Rich Toscano

@richtoscano

Followers

567

Following

176

Media

106

Statuses

968

Financial advisor at https://t.co/tYNAbeZ7lb, housing charter at https://t.co/Jr0iKwvhhT, value investing nerd, other kinds of nerd.

San Diego

Joined July 2009

Anwyay - more background in the article (which I tried to make short-ish, and so ended up making the footnotes almost as long as the main text): https://t.co/eyuJnYzPhn (whatever/whatever)

pcasd.com

I talk to a lot of people about real estate, and I find that most of them have fairly high expectations for housing’s investment potential. It’s not just a

0

0

1

Oops I forgot to do my little (x/y) thing at the end and I think I miscounted the total to boot

0

0

0

None of this is to say don’t buy a home — just that they aren’t the easy-money investment so many think. Best to thoroughly run the numbers with realistic, historically-informed assumptions, to properly weight financial vs. personal considerations.

0

0

0

So in sum, housing looks great in the (recent) rearview mirror but looking forward it offers limited potential for price gains, elevated risk of price declines, and rental yields near historic lows.

0

0

1

High valuations are harmful to future returns in 2 ways: they raise the risk of price declines if valuations revert, and they mechnically translate to lower rental yields (historically the main component of RE returns). (6/8)

0

0

1

The shock came from the pandemic; specifically the remote-work revolution (unlikely to repeat) and all-time low mortgage rates (now reversed). These are in the past but they leave behind very high prices and poor affordability. (5/8)

1

0

0

First, US housing supply grew faster than population over this period. Second, the bulk of the decade’s appreciation was crammed into a 2-year period — more consistent with an economic shock than slow-moving factors like demographics. (4/8)

0

0

0

The past decade was different and delivered exceptional appreciation. Real prices went up about as much as they did in the entire 4 decades prior. The standard explanation is a structural housing shortage but the facts don't support this thesis. (3/8)

0

0

0

The long term trend for home prices is just to slightly outpace inflation — or maybe not even that, once quality changes are fully accounted for. (Glamour markets such as San Diego have gone up more, but they have their own issues, discussed in the article). (2/8)

0

0

0

Promise you won't get mad? I think housing is an overrated investment. I wrote an article about it… quick summary follows: (1/8)

10

0

1

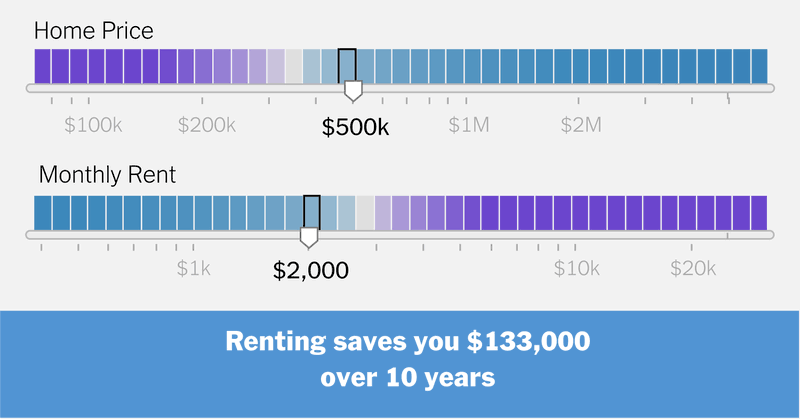

Well that was fast... the Redfin one looks pretty good? https://t.co/SLTJVFl2lx THANKS ROBOT OVERLORDS

1

0

1

🦗🦗🦗 I guess I'll see what our robot overlords can come up with...

1

0

0

PS here's the link to the NYT one:

nytimes.com

Our calculator, updated in July 2025, takes the most important costs associated with buying or renting and compares the two options.

1

0

0

Twitter friends, I am seeking suggestions for a rent-vs-buy housing calculator that accounts for the whole picture (opportunity cost, taxes, etc). The NYT one is excellent, but it's behind a paywall and I'd like an option to recommend to non-subscribers.

1

0

0

Best finance podcast of the year 👇

Understanding Return Expectations (S7E21) In this episode, I speak with Antti Ilmanen, Principal and Global Co-head of the Portfolio Solutions Group at AQR Capital Management. Antti has long been one of the most thoughtful voices in the world of expected returns, having

0

0

2

How many tranq darts did the compliance team have to fire into @CliffordAsness to keep him from changing this to "volatility laundering?"

13

4

118

As I work on this article I've been writing, I want to pre-register that I like em dashes and have overused them for my entire adult life.

0

0

1

If the typical seasonal increase happens we'll be well into the price decline zone. But it's possible that tariff panic distorted the typical seasonal patterns. More charts here:

0

0

0