchers and practitioners must move beyond raw estimates, incorporating corrections for nonNormality, small sample bias, and multiple testing."

0

0

14