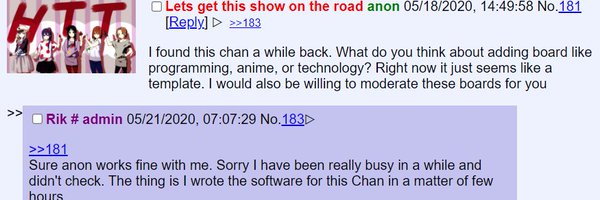

Rik

@riksucks

Followers

2K

Following

30K

Media

481

Statuses

7K

Risk & Financial Simulations @BlockAnalitica Previously: @LlamaRisk @TimeswapLabs

Bed

Joined December 2016

Excellent overview! Cash is always at the top of these lists, and we'll only continue to ship more features to make the product even more useful.🚀🚀

Everyone wants to spend their crypto without off-ramping, here’s how the top cards compare. EtherFi Cash Card @ether_fi DeFi-native Visa card to spend or borrow against staked ETH. Pros • Up to 3 % cashback in $SCR tokens • Non-custodial • Borrow against staked ETH •

14

14

157

As of Python 3.14, the free-threaded (or no-GIL) version of the Python interpreter is no longer considered experimental.

87

367

3K

Is this better bet over other yield sources that base themselves on funding rate arb (since it has been decreasing lately), idts kek

0

0

0

if you are salivating looking at ~30% APY for USDai, then know that USDai is being sold at least 6% premium already, and in plasma, you are probably getting ~15% apy or around ~5.5% of "realized yield" the demand is insane holy shit

3

0

10

don't get too happy, indian govt would probably shit out some CBDC

1

0

7

The ethos behind blockchain and open source is transparency. And when a team reflects transparency even in their decision-making for everyone, you know how committed they are to the cause 🫡🫡 Gg @hyperlendx

2

1

13

🚀 We’re at @token2049 Singapore – the world’s largest crypto event! 🌏✨ Come say hi to the BlockAnalitica team 👋 #TOKEN2049 #Singapore #Crypto #DeFi

4

7

12

On Monday, the Sphere dashboard recorded 330 liquidation events, totaling $17.54M in collateral liquidated and $16.64M in debt repaid across DeFi protocols. Here's a breakdown of that volatile 24-hour window:

1

5

15

Absolutely insane demand for @yieldbasis on @legiondotcc. Over $135m in allocation requested for a $5m cap.

3

1

11

X is deeply concerned by the recent order from the Karnataka court in India, which will allow millions of police officers to issue arbitrary takedown orders through a secretive online portal called the Sahyog. This new regime has no basis in the law, circumvents Section 69A of

1K

3K

12K

@Hyperlendx's transparency deserves credit, parameter changes were explained to the community upfront, and the protocol has stayed true to that standard. Risk clarity builds trust.

0

0

7

The outcome also validated our risk models. Before listing, we ran extensive Monte Carlo “bank-run” simulations using historical LST depeg data. The proposed parameters held up, and this live stress confirmed it.

1

0

6

This is how risk should be quantified in DeFi markets: parameters that keep lenders safe from systemic loss while letting borrowers loop with confidence. Too often systems pick one side, our design proves you can protect both.

1

0

8

This design ensures lenders are insulated from smart-contract or depeg risk, while borrowers are also protected from market noise. The 75% LTV vs 80% LT buffer provided further stability during volatility. As mentioned in our proposal:

1

0

8